Updated January 9, 2024

The Setting Every Community Up for Retirement Enhancement (SECURE) Act aims to address the savings shortfall many Americans face as they head into retirement. It was signed into law in 2019 and has several provisions designed to incentivize retirement planning and diversify savings and investment options available to retirees.

The Act also contains provisions that benefit annuity providers and those who see the need for more lifetime income options in retirement plans.

In this article, a retirement expert explains the benefits of these SECURE Act annuity provisions. He’ll focus on two provisions – Sections 204 and 401 – both of which have a favorable effect on annuities.

The SECURE Act was drafted to assist Americans in saving for retirement and providing them with more investment options. It was signed into law on December 20, 2019, by former President Donald Trump as part of the Further Consolidated Appropriations Act of 2020. The SECURE Act was also the first major retirement-related legislation enacted since the Pension Protection Act of 2006.

The SECURE Act contains several provisions designed to incentivize retirement planning, diversify savings and investment options, and make it easier to access tax-advantaged savings programs. Some of the legislation’s highlights include:

A new version of the law, the SECURE 2.0 Act, was passed in 2022. It contains additional provisions but has the same goal of increasing access to and incentivizing participation in retirement plans.

The SECURE Act contains provisions that have a beneficial impact on annuities. Retirement expert Jamie Hopkins zeroes in on two of these provisions:

Hopkins is the founder and owner of Hopkins Retirement Consulting. He is also a finance professor of practice at Creighton University’s Heider College of Business.

Americans can access a range of retirement income options designed to provide sustainable withdrawals. These include mutual funds and managed accounts. Only insurance companies can offer a guarantee.

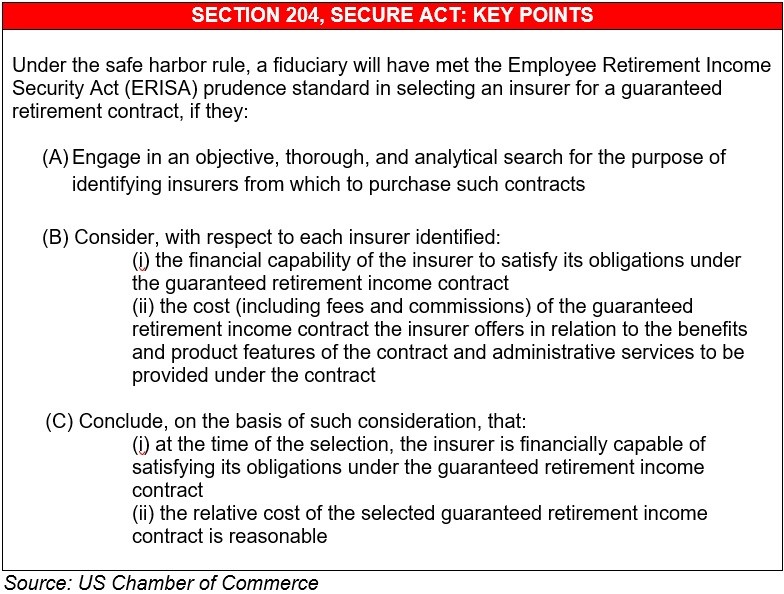

Some fiduciaries of retirement plans have found it burdensome to look for an insurer that has been around for at least 20 years to make payments to retirees. The safe harbor provision of the SECURE Act addresses that.

“The provision’s goal is to help relieve fiduciaries’ responsibilities in selecting and reviewing annuity providers and annuities to ease the burdens of getting annuities into 401(k) plans,” Hopkins explains. “Seen as a huge gift to the annuity world, this is a big win for annuity providers and those who believe retirees need more lifetime income options in their retirement plans.”

Hopkins adds that because of the provision, fiduciaries no longer need to select the lowest-cost product for their plans.

“The provision allows them to meet their fiduciary requirements if they choose an annuity provider who’s in good standing with state regulators. They’re no longer pressured to do a full due diligence review on the products and provider, although I still suggest fiduciaries to do so.”

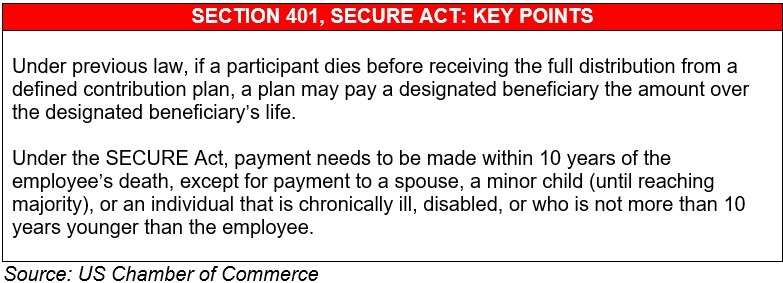

Section 401 of the SECURE Act implements more restrictive rules when it comes to RMD to designated beneficiaries of IRAs.

