During a bull market, the critical fiduciary success factor is connecting with a client’s mind. During crises, the critical factor is connecting with the client’s heart.

1. Fiduciary is a relationship, not a transaction. You’ve learned that a quarterly performance report can’t paper over a client’s emotional voids.

2. ESG/SRI is now an integral part of a fiduciary standard. Before the crisis, you often heard that the inclusion of ESG/SRG could trigger a fiduciary breach. Now the opposite is true — having a discussion with a client about impact investing is considered a fiduciary best practice.

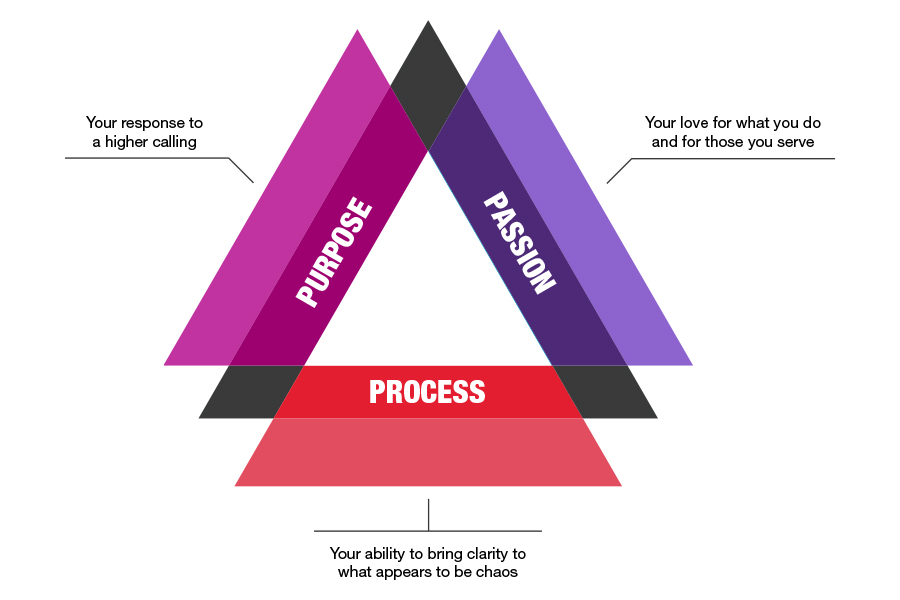

3. The 3 F’s have been supplanted by the 3 P’s: You can no longer define your value proposition in terms of fiduciary, funds and fees. Instead, the imperative is that you demonstrate your capacity for purpose, passion, and process.

4. It’s now easier to spot the disingenuous fiduciary. What matters during a crisis is compassion, character and competence. As such, a broker who acts like a fiduciary is far more preferable than a fiduciary who acts like a broker.

5. You have a fiduciary duty to harden clients for a VUCA world. We‘ve had to come to grips with the fact that we live in a volatile, uncertain, complex and ambiguous world. It’s now harder to model the risk/return profile of asset classes and to conduct the appropriate due diligence on investment options.

6. You’ve learned the importance of connectivity and having a communications cadence. Whatever the frequency of your communications with clients before the crises, during the crises you probably had to double it.

7. What clients needed during the crises couldn’t be found in Reg BI. A crisis is the absolute worst time to ask a client to sign a complex disclosure, for complexity often inhibits the formation of trust.

Don Trone is CEO of the new Center for Board Certified Fiduciaries.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

A survey reveals seven in 10 expect it to be a source of income, while most non-retired respondents worry about its continued sustainability.

AI suite and patent for AI-driven financial matchmaking arrive amid growing importance of marketing and tech among advisory firms.

The RIA's addition in Dallas, previously with Raymond James, comes just as the take-private deal between Corient's parent firm in Canada and Mubadala Capital comes to completion.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning