Exchange-traded fund investors are diving headfirst into high-yield debt just days before the Federal Reserve’s interest-rate decision.

Risk assets of all stripes have been climbing as optimism builds around the Fed dialing back the pace of rate hikes after it delivers an expected fourth 75-basis-point rate increase in a row Wednesday. The renewed appetite for risk has boosted equities and sent billions into credit ETFs despite lackluster corporate earnings.

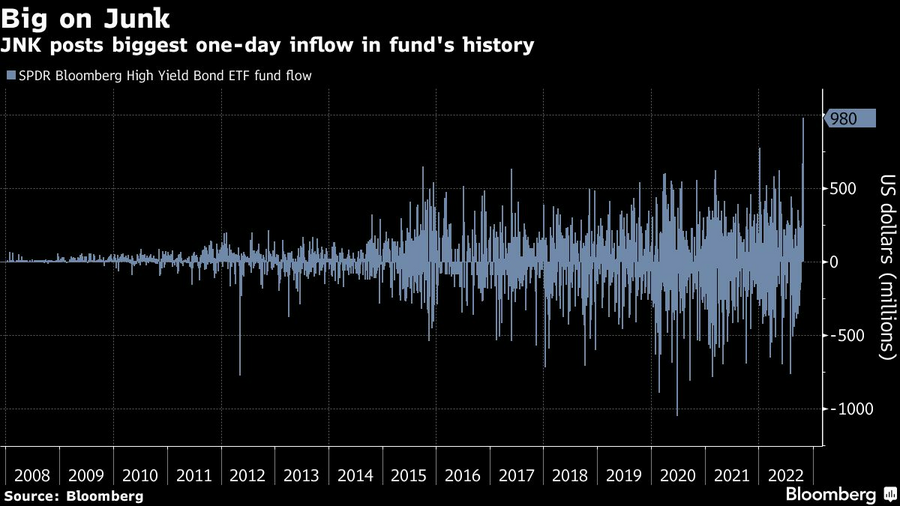

Traders poured roughly $980 million into the $8.5 billion SPDR Bloomberg High Yield Bond ETF (JNK) Friday in the fund’s biggest one-day inflow since 2007, Bloomberg data show. The influx follows JNK’s strongest two-week rally since May.

But this week’s Fed meeting may deliver a reality check to the bulls, according to Independent Advisor Alliance’s Chris Zaccarelli.

“We believe this will ultimately be a head fake as any risk-on rallies will run out of steam once investors realize the Fed is serious about raising rates and keeping them higher for longer,” said Zaccarelli, the firm’s chief investment officer. “From a fundamental point of view it is a risky time to be buying risk assets, although from a technical point of view it makes sense short term.”

Momentum cooled Monday, with JNK dropping 1% alongside U.S. stocks. The worst inflation in a generation and the Fed’s campaign to cool it have dragged JNK more than 12% lower on a total-return basis this year, Bloomberg data show.

DataTrek Research’s Nicholas Colas sees Monday’s price action as a blip. Junk bond spreads over Treasuries have narrowed in recent weeks, suggesting that there’s little concern about corporate America’s ability to cover interest costs or refinancing expenses.

“The highest risk parts of the U.S. corporate bond market are signaling similar confidence to that of American equity markets just now,” DataTrek co-founder Colas wrote in a note Monday. “We are looking for HY spreads over Treasuries to continue to narrow as a confirmation that the current equity market rally has further room to run.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.