A prominent proxy advisory firm is telling shareholders to vote against Goldman Sachs Group Inc.’s executive pay plan after the Wall Street giant’s top leaders were given lofty raises in a year when profits slumped.

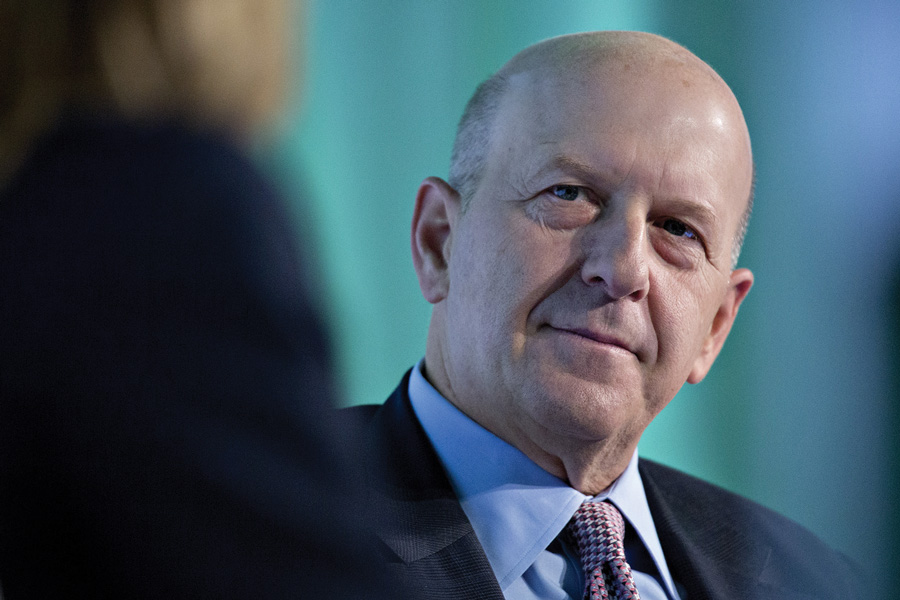

Glass Lewis & Co., a major voice on annual shareholder votes, cited the “significant disconnect between pay and performance” at New York-based Goldman in making its recommendation. The bank had boosted Chief Executive David Solomon’s compensation to $31 million, marking a 24 percent jump for a year when Goldman’s earnings plunged by a similar amount.

“This does not instill a sense of optimism that the ongoing disconnect will see improvement in the near term,” Glass Lewis said in its recommendation on the non-binding vote. “Given these factors, we believe that shareholders may reasonably withhold support from this proposal at this time.”

Other executive officers also recorded an increase in their 2023 compensation. Goldman chief operating officer John Waldron’s pay package jumped 28 percent to $30 million.

Glass Lewis said that Goldman shareholders should be wary of the continued disconnect between pay and performance, with the company receiving its second consecutive “F” grade. Despite Goldman receiving the same grade last year, Glass Lewis had recommended shareholders sign off on the pay plan then.

The board lifted Solomon’s pay as the firm spent much of the past year dousing internal rifts and pitching investors on a simplified strategy. After giving up on its retail banking ambitions, New York-based Goldman has returned its focus to business lines embraced by Solomon’s predecessors.

Goldman’s compensation committee cited the CEO’s “decisive leadership in recognizing the need to clarify and simplify the firm’s forward strategy,” according to a February filing. That reasoning drew private gripes from other Goldman executives, who pointed out that the firm was pulling back from a poorly executed retail-banking plan that the CEO had embraced over internal opposition.

The recommendation to vote down the pay proposal comes ahead of the bank’s annual meeting on April 24, where it’s seeking shareholder approval of executive pay.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.