In the face of this year’s terrible stock market, the fee-only registered investment adviser industry surged in 2022, totaling more than $3 trillion in client assets for the first time in the InvestmentNews tally of RIAs by region.

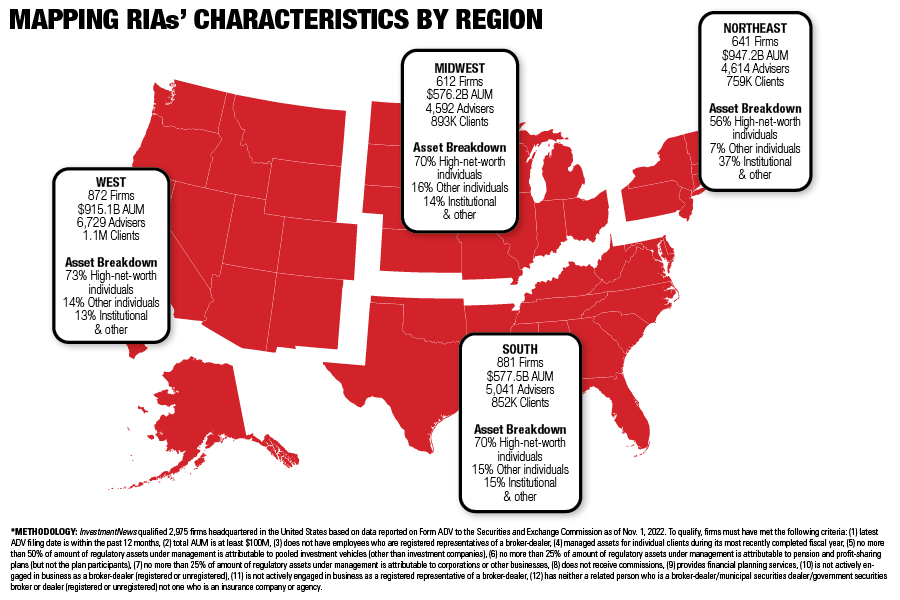

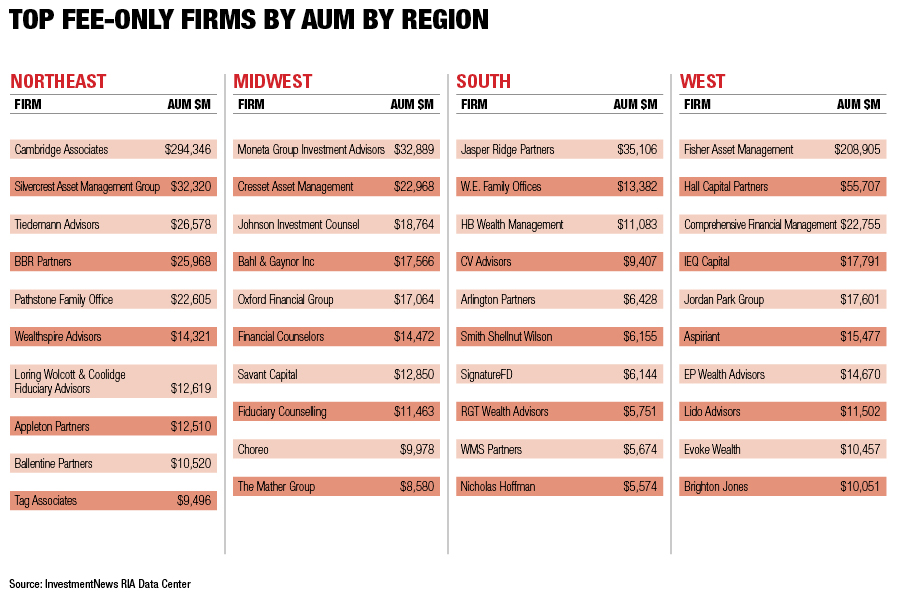

The InvestmentNews annual review of RIAs by region includes firms with $100 million or more in assets, according to their most recent Form ADV on file with the Securities and Exchange Commission, and splits them into four regions: the Northeast, West, Midwest and South.

In all four regions, 3,006 RIA firms reported $3.015.5 trillion in assets this year, compared to $2.493.5 in 2021, according to InvestmentNews Research data. That’s a one-year increase of $522 billion, or 20.9%.

Most firms file the Form ADV in the spring, so the total asset levels at the RIAs are most likely lower right now, as the S&P 500 has declined 16.96% as of Nov. 29. But the surge to $3 trillion in client assets is clearly a milestone for an industry that has long been pooh-poohed by the retail brokerage titans of Wall Street.

To put that into perspective, one Wall Street wirehouse, Morgan Stanley, finished 2021 with $4.9 trillion in client assets, and management there expects to add $1 trillion in client money every few years or so.

But those assets at Morgan Stanley and other wirehouses are not purely wealth management assets. They include asset managers and discount or online brokerage assets, and those do not command nearly the pricing and premium of the wealth management and RIA industry, which, as a rule of thumb, charges clients roughly a 1% annual fee for assets under management.

Meanwhile, large RIAs have been adding clients. Over the past five years, the number of clients at large firms has increased annually on average from 12% to 15.7% depending on the region, clearly an indication of strong demand for financial advice across the country.

“Despite the economic turmoil we have right now, with inflation and the bad stock market this year, the tailwinds are still strong for financial advisers and RIAs,” said Dennis Gallant, associate director with Institutional Shareholder Services. “More people are seeking financial advice. The baby boomers are retiring. Millennials are entering their peak earning years. It’s a demand for financial advice that feeds into the entire wealth management market.”

“Plus, the RIA market and firms with experienced advisers are the destination for other advisers,” Gallant said. “The RIAs are clearly benefitting from the breakaway brokers leaving the wirehouses.”

