A new exchange-traded fund from Global X seeks to invest in the green-building market, the company announced Wednesday.

The need for lower-carbon dwellings is projected to ramp up in the coming years, with the world’s population on track to reach nearly 10 billion people by 2050, most of whom will reside in urban areas, the company stated, citing data from the United Nations.

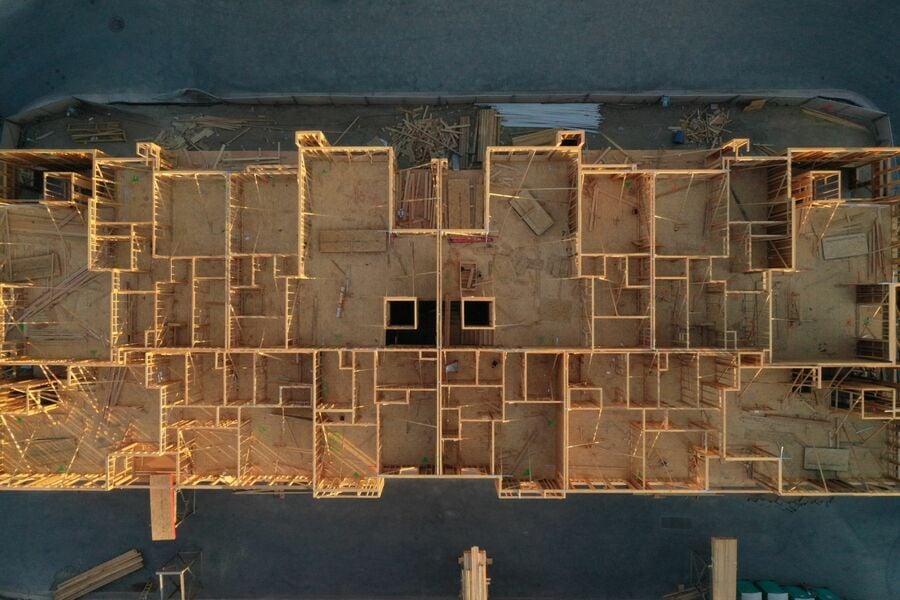

By that time, the housing stock will need to double in order to accommodate growing demands for place for people to live and work, Global X said.

The Global X Green Building ETF, which has an expense ratio of 45 basis points, will “invest in companies that are positioned to benefit from increased demand for buildings that reduce or eliminate negative impacts, and/or create positive impacts, on the natural environment, including green building development, green building management and green building technologies and materials.”

Some urban areas will be more affected by changing climate and rising sea levels, the firm noted. Buildings account for 38% of energy-related carbon emissions across the world, as well as half of all extracted materials, making the area “key to reducing building-related emissions and improving urban resiliency in the face of climate change.”

Global X’s thematic growth line of 35 ETFs represent more than $19 billion in assets under management, according to the firm.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.