Neuberger Berman Group LLC is launching three actively managed exchange-traded funds Thursday, becoming the latest big asset manager to dive into Wall Street’s $7 trillion ETF industry.

The Neuberger Berman Connected Consumer ETF (NBCC) focuses on companies that benefit from the spending habits of Gen Z and millennials, or those born between roughly 1981 and 2012. The Carbon Transition & Infrastructure ETF (NBCT) invests in businesses transitioning to low-carbon resources, electrification, and carbon-reduction solutions. The Disrupters ETF (NBDS) targets roughly 30 companies across tech, healthcare, consumer, and financials that can shape the future.

The launches mark the latest in a series of ETF entrances by major asset managers as investors increasingly ditch mutual funds in favor of the cheaper, easier-to-trade wrapper. Already this year, Capital Group has waded in after a decade on the sidelines, and just last week Morgan Stanley revealed it is building its own ETF platform.

Neuberger has opted for actively managed, thematic offerings in a bid to stand out in the heavily saturated market, according to Hari Ramanan, chief investment officer of research strategies at the firm. Almost 3,000 ETFs are now trading in the U.S., according to data compiled by Bloomberg.

“It’s a crowded marketplace,” Ramanan said in an interview. “If we’re going to come and join this party, we’d better bring something different, we’d better bring something incremental to what’s already out there.”

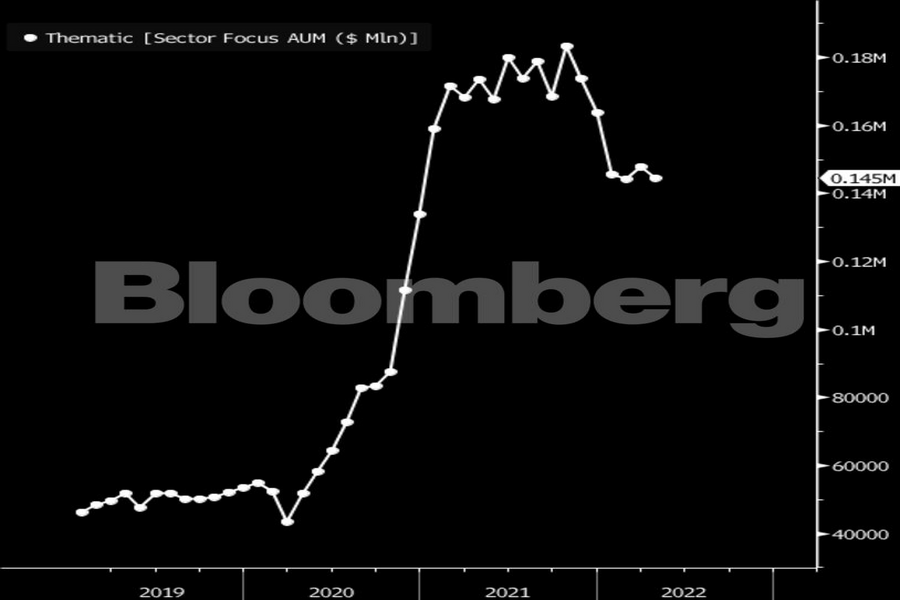

Thematic funds — which invest based on emerging trends like robotics or clean energy — boomed in recent years alongside an influx of retail investors and as the pandemic accelerated digital adoption across many industries. However, they have stalled amid this year’s stock turmoil, and assets in thematic ETFs have dropped to about $145 billion from $164 billion at the end of 2021, according to Bloomberg Intelligence data.

Employee-owned Neuberger manages about $460 billion. The three new funds bring to the market years of research conducted to understand both consumers and companies, Ramanan said. They were created in response to clients who wanted access to the firm’s strategies via ETFs.

Each fund will carry a 0.55% expense ratio.

Most firms place a limit on advisors’ sales of alternative investments to clients in the neighborhood of 10% a customer’s net worth.

Those jumping ship include women advisors and breakaways.

Firms in New York and Arizona are the latest additions to the mega-RIA.

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.