Advisory firm use of outsourced investment managers remained steady in 2020, but new data show that strategies are shifting amid a backdrop of pandemic disruptions and market uncertainty.

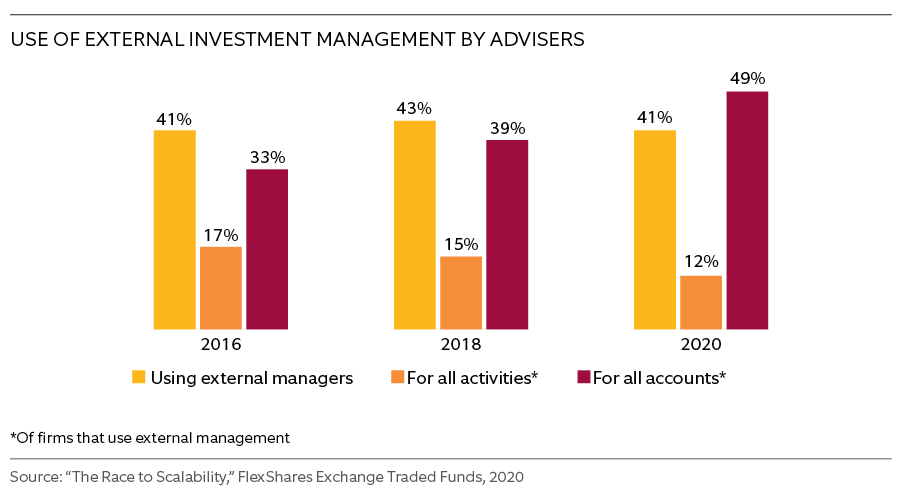

The share of advisory firms using third parties to manage investments stood at 41% in 2020, unchanged from four years ago, according to the upcoming white paper, “Race to Scalability 2020.” Over the same period, however, these firms have become both less likely to outsource all investment activities and more likely to outsource all their client accounts.

The data come from a biennial survey conducted by FlexShares Exchange Traded Funds for the past decade. InvestmentNews Research partnered on the 2020 survey, which was fielded between March and June and gathered responses from more than 500 independent advisers.

While the share of advisers using external managers has been relatively steady across studies, only 12% of firms that outsource did so for all investment-related activities in 2020, down from 17% in 2016 and from 50% in 2012. Increasingly, firms are focusing on the areas where outside expertise is most valuable.

Conversely, the share of these advisers that use an external manager for all client accounts rose from 33% to 49% between 2016 and 2020.

The divergence is part of a shift from outsourced investment management as an “all-or-nothing proposition” to a strategic focus on what firms do best, said Laura Gregg, director of practice management and advisor research at FlexShares.

“What has been clear over the past decade is that advisers are continuing to get more strategic in how they gain efficiencies and manage client assets,” Gregg said. “That’s because it’s increasingly hard — if not impossible — to manage everything in house.”

Many of the advisers who don’t outsource investment management say it’s because managing investments is part of their core value proposition, or a service they provide to other advisory firms. As these firms put more focus on investment management as a central business strategy, on average they find efficiencies by outsourcing between two and three other activities, such as information technology and marketing, the study found.

Even as these long-term trends unfold, 2020 may emerge as an inflection point. Among a sample of advisers who do not currently outsource investment management, 85% said the pandemic would lead them to reconsider their strategy.

“As pressures continue to mount — whether that’s fee pressures or the level of noninvestment demands of clients — I do think we’ll see more movement or openness to external managers,” Gregg said.

This research will be covered in more depth on the Race to Scalability webcast. Join the experts Nov. 12 as they discuss trends and tactics advisers are using to effectively grow their business. Register here.

To learn more, watch "The Race to Scalability: Coming November 12th."

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.