“Some of this asset growth is clearly market-related because 2021 was a huge year in the stock market and this is the spillover,” said Lou Diamond, an industry recruiter. “Most RIAs really don’t grow; they tend to shrink. They struggle with organic growth.”

“But the mega RIAs are really driving the asset flows to the channel,” Diamond said. “Those large RIAs have simply figured it out, from acquisitions to hiring advisers.”

“Also, the Covid pandemic converted previous self-directed investors who got crushed in the market in 2020 to RIA clients, in my opinion,” he said. “Add in digital marketing, with advisers meeting with clients virtually. That’s working with a larger base of customers in a more efficient way.”

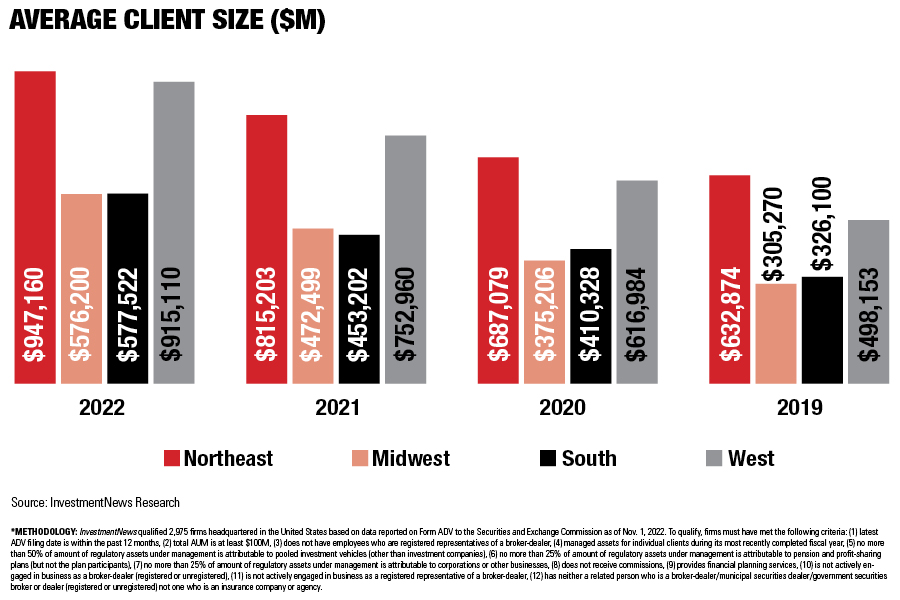

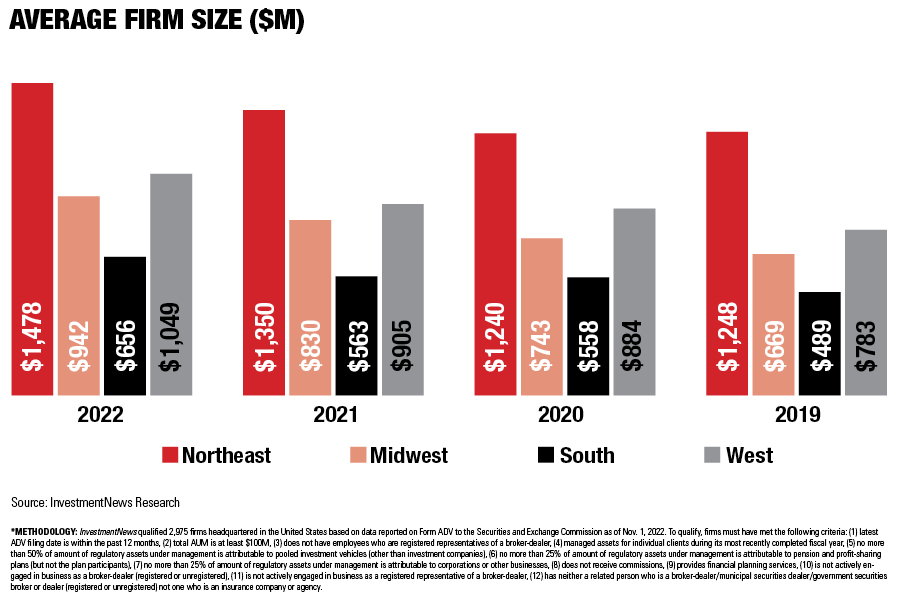

RIA firms continued to rebound in the Northeast this year after actually declining two years ago when the Covid-19 pandemic was at its worst and drove some financial advisers from Boston, New York and Philadelphia to do business in Florida. Average firm size growth in the Northeast this year was 9.8%. And large RIAs in the region had $947.2 billion in assets this year compared to $815.2 billion in 2021, year-over-year asset growth of 16.2%.

In the Midwest this year, large RIAs notched $576.2 billion in assets compared to $472.5 billion a year earlier, or annual growth of 21.9%.

Meanwhile, the RIAs in the South and West regions continued to see robust growth as Covid 19’s impact on businesses lessens.

In the South, RIAs reported close to $577.5 billion in assets this year compared to almost $453.2 billion in 2021 for growth of 27.4%. In the West, they reported $915.1 billion in assets this year compared to almost $753 billion in 2021 for growth of 21.5%.

Despite a lighter regulatory outlook and staffing disruptions at the SEC, one compliance expert says RIA firms shouldn't expect a "free pass."

FINRA has been focused on firms and their use of social media for several years.

RayJay's latest additions bolster its independent advisor channel's presence across Pennsylvania, Florida, and Washington.

The deal ending more than 30 years of ownership by the Swiss bank includes six investment strategies representing more than $11 billion in AUM.

Divorce, widowhood, and retirement are events when financial advisors may provide stability and guidance.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.