ETF Managers Group launched an exchange-traded fund tracking companies focused on testing and treatments of infectious diseases.

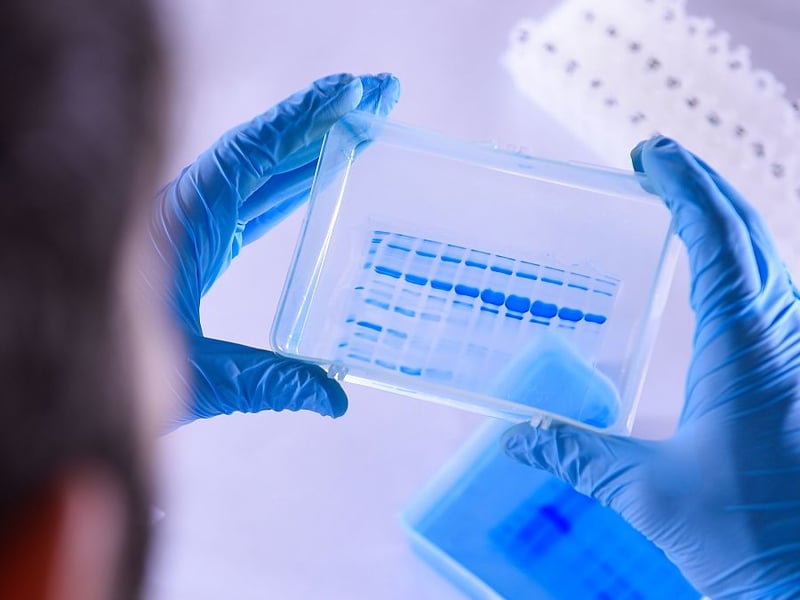

The ETFMG Treatments, Testing and Advancements ETF, which started trading Thursday under the ticker GERM, gives access to both established biotechnology companies and “unsung heroes,” the firm said in a statement.

The fund tracks an index whose biggest holding is Moderna Inc., a company that’s seen its stock price more than triple this year on news of its progress in developing a vaccine.

As global coronavirus cases exceed 8.3 million, companies, health authorities, drug regulators and research institutes are working around the clock to come up with the world’s first effective vaccine for COVID-19. Concern over a second wave of the pandemic threatens recent efforts to relax restrictions and revive businesses after months of lockdowns.

“Everyone is thinking about treatments and vaccines,” said Sam Masucci, chief executive officer and founder of ETF Managers Group. “It touches them very personally. We tried to develop a product of all the companies at the forefront that will hopefully get us back to a more normalized life.”

The fund has a 0.68% expense ratio.

Earlier this year, Pacer Financial filed for a BioThreat ETF (VIRS), which is focused on companies combating biological threats to human health.

This kind of thematic fund is effectively “a trifecta bet” -- meaning the issuer has to get the theme, stocks and valuations right, according to Ben Johnson, director of global ETF research at Morningstar Inc.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.