From certain perspectives, it might appear as if the debate over mutual funds versus exchange-traded funds is already settled.

At about $20 trillion, the 100-year-old mutual fund industry is still twice the size of the total US ETF footprint. And there are plenty of reasons why mutual funds remain relevant, but the asset-flow patterns over the past several years have been tilting hard in favor of the 32-year-old ETF industry.

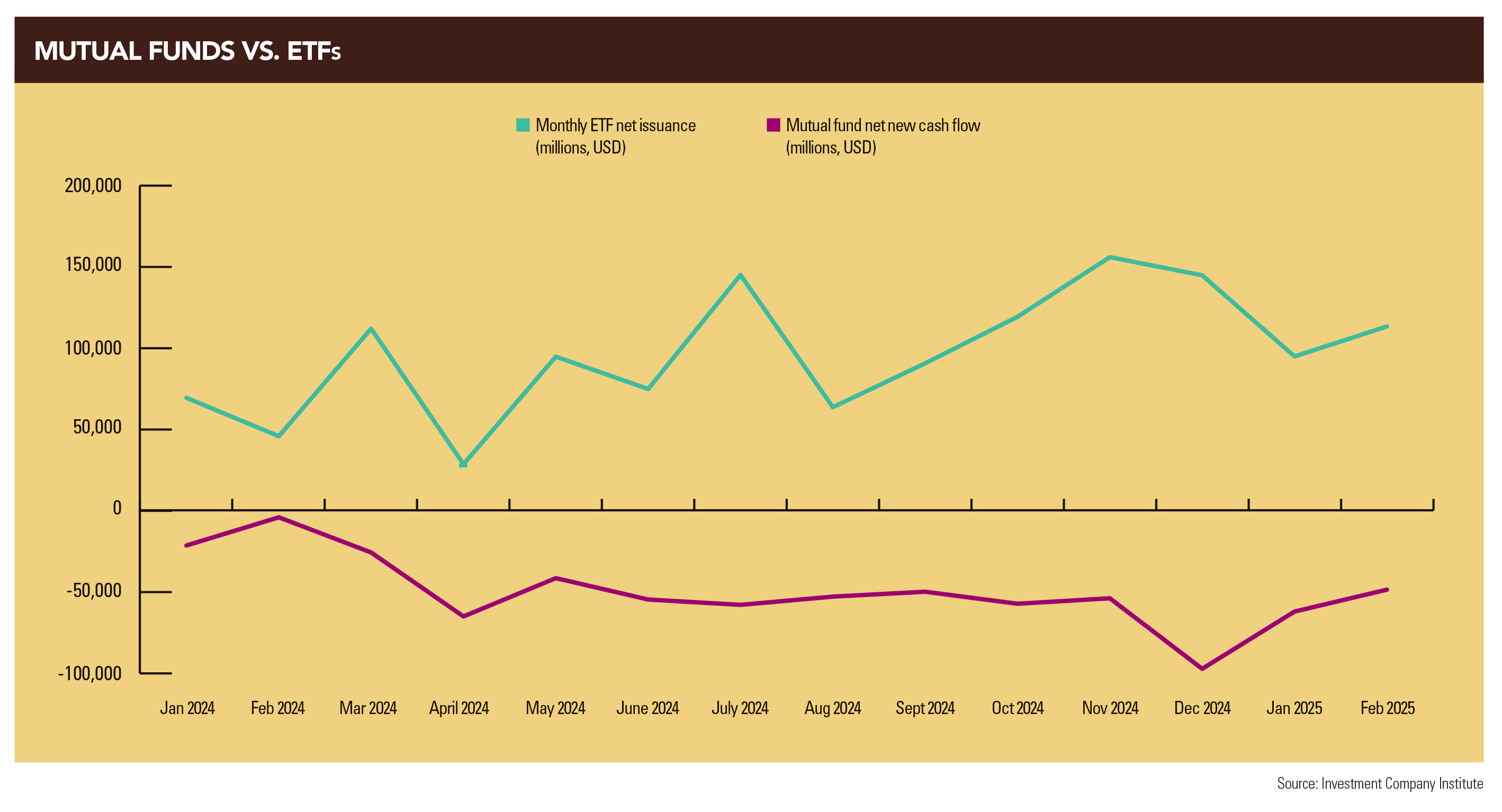

According to the Investment Company Institute, ETFs took in $1.1 trillion last year, while mutual funds suffered nearly $350 billion worth of outflows. Of those ETF inflows, $300 billion went into actively managed strategies, once seen as a stronghold category for mutual funds.

This year, through mid-April, the ICI reports $268 billion worth of net outflows from mutual funds and $340 billion worth of ETF inflows. And that happened with a market declining toward correction territory.

“It’s been a bloodbath for mutual funds,” says Bryan Armour, director of ETF and passive strategies research at Morningstar.

But, even against that backdrop, Armour and others see various silver linings for the mutual fund industry that suggest the debate is a long way from being resolved.

For example, he expects the Securities and Exchange Commission to approve ETF share classes for mutual funds at some point this year.

With amended SEC filings coming from some of the more than 50 fund companies that have already applied for permission to introduce ETF shares classes for actively managed mutual funds, Armour says, “This could be a lifeline for mutual funds.”

Actively managed fixed income is another area where mutual funds continue to hold their own.

“People tend to prefer active managers for bond strategies, so money is still going into bond mutual funds at the same time that it’s flowing into bond ETFs,” says Todd Rosenbluth, head of research at TMX VettaFi.

“Advisors and individual investors generally find the bond market more complex and harder to navigate on their own,” he adds. “Historically, those active bond managers were primarily available in a mutual fund wrapper.”

An ICI breakdown of the past 27 months, through March, shows an uninterrupted streak of monthly outflows from equity mutual funds, while bond mutual funds suffered net outflows during just five of those months.

Paul Schatz, president of Heritage Capital, is among the financial advisors who rely on mutual funds for some of their investment allocations.

“In our high-yield bond strategy, mutual funds trade better, trend better, and behave better than ETFs,” he says. “The active bond ETFs are typically invested in the bigger, more liquid bonds that people get in and out of quickly, so that leads to more volatility.”

Schatz, who primarily invests in ETFs and individual securities on the equity side, also uses some mutual funds for certain “idiosyncratic strategies that don’t have ETF counterparts.”

“But if I’m just buying the S&P 500, I’m looking for the lowest cost I can find, and that’s usually in an ETF,” he adds.

Jing Zheng, founder of Neat Financial Planning, is also drawn to the lower costs of ETFs, but she turns to mutual funds to meet specific investment objectives.

“For international markets, which I believe tend to be less efficient, I often include actively managed mutual funds in addition to index-based ETFs,” she says. “I believe in the international markets, skilled mutual fund managers can add value by leveraging local market insights and having greater flexibility in stock selection.”

When it comes to fees, ETFs will almost always win.

According to ICI data, the asset-weighted average expense ratio for actively managed equity mutual funds is 65 basis points for mutual funds, compared with 43 basis points for actively managed equity ETFs.

But when it comes to basic indexed strategies, ETFs are offering broad market exposure for just a few basis points.

The lower fees are often cited as the driving appeal among financial advisors, which represent the largest consumers of ETFs. But tax efficiency, transparency, and liquidity also offer an edge to ETFs.

The advent of leveraged and inverse ETF strategies and single-stock ETFs gives ETFs the edge among active traders. Mutual funds, which can only be bought or sold at the end of each trading day, can’t compete with ETFs when it comes to such active trading strategies.

“The most significant contribution by ETFs as they’ve evolved over the last 30 years has been to bring low-cost index funds to anyone with a brokerage account,” says Don Bennyhoff, founder of Bennyhoff & Co.

“This raised awareness and acceptance of the benefits of low-cost funds and set the stage for one of the more consistent trends in the industry for the last 15 to 20 years, which is that higher-cost funds are steadily losing AUM to their lower-cost peers.”

Jen Wing, chief investment officer at GeoWealth, says the ETF industry is gradually filling in the gaps in the actively managed fixed income category.

“On the fixed-income side, the industry has seen strong demand for active ETFs, especially in categories like intermediate core-plus, multisector, ultrashort duration, and bank loans,” she says.

Wing believes the current economic environment, including increased market volatility, paves the way for active managers.

“Looking ahead, I believe active ETFs are poised to win market share,” she says. “In periods of heightened uncertainty or volatility, I personally tend to favor active management, as active managers may be better positioned to identify opportunities and manage risks that passive strategies do not have the process or flexibility to capture.”

While managers of actively managed mutual funds continue to push regulators for ETF share class approval, not having ETF share classes might be helping to keep some assets with embedded capital gains inside mutual funds.

“In the absence of a share class exchange, many successful actively managed mutual funds will likely be able to retain assets given unrealized capital gains on the part of participants where they are in taxable accounts,” says Steven Kolano, chief investment officer at Integrated Partners.

“Going forward, more asset managers seem to be launching new active and passive strategies right from an ETF wrapper as opposed to a 40 Act mutual fund wrapper, and as such, over time it seems that ETFs will continue to erode the market share of mutual funds,” he added.

From a pure use perspective, Noah Damsky, principal at Marina Wealth Advisors, believes the mutual fund wrapper that limits trading to once a day is the best structure for the kind of automatic investing most prevalent in retirement savings plans.

“Mutual funds can be automatically invested each month, which allows for straightforward dollar-cost averaging,” he says. “ETFs, like stocks, require a more manual process.”

For most retail investors saving for retirement, Damsky says, “having end of day liquidity via a mutual fund can ease the mental burden and eliminate your temptation to trade throughout the day, and this may be a short-term tradeoff that allows you to be successful over the long term.”

For now, the 401(k) plan space stands out as the golden goose for mutual fund companies, with few plans yet to navigate access to ETFs for plan participants.

Schatz of Heritage Capital blames the antiquated retirement plan platforms for keeping ETFs at bay.

“The retirement plan platforms are like dial-up internet, still operating in yesteryear,” he says. “Most of them cannot accommodate ETFs, but in the next 10−15 years, I think half of all plan assets will be in ETFs.”

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning