For the past 14 years, we’ve been studying the relationship between leadership behaviors and fiduciary responsibility. The research has been focused on the question: Do exemplary fiduciaries demonstrate the same behaviors as distinguished leaders?

The answer: It appears so.

More work needs to be done to psychometrically validate the research, but preliminary results indicate a strong correlation between genuine leaders and authentic fiduciaries.

We’re basing our studies on groundbreaking peer-reviewed published research in the new field of neuro-leadership. This work was conducted by Dr. Sean Hannah and his research collaborators, Dr. David Waldman, Dr. Pierre Balthazard, Dr. Robert Thatcher and others. (In the interest of full disclosure, Hannah, who is a tenured research professor at Wake Forest University, is also one of the founders of the new Center for Board Certified Fiduciaries.)

We’re learning to harness the power of neuroscience to increase our understanding of what makes an exemplary fiduciary. Such a discernment is vital to the training and development of the more than 17.5 million men and women who serve in an investment fiduciary capacity. Ever hear of a ‘lay fiduciary’? There are 17.5 million of them.

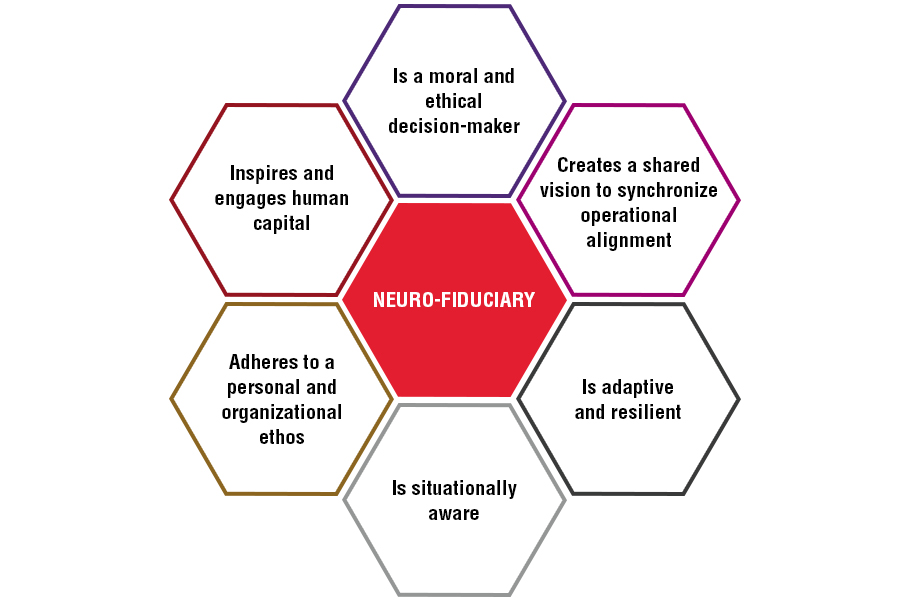

Central to the research in neuro-leadership is the identification of six neurological markers — hot spots in the brain — that distinguish the exemplary leader. These same six markers are now the basis for our studies in neuro-fiduciary.

1. Procedural justice: The capacity for ethical leadership, particularly your ability to enact a fair, just and transparent process to resolve moral conflicts or to allocate limited resources.

2. Vision/Inspiration: The capacity for inspirational leadership and your ability to define an engaging vision for the future. This requires a sense of purpose and passion for that purpose.

3. Self-complexity: The capacity to understand one’s own self within changing roles and requirements. This requires an ability to adjust and adapt your thoughts and behaviors to enact more appropriate responses to ill-defined, changing and evolving situations.

4. Situational awareness: The capacity to: (a) perceive changes in one’s environment, (b) interpret changes to determine whether and how changes may impact goals and objectives, and (c) make predictions as to how changes may impact future events.

5. Executive control: The capacity to resolve conflicts between an impulsive desire and adherence to a higher moral order.

6. Social astuteness: Your capacity for: (a) social intelligence, (b) interpersonal influence, (c) networking ability and (d) sincerity.

The pandemic has reinforced the importance of neuro-fiduciary training. Four neurological markers, in particular, were seen to be critical success factors. Advisers who excelled during the crisis demonstrated a greater capacity for vision/inspiration, self-complexity, situational awareness and social astuteness.

The critical role of the fiduciary means that we need to train on much more than rules and regulations. Furthermore, whether advisers is subject to fiduciary status, or not, they will be far more successful if they focus more attention on developing their leadership behaviors.

Don Trone is CEO of the new Center for Board Certified Fiduciaries.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning