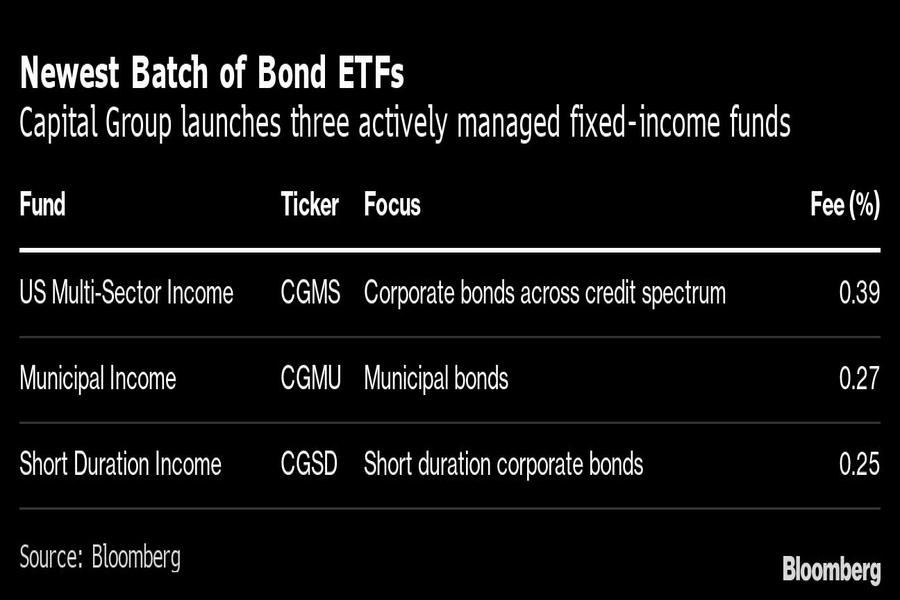

Capital Group is launching a fresh trio of exchange-traded debt funds, looking to cash in on the active-management mania that sent its ETF assets ballooning to $3.5 billion this year.

The new batch of bond funds started trading yesterday on the New York Stock Exchange, just eight months after the Los-Angeles based firm became the last major money-management firm to wade into the U.S.’ $6 trillion ETF market.

With focuses spanning from municipal bonds to short-duration debt, the ETFs are meant to offer access to high yields while managing risk linked to the Federal Reserve’s aggressive monetary policy, said Ryan Murphy, director of fixed income business development at Capital Group.

“We’re in an environment where you’re actually getting a very sizable amount of income out of fixed income,” he said.

Inflows into fixed-income ETFs nearly doubled in the past week to more than $9 billion, marking the fourth straight week of inflows, led by credit, according to data compiled by Bloomberg.

The funds, first filed for in July, join Capital Group’s lineup of existing exchange-traded products, which includes five stock ETFs and one fixed-income ETF. Investors have poured more than $3.5 billion into those six ETFs since they began trading in February, according to the firm’s data as of Oct. 25.

Capital Group has “a very strong distribution network that has relationships with many advisors,” said James Seyffart, an ETF analyst at Bloomberg Intelligence. “Their ability to garner these billions in such a historically bad market really speaks to the strength of those relationships.”

Firms in New York and Arizona are the latest additions to the mega-RIA

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Sieg, 58, was head of Merrill Wealth Management, left in 2023 and returned that September to Citigroup, where he worked before being hired by Merrill Lynch in 2009.

Technology can do a lot of things, but advisors still have undeniable value

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.