Even before this year’s market crash, the wealth management industry’s richest clients were frustrated about fees.

A third of those with more than $1 million of investible assets were uncomfortable with them in 2019, according to Capgemini’s World Wealth Report 2020. Such discomfort will likely rise in today’s volatile markets.

The survey of more than 2,500 individuals found that about one in five plans to switch their primary wealth management firm in the next year, with high fees the top reason.

Their main concerns were about transparency, performance and value received. They also said they preferred fee structures to be performance- and service-based instead of asset-based.

It’s the latest sign of the pressure the industry is under as clients balk at costs and digital competitors emerge. The majority of investors weren’t satisfied by the quality of personalized information they receive, and about three-quarters of those surveyed said they would consider offerings from nontraditional providers like the big tech firms.

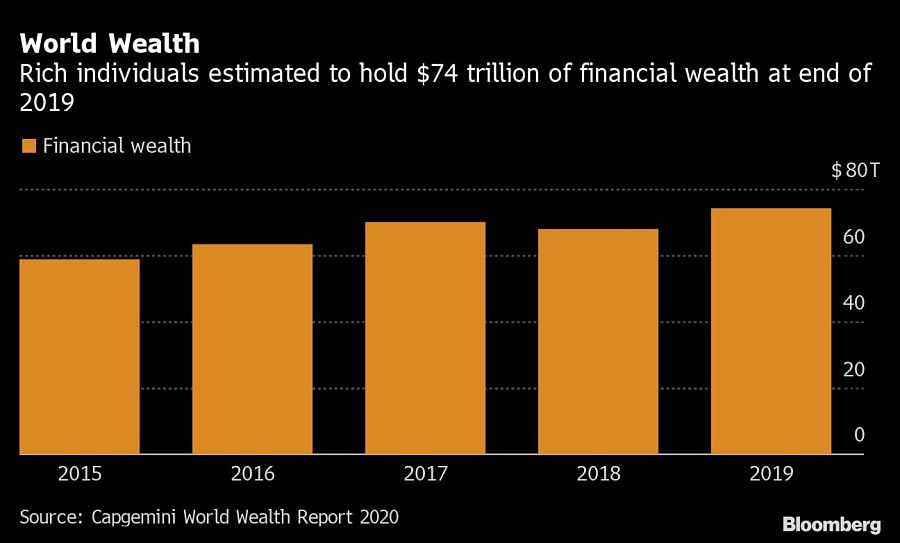

The discontent comes even as the rich get richer: The report estimates that the net worth of wealthy individuals climbed to $74 trillion at the end of 2019, up 8.7% from 2018 and $46 trillion in December 2012. The population of millionaires reached almost 20 million, including 183,400 with a net worth above $30 million, versus 18 million in 2018 and just 12 million in 2012.

For the first time since 2012, the Asia-Pacific region didn’t lead wealth growth last year -- it was North America. The U.S. alone had 5.9 million millionaires at the end of 2019, up from 5.3 million in 2018 and more than any other country. Japan followed, with 3.4 million millionaires, followed by Germany, China and France.

The wealthy favored equities in the first two months of 2020. They allocated 30% of their assets to stocks, compared with 17% to fixed income, 15% to real estate, 13% to alternative investments and 25% in cash.

The survey did flag some promising growth areas for wealth managers. Those under 40 were far more likely to be willing to pay for value-added services such as real estate investment advice and tax planning. Sustainable investing is another bright spot, especially for the richest investors.

The new regional leader brings nearly 25 years of experience as the firm seeks to tap a complex and evolving market.

The latest updates to its recordkeeping platform, including a solution originally developed for one large 20,000-advisor client, take aim at the small to medium-sized business space.

David Lau, founder and CEO of DPL Financial Partners, explains how the RIA boom and product innovation has fueled a slow-burn growth story in annuities.

Crypto investor argues the federal agency's probe, upheld by a federal appeals court, would "strip millions of Americans of meaningful privacy protections."

Meanwhile in Chicago, the wirehouse also lost another $454 million team as a group of defectors moved to Wells Fargo.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.