In the age-old riddle of why retail-class investors consistently represent the tail-end of virtually every broad market investment trend, one clue might be found within the mutual fund industry.

Here we are with the S&P 500 Index up more than 100% from the market bottom in March 2009 and fund investors are still pulling money out of stock funds while shoveling money into conservative bond funds.

According to the Investment Company Institute, from March 2009 through May 9, 2012, equity mutual funds experienced $166.2 billion in net outflows, while bond funds over the same period had net inflows of $835.7 billion.

Of course, at this point, with the stock market rally looking like it's about to run out of steam — and signs of new risk popping up almost daily — the fund industry is surely ramping up for a more defensive lineup of investment strategies, right?

Not so much.

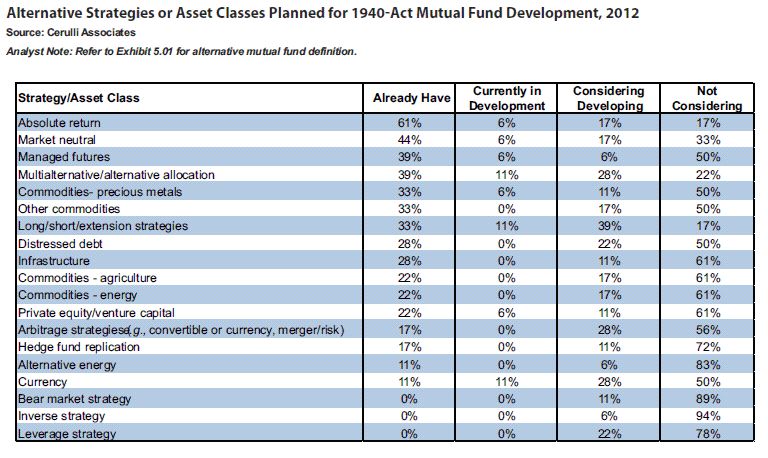

According to new report by Cerulli Associates Inc., the fund industry is starting to truly embrace alternative strategies — just not the kind you'd expect at this point in the market cycle.

The most popular alts mutual fund is absolute return, a development that should raise some regulatory eyebrows but apparently hasn't.

For an even better indication of where the fund industry prefers to lead investors, note the bottom three categories in the Cerulli research: bear market, inverse and leverage.

According to Cerulli, “No surveyed manager reported offering these strategies in a mutual fund and most are not considering them for development.”

The report further explained that inverse and leveraged strategies in particular are often associated with tactical trading methods and are therefore considered unsuitable for retail investors.

That could be it, or maybe fund companies just don't want to get caught in the awkward position of making a case for an inverse or bear market strategy that runs counter to the long-only strategies employed by 97.2% of all U.S. mutual funds.

Either way, alts mutual funds are finally catching on with investors. According to the report, there is now more than $200 billion in 475 alternative-strategy mutual funds. This compares to $78 billion in 304 funds in 2008, and $30 billion in 139 funds in 2003.

While alternative-strategy mutual funds have come and gone over the years, Cerulli analyst Matt Pickering said the number of funds has been steadily growing since 2003, and the pace has been accelerating since 2008.

“The obvious trend is that in 2008 investors woke up to what could possibly happen in the markets and now there's more of an appetite for risk mitigation,” he said. “Right now we're seeing portfolios where it might be customary to have 2% or 3% allocated to alternatives, but a lot of fund providers say they expect to see 20% allocated to portfolios over next five years.”

Greater use of alternatives in the pursuit of diversification is probably a good thing — assuming, of course, that the fund industry is leading investors in the right direction.

/images/newsletters src="/wp-content/uploads2012/06/twitter-bullet.png" Follow Jeff Benjamin