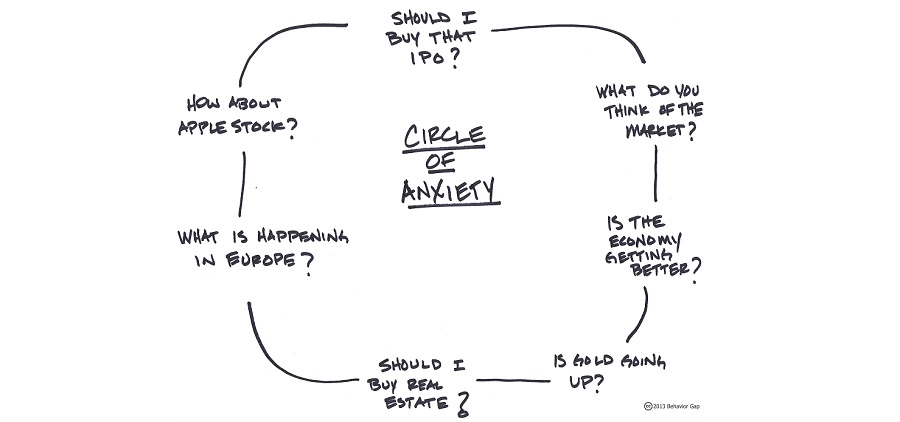

I've traveled all over the world in the last seven years, and I've run a mini experiment along the way. I ask people what word they would use to describe their feelings about money. The most common response I hear is akin to anxious. You could include fear, uncertainty and a bunch of other words, but in general, many people feel anxiety about money.

That's crazy to me! Not because I don't understand why people feel this way, but because they don't

need to feel this way. It starts with real financial advisers.

Real financial advisers have both the sacred blessing and a societal obligation to help people cope with their money anxiety. I can't think of a cooler job, but you may be wondering what you signed up for.

After all, you probably went to school for a finance degree or something similar thinking you'd be dealing with numbers and spreadsheets. Of course, it's super important that you have the technical chops to be in this industry. But the reality is that what you need in addition is probably much different from what you thought when you graduated.

Look, we're at a point where technology can do a lot of the technical stuff. But an algorithm can't help people understand the stories they're telling themselves about the numbers in the spreadsheet. In other words, you can't build an accurate spreadsheet (or algorithm, for that matter) if you don't know how to separate fact from fiction among the stories people tell themselves.

It doesn't hurt that getting clear about where people are and where they want to go can lessen anxiety. Also, as you help people detox from their stories, it becomes easy to see why you're worth every penny you receive for your work as a real financial adviser. Now, you could ignore the less technical things and stay focused on numbers and spreadsheets. But if you choose that option, then perhaps you should be worried about your job.

To be clear, though, the only way I know to help clients deal with anxiety requires real financial advisers taking the time to understand their clients' situations and helping them make good decisions repeatedly over decades. It's so much more than a 17-question risk questionnaire. It's about people's values and goals, their fears and dreams, their worries and concerns. Only then, after we know those things, can we apply the science of investing.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He's also the author of the weekly "Sketch Guy" column at the New York Times. He published his second book, "The One-Page Financial Plan: A Simple Way to Be Smart About Your Money" (Portfolio), last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.