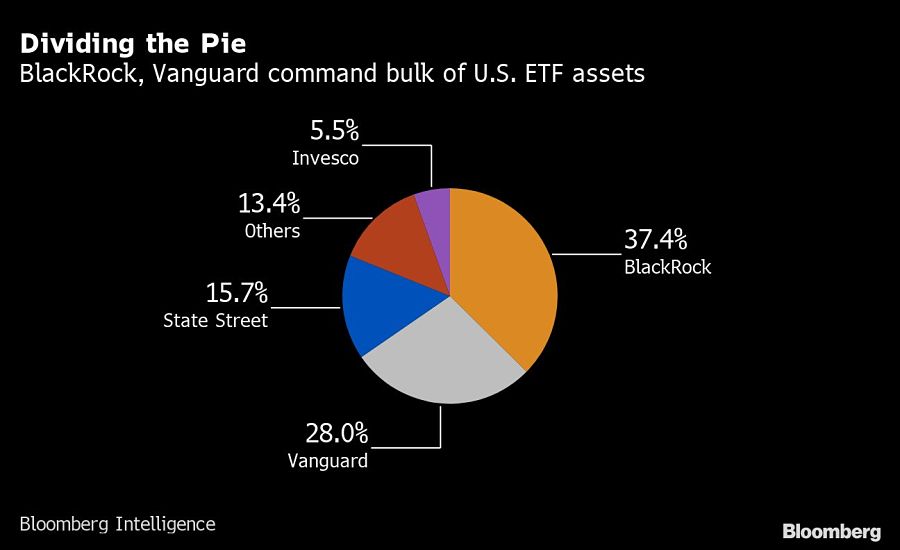

There’s a new champion in the battle for bragging rights atop the $5.3 trillion exchange-traded fund industry, while a familiar laggard is seeing its slice of the U.S. market shrink toward a record low.

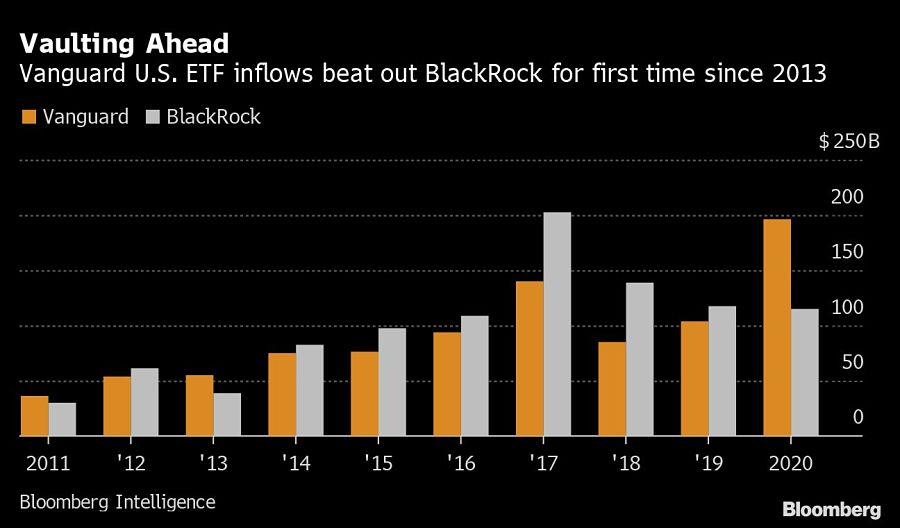

Vanguard Group is on track to beat BlackRock Inc. in attracting ETF flows for the first time since 2013, with a record of $194 billion so far in 2020, according to data compiled by Bloomberg.

The world’s largest asset manager lured $113 billion, while State Street Corp. was a distant third place, with $32 billion. The Boston-based firm’s market share is poised to drop for a fifth straight year after a $29 billion exodus from its crown jewel -- the $324 billion SPDR S&P 500 ETF Trust (SPY).

In a year that saw a pandemic send shockwaves through global financial markets, Vanguard and BlackRock have vaulted ahead of rivals in attracting cash to their ETFs. Both asset managers were helped in part by their popularity with financial advisers and their presence in model portfolios, which bundle funds into ready-made strategies. State Street hasn’t seen the same level of success given that fees on some of its top funds are relatively high, said CFRA Research’s Todd Rosenbluth.

While SPY is among the most profitable products partly due to its expense ratio of 0.095%, BlackRock’s $234 billion iShares Core S&P 500 ETF (IVV) and the $174 billion Vanguard S&P 500 ETF (VOO) each charge only 0.03%.

“As more retail and wealth management investors have joined the ETF market, State Street has missed out on a good chunk of those inflows,” said Rosenbluth, CFRA’s head of mutual fund and ETF research. “They were late to bring pricing down for products that are used as building blocks of investor portfolios.”

But flows alone don’t tell the complete story of State Street’s funds this year, said Matt Bartolini, head of SPDR Americas Research. SPY is the most actively traded ETF -- a status it cemented in 2020.

“We saw a significant increase in trading volume through the year, particularly in periods of volatility,” Bartolini said. “Investors gravitated toward our suite when they needed liquidity the most.”

Another highlight of the year was the booming demand for leveraged and niche products. The Ark Innovation ETF (ARKK) has become the largest actively managed fund, with Cathie Wood’s firm posting year-to-date inflows of $18.8 billion. Smaller issuers such as ProShares, First Trust and Direxion have also climbed the ranks.

“You are certainly continuing to see innovation coming from smaller issuers,” said Jillian DelSignore, principal at Lakefront Advisory. “You have these clusters of the industry that are nipping at the heels of the much larger issuers.”

Vanguard’s intake has been boosted by the conversion of some of its mutual-fund clients to lower-cost ETF shares, transactions that totaled $37 billion through the end of November, according to a Vanguard spokesman.

The steady inflows into those funds showcase the buy-and-hold ethos of the typical Vanguard investor -- financial advisers and wealth managers, according to Citigroup’s Scott Chronert. While BlackRock is also popular with that set of investors, its ETFs -- which tend to be highly liquid -- are often used as trading tools, the analyst said.

“When investors wanted to easily and conveniently access market opportunities anywhere in the world, they turned to iShares,” a BlackRock spokeswoman said, adding that those funds “have repeatedly demonstrated their versatility and resilience this year.”

Several analysts say it’s still unclear whether the gap between the top two ETFs and the rest of the pack will continue to widen in 2021. Bloomberg News reported earlier this month that State Street was exploring options for its asset management business -- including a merger with a competitor -- to gain scale, according to people familiar with the matter. A State Street representative declined to comment on the article.

“The pie is growing and State Street is getting some of the slices,” CFRA’s Rosenbluth said. “That can be appealing to a smaller ETF provider or a firm that has been on the outside looking to break into the ETF market.”

A complaint by the Social Security Administration's chief data officer alleges numbers, names, and other sensitive information were handled in a way that creates "enormous vulnerabilities."

The New Orleans-based 5th Circuit has sided the industry groups arguing the commission's short-selling rules exceeded its authority.

The deal will see the global alts giant snap up the fintech firm, which has struggled to gain traction among advisors over the years, for up to $200 million

Elsewhere, Osaic extended its reach in Knoxville with a former TrustFirst team, while Raymond James scored another win in the war for Commonwealth advisors.

Meanwhile, EP Wealth extended its Southwestern presence with a $370 million women-led firm in Santa Fe, New Mexico.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.