In her previous job, Jessica Goedtel saw a prospective high-income client question the advisory firm’s willingness to work with someone who earns a living as a sex worker. To Goedtel, the idea that someone would be concerned about gaining approval from a wealth management provider was enough to convince her that a niche market existed.

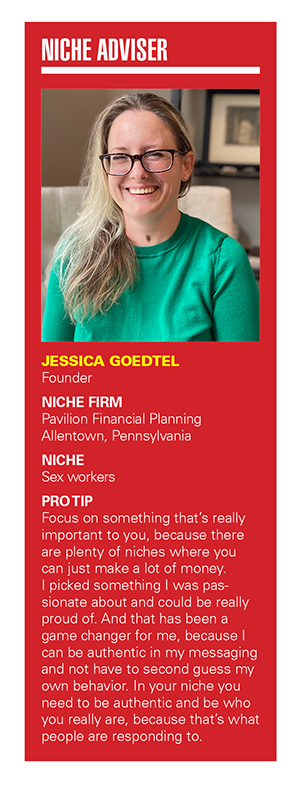

In August 2021, Goedtel founded Pavilion Financial Planning in Allentown, Pennsylvania to focus on her two distinct but unrelated niches of “tech workers and sex workers.” While the tech worker side of her subscription-based advisory practice currently represents the bulk of her business, Goedtel said the sex worker side might represent the greatest area of need and opportunity.

Though she readily uses the term sex worker to describe the niche, the focus is more specifically on a subcategory known as cam workers, which have been popularized by platforms such as OnlyFans.

While all cam workers on such platforms are not partaking in sex-related activities, Goedtel’s clients are typically earning income by providing virtual content and engagement with paid subscribers.

“I provide financial advice to women engaged in legal sex work,” she said. “Not that I have anything against illegal sex work, but for compliance purposes, I have to draw a line.”

In addition to the fact that all of her sex worker clients are women, Goedtel said the niche introduces some unique financial planning challenges, including variability of income and, sometimes, restricted access to banking services.

“It’s variable work and the income can fluctuate, which is almost akin to being a realtor,” she said.

Goedtel said sex workers also face certain banking obstacles related to pressure from outside activist groups that are increasingly pressuring large financial institutions to disassociate with certain businesses, including sex work.

“It’s a frequent problem that sex workers lose access to banking, and it’s not always easy to find a bank to work with you,” Goedtel said.

In addition to the politicized morality campaigns against sex work, the category is often less attractive to certain banking and credit features because of the increased frequency of charge-backs and claims from customers who try to renege on payments for services.

“Ultimately, they’re small business owners,” Goedtel said. “They are dealing with bank accounts that get randomly closed, they need tax planning, and they need to be saving for retirement.”

Goedtel charges clients an annual fee that can fluctuate based on complexity, but typically hovers around $3,000, divided into 12 monthly payments.

In terms of marketing her services, Goedtel relies on social media and referrals but also features her sex worker niche on her website.

The new regional leader brings nearly 25 years of experience as the firm seeks to tap a complex and evolving market.

The latest updates to its recordkeeping platform, including a solution originally developed for one large 20,000-advisor client, take aim at the small to medium-sized business space.

David Lau, founder and CEO of DPL Financial Partners, explains how the RIA boom and product innovation has fueled a slow-burn growth story in annuities.

Crypto investor argues the federal agency's probe, upheld by a federal appeals court, would "strip millions of Americans of meaningful privacy protections."

Meanwhile in Chicago, the wirehouse also lost another $454 million team as a group of defectors moved to Wells Fargo.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.