In a worker adjustment and retraining notification, or WARN, filed Tuesday, JPMorgan Chase revealed plans to terminate a number of positions in its Jersey City, New Jersey, branch.

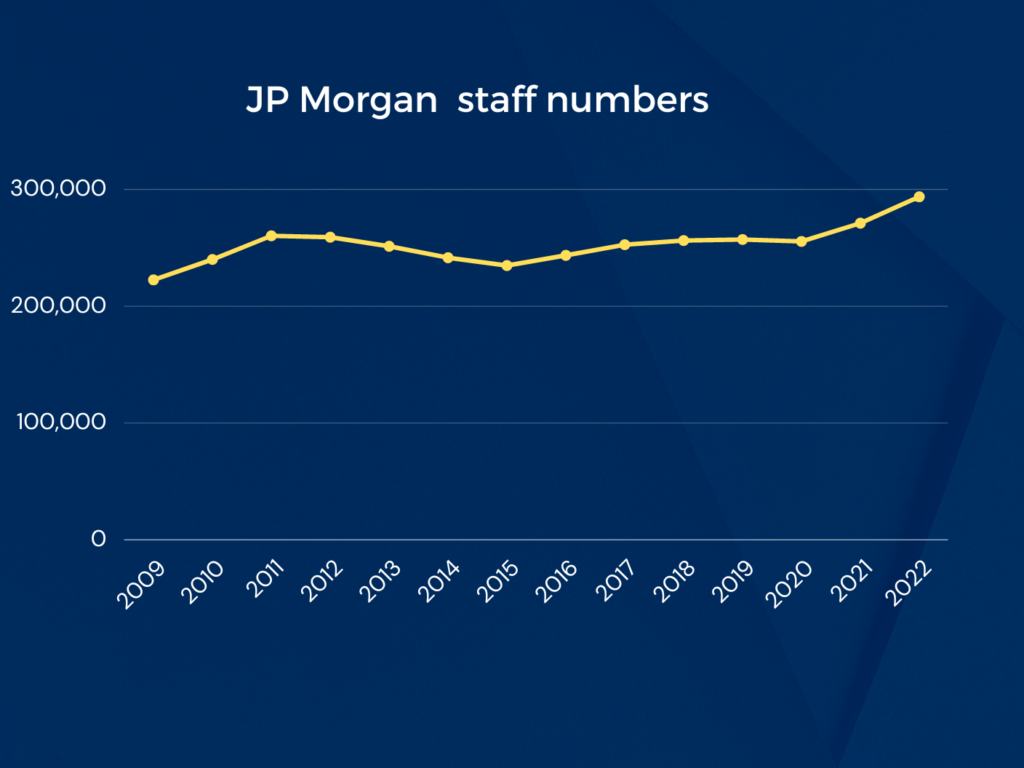

The planned layoffs are scheduled to occur in September, according to the notice. As the biggest U.S. lender, JPMorgan's workforce totaled 296,877 at the close of the first quarter, marking an 8% year-on-year increase.

JPMorgan commented that the layoffs "affect only a minor proportion of local workers, and efforts are underway to reallocate these employees. Our approach remains unchanged, and we manage the company with the goal of investing across various cycles. We're building for the long term and will persistently invest in recruitment, training, and technology". The bank further added that the 63 layoffs are part of a routine revision.

JPMorgan said that it currently has 560 vacancies in New Jersey and is striving to relocate the employees impacted by the job cuts. The bank employs 12,000 personnel in New Jersey. According to U.S. labor law, a WARN mandates companies with a workforce of 100 or more to provide a 60-day notice prior to plant shutdowns and large-scale layoffs.

In May, the bank considered laying off 500 employees across different departments. Additionally, it terminated nearly 1,000 positions at First Republic Bank after acquiring the struggling institution earlier this year.

Last month, the largest U.S. lender also terminated roughly 40 investment banking positions following a decrease in dealmaking activities. Rival banks Goldman Sachs Group, Morgan Stanley, and Citigroup have also resorted to layoffs in their investment banking divisions as a result of economic uncertainty.

Despite these layoffs, the investment bank has been going on a global hiring spree, hoping to capitalize on Silicon Valley Bank’s demise.

“It’s a very rare thing to have this monopolistic player go away overnight,” Doug Petno, chief executive of commercial banking at JPMorgan, said to the Financial Times. “We are open for business and we believe we can be the end-game winner.”

The bank has grown its $847-million-revenue overseas commercial banking team, which serves startups, by welcoming about 20 new bankers based in the UK. The expansion comes in addition to the recent hiring of 10 professionals in Israel.

The bank has also onboarded John China, a former senior executive from SVB, to co-lead its innovation-focused business segment in the U.S. There are also plans in the pipeline to further enhance its presence in various Asian offices.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.