With markets in tumult and inflation surging, the allure of high-dividend stocks is growing fast.

Exchange-traded funds that track the highest-yielding stocks have taken in about $25 billion in assets so far this year, a new record for the value-oriented category, and inflows could reach $50 billion by year-end, according to Bloomberg Intelligence senior ETF analyst Eric Balchunas.

Companies that pay big dividends to their holders have long been wallflowers compared to sexier tech stocks, but that’s changing as the Federal Reserve rapidly hikes interest rates, raising fears of a recession, sending growth stocks spiraling and causing bond prices to slump.

“Investors have a need for yield, yet people are skittish to get that yield in the bond market because they know the Federal Reserve is hell-bent on raising rates,” Balchunas said on Bloomberg’s “Trillions” podcast. “With these ETFs, you’ve got this perfect one-two punch where they have two things people want right now — exposure to energy and high dividends.”

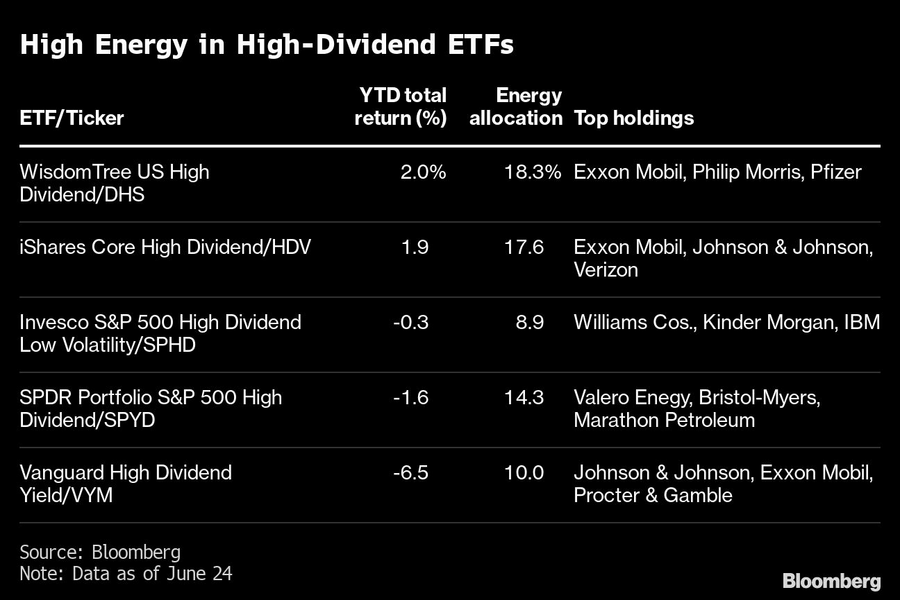

Energy companies often have high dividend yields, and the sector is the only portion of the S&P 500 Index that’s in the green this year as the war in Ukraine has crimped supplies, with the sector rising 29% as of Friday’s close versus a decline of 18% for the broader benchmark. Meanwhile, dividend-paying stocks have outperformed every other factor except value year-to-date, according to data compiled by Bloomberg.

Some of the high-dividend ETFs have energy stakes approaching 20%, helping boost their performance. Exxon Mobil Corp. (XOM), which yields just over 4% and whose stock is up 42% this year, is a top holding in many funds. These include the WisdomTree US High Dividend Fund (DHS) and the iShares Core High Dividend ETF (HDV), both of which have total returns of about 2% so far this year.

Many funds have dividend yields between 3% and 4%, about double the S&P 500’s trailing 12-month yield of 1.6%. While the 10-year Treasury note yields over 3% as well, “until the Fed cools off, the bond market is going to be a tough place,” said Balchunas. “We’ve seen it in mutual fund flows with older investors bailing. That will be a constant drain on the prices of bonds for the foreseeable future.”

The yields offered by high-dividend ETFs may be similar across funds, but they vary greatly in how they find that yield. The Vanguard High Dividend Yield ETF (VYM) holds about 440 stocks and tracks the FTSE High Dividend Yield Index, which is made up of U.S. companies (excluding real estate investment trusts) that have paid above-average dividends for the previous 12 months. The SPDR Portfolio S&P 500 High Dividend ETF (SPYD), meanwhile, homes in on 80 of the S&P 500’s highest-yielding companies.

The ETFs also weight their portfolio companies differently, which can dilute or amp up concentration. Some weight by market cap, some weight every stock equally, and some weight based on dividends. In WisdomTree’s ETF, for example, which focuses on the highest dividend yields, Exxon Mobil has a 7.3% weight, while it is a much more tame 2.8% in Vanguard’s market cap-weighted fund.

“If a fund weights by dividends you clearly are going to have some stocks that dominate, and that can be a little scary, because yes, this thing yields a lot but now it’s really controlling your fund,” said Balchunas. “Some investors would likely opt for the equal-weighted version on these funds.”

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning