The Financial Industry Regulatory Authority Inc. has censured RBC Capital Markets, fined it $550,000 and ordered restitution of $456,155 plus interest over actions involving high-yield bonds.

Finra said that from July 2013 through June 2016, RBC failed to identify for review more than 100 customer accounts with conservative profiles for potentially unsuitable concentrations of high-yield bonds. in a number of those accounts, Finra said, the holdings in high-yield bonds were more than six times the thresholds set by the firm.

RBC failed to do the reviews, Finra said, because of firm policies and procedures that did not sufficiently address suitability factors representatives should consider before recommending high-yield bonds. Also, Finra said the firm’s automated system to alert reps about possible overconcentration didn’t function as intended.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

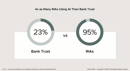

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.