Wedbush Securities is angling to supercharge its growth in the Eastern US – and it's tapped a veteran advisor from B. Riley to lead the way.

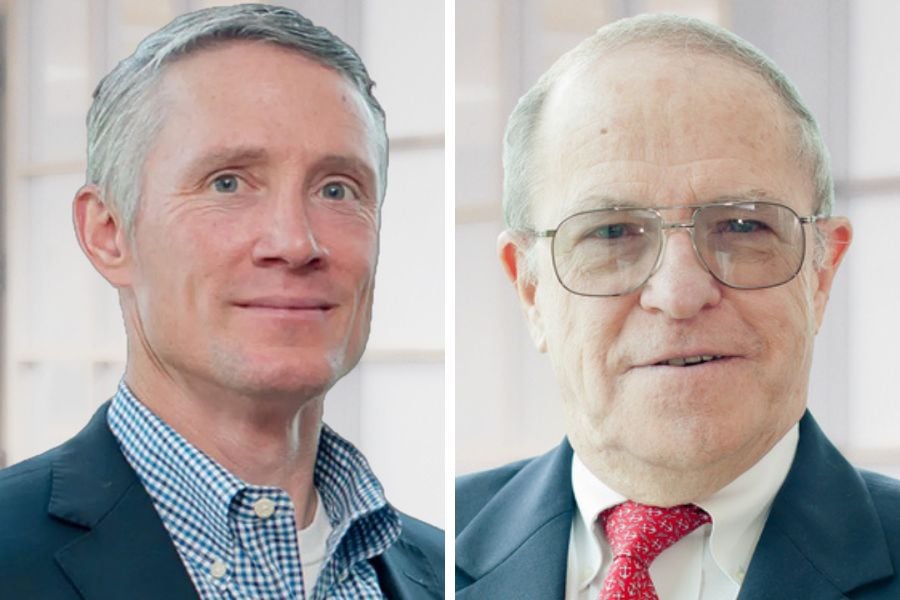

On Wednesday, the firm announced Mike McCall as its Northeast market manager, tasked with leading its expansion in the Northeast and Mid-Atlantic Markets.

McCall, along with his business partner of 20 years Mike Connelly, joined WedBush Securities after previously being affiliated with B. Riley.

B. Riley has suffered a raft of star advisors depart in recent months as the firm's ongoing troubles with regulators and growing debt burden took its toll. Late last month, the embattled firm confirmed it was selling part of its employee wealth arm to Stifel, but would be retaining its independent advisors.

McCall joined Wedbush as senior vice president of investments and market manager for the Northeast and Mid-Atlantic regions, wile Connelly stepped in as vice president of investments. The duo, operating as the McCall Connelly Group, develop tailored portfolios and sustainable financial plans for clients, targeting opportunities from a global perspective with an eye on micro and macroeconomic conditions.

Together, they oversee more than $200 million in client assets, a spokesperson at Wedbush confirmed.

“I look forward to leveraging the firm’s full range of resources to continue providing exceptional service to my clients,” McCall said in a statement Wednesday.

McCall, who has more than 30 years of experience in wealth management, will oversee regional expansion efforts and lead Wedbush’s advisory services in the greater Philadelphia area.

Chris Mone, executive vice president and head of wealth management at Wedbush, described the McCall Connelly Group’s addition to its Main Line, Philadelphia office as "a key piece in our plan for Northeast expansion and broader growth as a firm."

"Their combined skill set offers clients a superb advisory experience, and we are thrilled to have them,” he said.

Based in Los Angeles, Wedbush Securities has been a leading independent financial services firm since 1955, with nearly 100 offices and 900 professionals across the US.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.