JPMorgan Asset Management will convert a $1.1 billion fixed-income mutual fund into an ETF on Friday, joining a growing Wall Street trend that’s expected to see as much as $1 trillion make the switch.

The JPMorgan Inflation Managed Bond Fund (JIMAX) is becoming the JPMorgan Inflation Managed Bond ETF (JCPI) after the close, according to a notice on the fund’s website. It’s the first of four planned conversions by the firm that will shift around $9 billion of assets into exchange-traded funds by mid-June.

Just a year after the first formal conversion between the two investment structures took place, multiple issuers have now made the move as investors increasingly favor typically lower-cost, more tax-efficient ETFs.

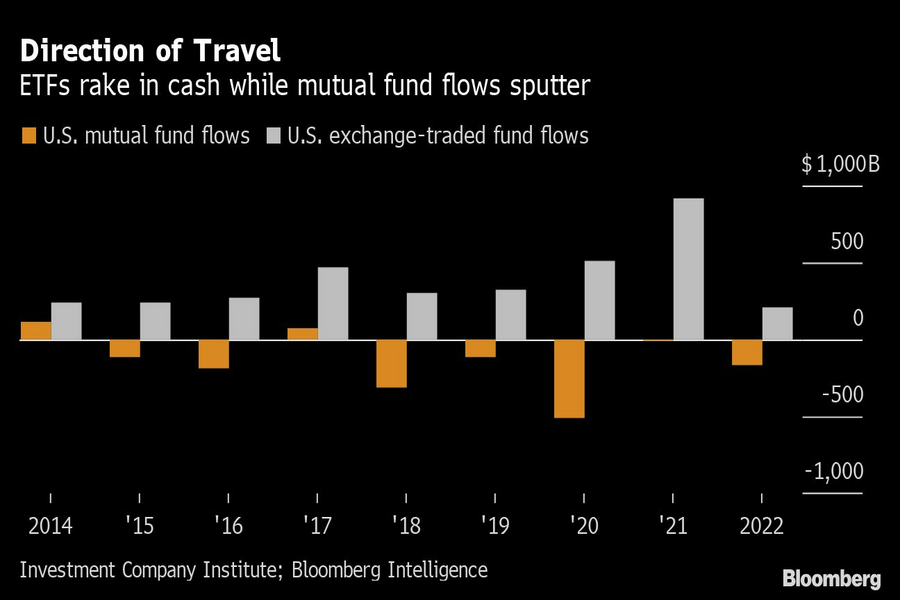

More than $160 billion has exited mutual funds in 2022 so far as ETFs have absorbed over $200 billion, Investment Company Institute data show.

“Conversions in general are going to continue to accelerate, they’re proving to be an interesting avenue for entrants,” said Jill DelSignore, managing director at FLX Networks. “Coming to the market with a track record and assets is incredibly important.”

Bloomberg Intelligence estimates that as much as $1 trillion could ultimately be converted to ETFs from mutual funds.

While that would be a huge boost to the $7 trillion U.S. ETF market, it’s around 5% of the mutual fund world. The challenge for most funds is that switching is complex and not suitable for every product. Meanwhile, the American pension system remains heavily geared toward the more established vehicle.

The biggest conversions so far are from quant giant Dimensional Fund Advisors, which flipped around $29 billion in June last year. Others switchers have included Motley Fool Asset Management, which finalized a nearly $1 billion move in December. Franklin Templeton has plans to join the conversion club later in 2022.

As more of them make the switch, asset managers will face some “potentially eye-opening” moments if the strategies fail to attract more cash, reckons DelSignore.

“The ETF wrapper is an amazing one, but it’s not magic,” she said.

The expense ratio of JCPI will be 0.25%, cheaper than fees on the various share classes of the mutual fund. The conversion will expand JPMorgan’s stable of U.S. ETFs to 41, according to data compiled by Bloomberg.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.