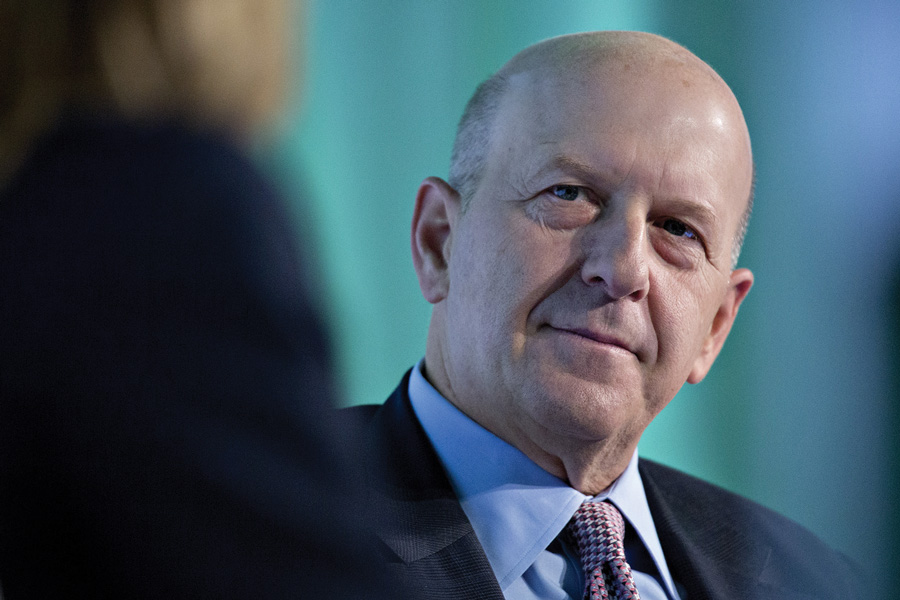

Goldman Sachs Group Inc. cut Chief Executive David Solomon’s compensation by about 30% to $25 million for 2022, a year in which the firm's share price and profit tumbled and it retreated from a highly public effort to create a consumer bank.

The package includes a $2 million base salary and $23 million in variable compensation, with $16.1 million of that in the form of restricted stock units, according to a filing Friday.

The firm’s compensation committee considered factors including Goldman’s performance and how it did relative to its main rivals in determining Solomon’s pay, according to the filing.

“The committee also took into account the firm’s continued progress in its strategic evolution as well as Mr. Solomon’s strong individual performance and effective leadership,” it said. “These factors were considered in the context of a challenging operating environment.”

The investment banking giant poured billions of dollars into its consumer effort, dubbed Marcus, only to suffer $3.8 billion in pretax losses over the past three years. Solomon has conceded that the company tried to push too quickly into the sector.

Goldman embarked on one of its biggest rounds of job cuts ever this year, with a plan to eliminate about 3,200 jobs as it sought to keep a lid on costs.

An industrywide slowdown has crimped earnings across Wall Street. At Goldman, net income fell 48% to $11.3 billion last year, and the bank’s return on equity was 10.2%, below the 14%-to-16% target it set for itself earlier in 2022.

The shares dropped 10% in 2022, outperforming the 12% decline in the S&P 500 Financials Index.

Banking executives have been bracing for their compensation to tumble as Wall Street tries to contain costs amid a dealmaking slowdown.

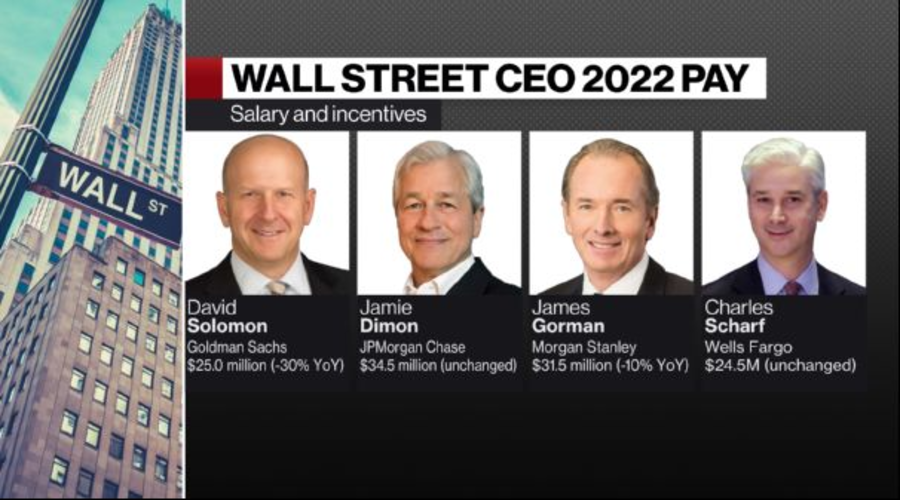

Solomon, 61, was one of the best-paid CEOs at a major U.S. bank for 2021, receiving $35 million in compensation — a figure matched by Morgan Stanley’s James Gorman for that year. For 2022, Gorman saw his pay cut by 10%, to $31.5 million. JPMorgan Chase & Co. left CEO Jamie Dimon’s pay unchanged at $34.5 million for that year.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.