The extreme pace of new 401(k) lawsuits this year is showing the legally precarious spot most plan fiduciaries occupy, and that position is only becoming more difficult.

It is rare for a plan to have a near-perfect design and watertight documentation showing the prudent process that went into it. And aside from that, the biggest source of protection from those lawsuits, fiduciary liability insurance, is getting harder to come by.

Premiums, for example, are up by about 35% from a year ago -- but that is hardly the biggest change to fiduciary insurance amid so much litigation. Coverage limits are now much lower than they used to be, meaning that employers must buy as many as five policies from different insurers in order to have the full level of coverage they once did. And the retention fees they must pay to renew policies have skyrocketed to as much as $2 million.

“Until this point, the fiduciary carriers just took it on the chin. For 10 years, these cases were manageable,” said Daniel Aronowitz, managing principal at insurer Euclid Specialty Managers. “But now, the three to five cases [are] being filed per week … The insurance industry woke up and is trying to take some action to maintain profitability.”

Fiduciary liability insurers have covered the cost of defending lawsuits and have footed the bill for massive settlements.

The cases, which generally focus on the fees that 401(k) or 403(b) plan participants pay for investment management or administration, have resulted in a push toward low-cost index funds on investment menus and record-keeping fees being renegotiated. Many lawsuits, for example, allege that plan sponsors have failed in their fiduciary duty by failing to consider index funds rather than actively managed products, not opting for the lowest-cost share class available, not using lower-cost vehicles such as collective investment trusts and not cutting administrative fees to a bare minimum.

Prominent litigators, such as Jerome Schlichter, have stated that excessive-fee litigation has been necessary for plan fiduciaries to comply with the Employee Retirement Income Security Act and operate their plans in the best interest of workers saving for retirement.

It’s hard to argue with that; overall 401(k) costs have been declining for years, and many plan sponsors clearly take their fiduciary duties more seriously than they did in the past, with the looming threat of litigation almost certainly being a consideration.

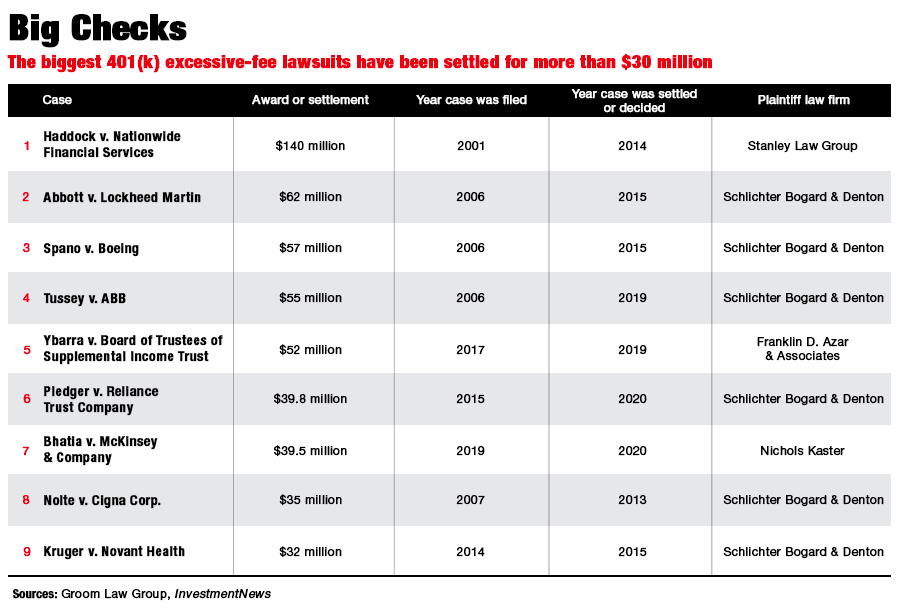

But the massive settlements struck in some of those cases -- as much as $140 million in a lawsuit against Nationwide, for example -- have attracted a horde of plaintiff law firms to the ERISA space. While firms such as Schlichter Bogard & Denton led the way for some of the biggest settlements to date, it’s the newer entrants and the volume of cases they are filing that have contributed the most to the fiduciary insurance crunch, sources said.

“2020 has just been an unprecedented year in terms of the suits filed,” said Wendy Von Wald, fiduciary product manager at Travelers. “It’s just been quite astonishing.”

One firm, Capozzi Adler, has brought dozens of new, nearly identical claims against plan sponsors, for example.

Over the past five years, it seemed that the pace of litigation might slow, particularly against colleges and universities, which Schlichter and others targeted heavily several years ago.

