BlackRock Inc.’s revamped $7.6 billion lineup of style ETFs will feature new benchmarks, different tickers and a perk: rock-bottom fees.

The world’s biggest exchange-traded fund issuer is cutting the expense ratios on nine iShares Morningstar U.S. Equity Style Box ETFs to a range of 0.03% to 0.06%. That’s down from previous charges that varied between 0.25% and 0.30%. Those products -- which focus on specific approaches such as company size and growth or value investing -- are now tracking the Morningstar Broad Style Indexes that were launched in January.

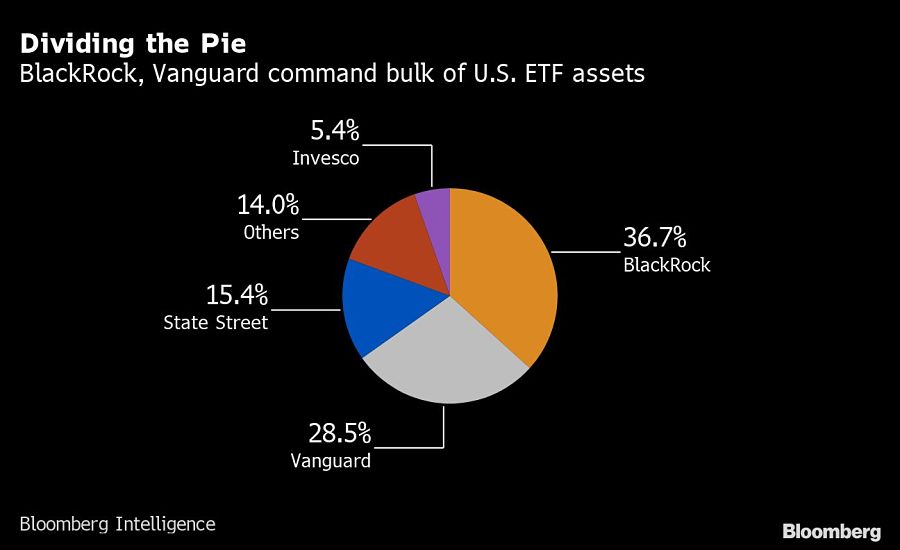

Fees have emerged as a battleground in the quickly growing $6 trillion ETF industry, where competition has prompted some of the biggest funds to slash costs to industry lows. BlackRock has been locked in a contest with runner-up Vanguard Group for flows, with the latter winning last year for the first time since 2013. Meanwhile, once-niche issuers such as Cathie Wood’s Ark Investment Management have jumped up the leaderboard as investors swarm to theme-friendly funds.

The decision on cutting fees reflects BlackRock’s commitment to being the leading ETF provider in all segments of the industry, including the burgeoning thematics arena, according to the head of iShares Americas Armando Senra.

Back in June, BlackRock lowered the expense ratio of its largest fund -- the $258 billion iShares Core S&P 500 ETF -- to 0.03% in order to match a rival product from Vanguard.

“We wanted to be incredibly competitive in the market for that cost-conscious buyer,” Senra said in a phone interview.

Prior to the fee cuts, BlackRock’s style ETFs were expensive relative to peers. The biggest of the collection, the $2.3 billion iShares Morningstar Growth ETF -- formerly known as the iShares Morningstar Large-Cap Growth ETF -- has an expense ratio of 0.04%, versus 0.25% previously. That brings the fund in line with the fee on the $68 billion Vanguard Growth ETF.

In addition to the sweeping changes, the style funds have also undergone share splits of varying ratios. Senra said that model portfolios -- both BlackRock’s own and those created by outside firms -- are a key area of focus for the company. Many of these are built with small account sizes, often under $10,000, said Chad Slawner, BlackRock’s head of iShares U.S. product.

“Many of the firms that give us feedback want lower share prices to be able to build the models appropriately,” Slawner said.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.