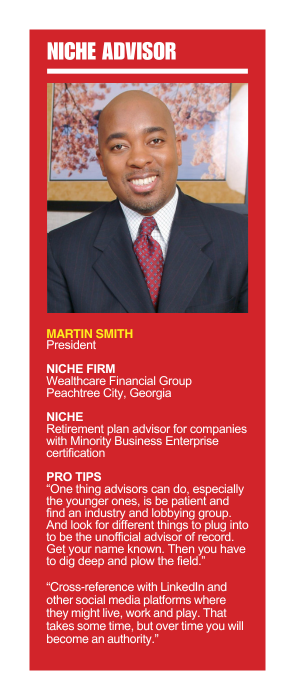

Martin Smith is nothing if not patient in his approach to building out a financial planning niche that focuses on capturing retirement plan business from companies that hold a Minority Business Enterprise certification.

Smith, president of Wealthcare Financial Group in Peachtree City, Georgia, applies an old-school strategy that involves a lot of cold calling; he stumbled on the MBE niche while combing through retirement plan prospects.

Ten years ago, when he was based in Maryland, Smith was undertaking the arduous task of contacting small business owners to offer a review of their employee retirement plans.

His advisory firm was already MBE-certified, but he didn’t make the connection to how he could leverage that to build new business relationships until he found a prospect that was also MBE-certified.

“I saw the world of MBE firms and realized I could focus my marketing message to that group, and that has broken the ice,” he said.

MBE certification is done at the state level and requires business owners to meet certain criteria related to income and net worth, in addition to qualifying as a minority. Most states have thousands of businesses holding the certification, which is where the fun begins for Smith.

“One thing I learned in my training at AG Edwards back in 1999 is the best prospect lists you can acquire are the ones you build yourself, not the ones you purchase,” he said. “I found the most success when I spent the time to curate my own list of prospective clients.”

Smith said he has a list of more than 10,000 prospective businesses in his database, which he tracks with various technology platforms that help him reach out to each company at least once a month.

The connections can be an email, an invitation to a webinar or even a direct phone call. On a recent summer morning, he confessed to having already made 18 calls to prospects before 11 a.m.

“I used to make 300 dials a day when I was calling individuals, but it takes longer to call businesses because they have a lot of gatekeepers,” he said.

His advisory firm is still small, and because the firms he’s working with will be smaller to qualify for MBE certification, he only has $30 million under advisement. But Smith has advisors based in Texas, New York, and Maryland to help him dig deeper into the niche.

Because there's nothing particularly unique about offering to advise or review a company-sponsored retirement plan, Smith said he's overt about leveraging the MBE certification.

“That’s my opening line,” he said. “I’ll call and mention that we are both MBE certificate holders.”

Like most retirement plan advisors, Smith is well versed in the potential to advise on the personal accounts of business owners and employees, and that is stepped up a notch with the MBE connection.

“When you’re working with an MBE firm, you’re more than likely to get the business owners as well,” he said. “With all my 401(k) plans, I have the personal accounts of the business owners, and some of the children’s accounts. I’ll build relationships with the owner, and some will want to talk about the retirement plan business. I’ll take whatever door opens.”

Divorce, widowhood, and retirement are events when financial advisors may provide stability and guidance.

The industry group and other financial associations called out risks from premature disclosures, overreporting, and bad actors weaponizing the rule's requirements.

In regards to the new fund, called WVB All Markets Fund, Morningstar analysts wrote that, “despite the brand-name pedigree of the asset managers involved, most of these strategies are untested.”

New Broadridge survey reveals surge in AI investments, with a third of respondents expecting a payoff within six months.

The latest launches in 2025, which include leveraged strategies, cryptocurrency, and active funds, mark a sharp turn from the passive revolution envisioned by Jack Bogle.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.