But in April, a new case was filed against the University of Miami over the school’s 403(b) plan, Von Wald noted.

“I don’t know that there are a lot of new plan sponsors out there buying insurance,” she said. “Certainly, those that were [already] purchasing it, we’ve seen them looking for higher limits.”

There have been about $1 billion in total settlements in defined-contribution plan excessive-fee cases over the past 10 years, Aronowitz noted. That has provided an incentive for the flurry of new lawsuits seen this year.

“There has been the most dramatic inflection point for the fiduciary liability insurance area that I’ve ever seen,” he said. “The market is close to a crisis point. There has never been anything like this.”

Defendants have about a 25% chance of winning motions to dismiss -- and if they don’t succeed on that front, they are very likely to settle, he said.

And it is nearly impossible to predict whether a plan fiduciary is likely to be sued, he said.

“There is nothing in ERISA that says you have to have only index funds,” he said. But through litigation, plaintiffs’ law firms have effectively created a new standard of care that is unsustainable, he said.

The Department of Labor could make fiduciary duty clearer, thus stemming the surfeit of litigation, he said. Or, the court system could establish a higher standard for bringing excessive-fee claims, he said.

The rates plan sponsors pay for fiduciary coverage depends in part on plan size, including total assets and the number of participants, Von Wald said. But other factors that can increase the risk of a lawsuit, such as the inclusion of the employer’s own stock as an investment within the plan, can raise prices, she said.

“It’s a very difficult time in terms of being a fiduciary. There is certainly more scrutiny in terms of the due diligence that’s required under ERISA,” she said. “The way the marketplace is moving in addressing these types of class action lawsuits will have an impact in the upcoming years, especially if we’re seeing the settlements in the range we have in the past.”

The retention rates that plan sponsors pay to continue coverage when a contract is up were once as low as zero, and more modest rates were about $100,000, Aronowitz said. Now, those rates are as high as $2 million, he said.

That is a big new cost to employers, but it’s not the only one, he said. In order to get coverage, or continue with an existing policy, insureds often must show that they’ve taken steps to de-risk their plans, which they do with the help of a risk-management consultant, he said.

“If you are a plan sponsor in America … you can’t do this alone,” he said. “You need an expert.”

However, the act of hiring a consultant does not give employers immunity, said Michael Kozemchak, managing director at Institutional Investment Consulting, a firm that works mostly with plans with more than $100 million in assets. Most plans of that size, across the industry, work with consultants, he noted.

“It’s a giant number of lawsuits that have been filed. I think all of them have a consultant,” he said. “Showing up for [plan] committee meetings isn’t going to keep you out of harm’s way. I think that’s a paradigm shift.”

2020 has just been an unprecedented year in terms of the suits filed, it’s just been quite astonishing.

Wendy Von Wald, fiduciary product manager, Travelers

A problem is that employers work with consultants that have a similar mindset, he said.

“If the client is complacent, they hire people who are complacent,” he said. “You see the personality marriage between a committee and a consultant, and I think that can be catastrophic.”

Even large-plan consultants often “punch in and punch out,” failing to be assertive with employers about changes that should be made to their retirement plans, he said.

Plan sponsors need to have thorough documentation showing that they went through a comprehensive process in selecting investments and services, though about 90% of them can’t adequately do that in court, he said.

That means having competitive bidding processes at least every three or four years for everything -- record keeping, custodial services, the brokerage window, managed accounts and investments, he said. But plan fiduciaries also need to keep tabs on investment performance and costs much more regularly, outside of issuing requests for proposals.

“Most consultants don’t put formality around looking at the lowest cost funds every year,” he said.

The median size of a settlement in 401(k) litigation is currently about $10 million, he said. As insurers are adjusting prices and coverage limits, particularly during a time when many employers are facing their own financial challenges, there will likely be a gap in the coverage plan sponsors need and what they can afford.

“That is creating a problem,” Kozemchak said. “A lot of sponsors are going to be running naked.”

AI is no replacement for trusted financial advisors, but it can meaningfully enhance their capabilities as well as the systems they rely on.

Prudential's Jordan Toma is no "Finfluencer," but he is a registered financial advisor with four million social media followers and a message of overcoming personal struggles that's reached kids in 150 school across the US.

GReminders is deepening its integration partnership with a national wealth firm, while Advisor CRM touts a free new meeting tool for RIAs.

The Texas-based former advisor reportedly bilked clients out of millions of dollars, keeping them in the dark with doctored statements and a fake email domain.

The $3.3 trillion tax and spending cut package narrowly got through the upper house, with JD Vance casting the deciding vote to overrule three GOP holdouts.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.