Financial advisers need to broaden their approach to marketing and embrace new business development ideas if they want to grow, and incorporating philanthropy is one tactic that many advisers are finding success with, according to a practice management expert.

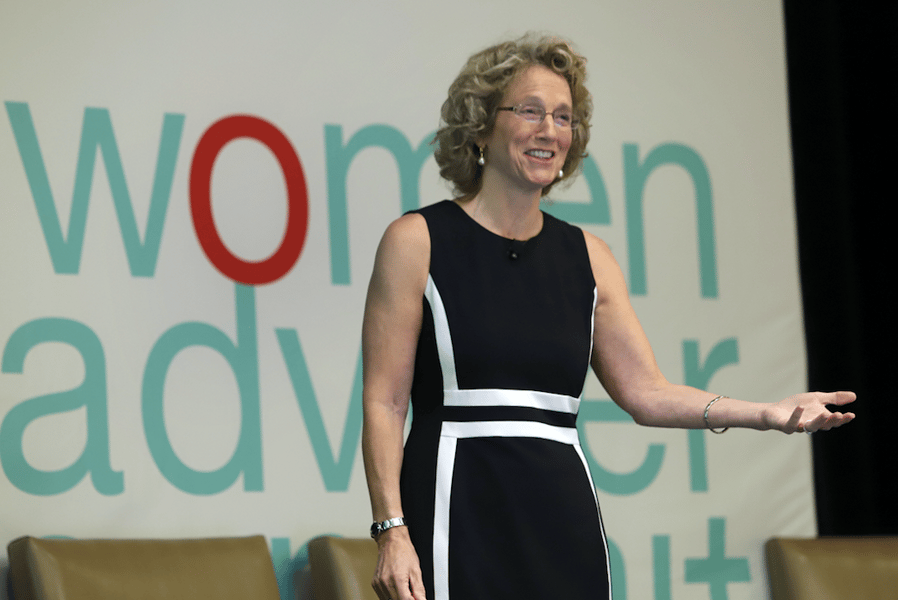

"Advisers often have old school thinking about marketing. They need to think more outside the box," said Susan Kay, director of business development at MFS Fund Distributors. "Community involvement can get you in front of the right people."

Ms. Kay, a featured speaker at the

InvestmentNews Women Adviser Summit in Denver Thursday, presented half a dozen ways that advisers are sponsoring events that support existing clients' charitable causes and introduce the adviser to excellent prospects.

For instance, one adviser hosts a private chef dinner in her home and asks a top client to invite 10 of his or her friends. The "cost" to attend is a donation to the client's favorite philanthropic cause.

This puts the close friends of a great client inside the adviser's home for 2½ hours.

"They will ask you what you do for a living," Ms. Kay told the nearly 200 women advisers attending the summit.

(More: What is 'money silence'?)

Another adviser offers to contribute an auction gift basket to their best clients' favorite charities and includes in each basket a certificate for "four hours of organizing your financial records in your own home."

Other advisers create events that honor their clients' charities, such as a bocce ball tournament, while one hosts a fundraiser on International Women's Day at which attendees make baskets for a battered women's shelter, and invites a client and her three best female friends.

The first step is that advisers need to know the top charities and causes of their top clients, Ms. Kay said.

"These events put an adviser in front of a number of people who tend to be similar to their best clients," she said.

Advisers also heard some business development tips from fellow financial planners speaking at the adviser summit.

(

More:

9 signs it's time to fire your client)

Hannah Buschbom, partner at

Ameriflex Financial Services, recommends that advisers have a succinct "elevator pitch" or

description that explains what they do best. Hers is, "I work with women who are suddenly single."

Lisa Sappenfield Boyer, owner of

Boyer & Sappenfield Investment Advisors, recommends that advisers find ways to show off their personality, especially on

social media.

She posts what she and the firm are doing within the community, and puts up pictures of her grandson on Facebook.

"It was a flashpoint for me that we have to keep sharing who we are," Ms. Boyer said. "People want to do business with people who are like them."