The enforcement division of the Securities and Exchange Commission has issued formal requests, including subpoenas, to a number of investment firms over their sustainable investment advertising practices. This escalation shows the SEC’s heightened scrutiny on environmental, social and governance funds.

A significant point of concern for the SEC includes mainstream investment funds transitioning into ESG-focused entities. Additionally, there's interest in funds marketed both in the U.S. and Europe that may possess similar investment strategies, assets or management teams, yet provide varying levels of disclosure depending on the region.

The SEC established a dedicated team of 22 headed up by Kelly Gibson in 2021 to “root out ESG-related misconduct.”

“Investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies,” SEC Chair Gary Gensler said back in March, 2022 when the SEC proposed rule changes that would require registrants to include certain climate related disclosures in their registration statements and periodic reports. “Investors need reliable information about climate risks to make informed investment decisions.”

While some ESG-related settlements, involving firms like BNY Mellon ($1.5 million fine) and Goldman Sachs ($4 million), took place in 2022, no such cases have been reported yet this year.

However, this could change with ongoing probes. For instance, German investment firm DWS recently reserved $23.22 million for a potential ESG-related settlement with the SEC and other bodies.

Former SEC commissioner Michael Piwowar, currently executive vice president, finance, at the Milken Institute, told the Financial Times to “anticipate more regulatory actions emerging shortly.”

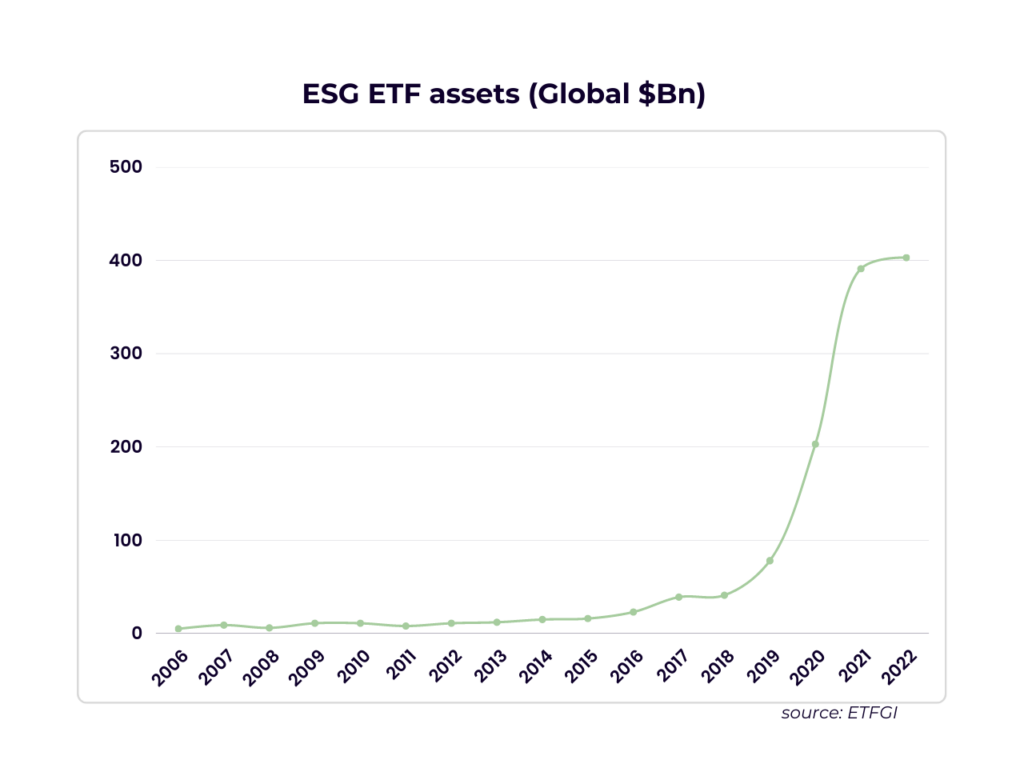

Global assets in sustainable investments surged to $3 trillion in 2021 from $1 trillion in 2019, as reported by Morningstar. Nonetheless, U.S. investors' enthusiasm has since waned and they've pulled out vast amounts from such funds. According to Refining Lipper data, by the end of November 2022, investors had withdrawn a net $13.2 billion from ESG stock, bond and mixed-asset funds, representing the first net outflow since 2011.

The specific investment firms that received recent subpoenas remain undisclosed, and according to a Financial Times report, the SEC declined to comment.

It's noteworthy that the SEC isn't the sole body delving into ESG disclosures. In a recent instance, the Australian Securities and Investments Commission accused U.S. firm Vanguard of inaccuracies in its ESG statements.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.