Under the provision, most non-spouse beneficiaries will have to take distributions from inherited retirement accounts within 10 years following the owner’s death. Prior to this, non-spouse beneficiaries were allowed to take distributions from inherited IRAs over their lifetimes.

“The act’s stretch provision eliminates most beneficiaries’ ability to stretch distributions from IRAs and defined-contribution plans over their life expectancy — excluding spouses, who can still take advantage of stretch strategies,” Hopkins explains.

“If stretch distributions were removed, any annuity contract held within a defined-contribution plan or individual retirement account would fall into the 10-year distribution period for non-spouse beneficiaries. This would be a big problem for IRAs and 401(k)s holding certain types of annuity contracts.”

Hopkins notes, however, that the SECURE Act provides an exception for certain existing annuity contracts.

“The bill states that certain qualified annuity contracts meet the exception,” he explains. “To meet the exception, they must be commercial annuities that make payments over the life of the employee or life of the employee and a designated beneficiary’s life.

“Grandfathered annuities under the SECURE Act would pay for the lifetime of two people. An example is a single premium immediate annuity or annuity in payout that would continue payouts to children or grandchildren over their lives. As long as the annuities meet the grandfathering rules, there should be no issue.”

But new annuities or annuities without a definitive payout decision won’t fall under the grandfathering rules, according to Hopkins.

He adds that annuity contracts’ ability to pay out over two non-spousal lives will only remain possible if the non-spousal individual qualifies as an eligible designated beneficiary.

“Under the SECURE Act, an eligible designated beneficiary is an individual who is either disabled or chronically ill (as defined by the IRS) or any individual who is no more than 10 years younger than the IRA owner,” Hopkins explains. “If the non-spousal annuitant is within the 10-year age range, the annuities could still be placed for siblings and significant others. Annuities paying out to the surviving spouse will be OK.”

He adds that new annuities sold with joint non-spouse beneficiaries moving forward in IRAs might not be able to adhere to the 10-year distribution rules.

“These annuities will need some cash-out or modification feature moving forward. This could be a real issue for some annuities currently inside of IRAs without this option or annuities that are sold after the SECURE Act.”

Hopkins also notes that while the SECURE Act might not secure retirement for everyone, it does offer some commonsense changes.

“The gut reaction to the bill is that the huge impacts on the stretch IRA distributions and annuities are for the better,” he says.

The SECURE 2.0 Act builds on the SECURE Act of 2019 to create more savings and investment opportunities for retirees. It was signed into law on December 23, 2022.

The expanded legislation contains more than 90 new provisions. Just like those in the SECURE Act, these provisions aim to incentivize retirement planning and offer flexible income options for those heading into retirement.

Some of the law’s highlights include:

One key difference between the SECURE Act and the SECURE 2.0 Act is the effective dates of the provisions. Many of the provisions in the original legislation came into effect at the beginning of 2020, or just days after it was passed. Some complex provisions under the SECURE 2.0 Act, however, are pushed out to 2024 and even beyond.

While not the focus of the legislation, some provisions of the SECURE 2.0 Act have a favorable impact on annuities. These include:

Section 201: Remove required minimum distribution barriers of life annuities.

This provision eliminates availability barriers to some tax-advantaged retirement accounts. Previously, RMD tests limited the accessibility of some lifetime annuities, which came with large benefit increases every year. The SECURE 2.0 Act caps the increase for this type of annuity at 5% each year.

Section 202: Qualifying longevity annuity contracts.

This provision of the SECURE 2.0 Act makes it easier to invest in qualified longevity annuity contracts (QLAC). It raised the amount a participant can take from their retirement account for purchasing a QLAC to $200,000. Previously, the figure was capped at $125,000 or 25% of the account’s value, or whichever is greater. The $200,000 limit is also indexed to inflation, unlike the previous cap.

Section 204: Eliminating a penalty on partial annuitization.

This provision allows the account holder of a partially annuitized plan to combine the payments from both the annuity and the plan when calculating their RMD. Previously, the two accounts had to be separated, with each having their own RMD calculation. This often resulted in higher RMD payments than if the plans were counted together.

You can learn more about the SECURE 2.0 Act, including how it affects annuities, in our SECURE 2.0 Act News Section. Don’t forget to bookmark this page, so you can easily access breaking news and expert opinion about the legislation.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.