Like father, like financial advisor.

Bringing a new member into a fully operating wealth management business generally offers an injection of optimism along with the prospect of growth. It could introduce much-needed technological or marketing expertise to the team, for instance, or broaden the division of labor, making everyone’s load a little lighter.

And it’s even better if a new addition brings assets to the operation. An AUM infusion is always a welcome benefit for a firm intent on expansion.

All that said, despite the best of intentions and background checks, partnerships don’t always work out. Bad fits happen. And breaking up – and unwinding those assets – can be very hard to do.

That’s why Hannes Grascher, a UBS wealth manager overseeing over three-quarters of a billion dollars in assets, was extremely careful when bringing his son Max onto his team, the New York International Group. The last thing he wanted to do was disturb an already streamlined operation, let alone a warm relationship with his offspring.

“The plan was never to bring him into our team right away, but rather let him go through an extensive training program that UBS offers,” Hannes said. “In the program, recent college graduates are funneled through various roles and departments, after which they can decide which part of the firm would be a good fit for them.”

After the three-year program concluded, Hannes felt Max was ready to join his team, which he did in the summer of 2020, smack in the middle of Covid. The pandemic actually helped the acclimation process as it provided the pair with a unique challenge they could overcome together. It also afforded the elder Grascher an opportunity to discover how his son’s talents could best be utilized.

“We had a lot of our ultra-high-net worth families who were going through generational wealth transfers. They really liked the fact that there was somebody on the team who was their kids’ age who then could continue working with their family after I was out of the picture,” said Hannes.

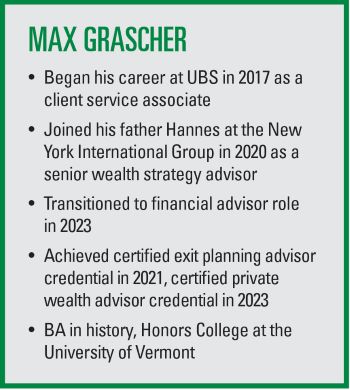

Aside from connecting with the children of Hannes’ clients, Max, a former college athlete, also offered useful skills when prospecting for professional athletes and entertainers, a cohort well known for blowing through their fortunes due to a lack of financial guidance.

“Since he joined us, we’ve been doing a lot of work with NBA players and their families. A lot of athletes are Max’s age and just have a better connection with him,” said Hannes. “At the same time, the parents like to see the gray hair and experience in the room.”

The idea of targeting pro athletes and pop stars originally came from Max at his father’s request. It has since grown into a significant segment of what is now the Grascher family business.

“When I first joined my father in July of 2020, the first thing he told me was to figure out the types of clients I’d like to work with when I became a full-time financial advisor. Given my passion for sports and music and being a former collegiate athlete myself, it made a great deal of sense to try and work with professional athletes and entertainers,” said Max, who last summer was invited to sit on an educational panel for recent NBA draftees and their parents.

When it comes to his development as a financial advisor, Hannes is a proponent of letting Max learn from his mistakes. He just works to make sure they are “cheap ones.”

“Fortunately, we have had very few disagreements and are compatible. He respects my experience and tries to learn as much as he can, and I soak up his energy and drive to get things done,” Hannes said.

For his part, Max says working alongside his dad in the office feels a lot like the camaraderie he felt as a college soccer player.

“I’m learning a lot from him every day, and seeing him excel at his job always motivates me to lift my game. I think there are certain things that I do that definitely motivate him to continue improving,” said Max.

Max is also striving to be a better and more knowledgeable teammate as well. Last year he went through a six-month process to earn his certified private wealth advisor certification via the Booth School of Business at the University of Chicago.

In terms of investment style, they both coordinate and take a holistic approach when constructing portfolios and wealth plans for clients. Nevertheless, Max admits his father is a bit more “old school” in picking certain equity positions, while he tends to lean more toward “ETFs and diversified funds that are less concentrated.”

One other item worth noting, according to Hannes, is that his clients also welcomed Max – and what he represents – with open arms.

“Our family clients appreciate the continuity Max and the younger members of the team represent. Many of them build their wealth through family-owned enterprises and they totally get the importance of planning to transition to the next generation,” he said.

Hannes says the pair have discussed how their business will eventually be passed down once he steps aside. He says it’s the same conversation he has with many of his clients and involves how to fairly incorporate siblings not involved in the family business into an estate plan.

“Max will take over the business when I retire, and I told him that I would have to make financial adjustments to be fair to his two siblings,” he said. “And he understands it.”

“My goal is to teach Max the best practices that I have learned over the last 30 years and help him to build his own business and then leave him my business when I’m ready to retire,” Hannes said. “And yes, it would be great if my younger kids or even grandkids had an interest in this business and could join Max 20 years from now, when he can go through the same process of teaching them how to run a successful wealth management business.”

In the meantime, both father and son are enjoying growing the business and spending quality time together.

“Most kids don’t spend that much time with their parents after graduating from college,” Max said. “Being able to go to work with him every day, and at the same time helping others achieve their goals, makes what we do feel less like the best job in the world. And best of all, we get paid for doing it!”

The $139 billion TAMP has hired industry veteran Phil Rogerson, unveils $10 million commitment for strategic expansion in North Carolina.

CEO Allen Darby sees a coming shift in M&A dynamics as AI eliminates clerical roles at RIAs, leaving buyers and sellers to negotiate who benefits from the added margin.

Michael Bell explains how the PE push in retirement plans will benefit investors, why warnings around risks may be overplayed, and what it will take to get plan fiduciaries comfortable with private investments.

Research highlights the dominant role of workplace retirement plans and breaks down the major factors dictating workers' IRA rollover decisions.

The wealth tech firm is rolling out its "Do Anything" assistant as leaders and strategists tout the next evolution of artificial intelligence.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.