Five years ago, I was taking care of clients and writing the Sketch Guy column at the New York Times. My family and I were settling into our new home in Park City, Utah. Things were good. Then, I got what you might call an "interesting proposition."

Looking back, I see that crossing paths with the folks at The BAM Alliance marked a point where good things turned into great things. Today, as I head down a new path (New Zealand!), I consider myself very lucky to have met many incredible men and women during my time at BAM. I wouldn't have met these individuals or had these amazing experiences if BAM hadn't come knocking on my door.

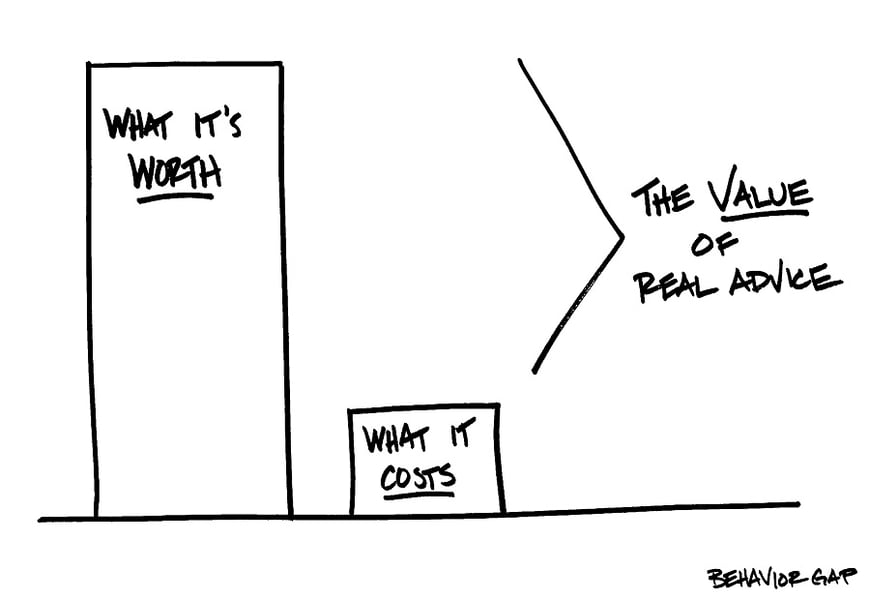

Perhaps most important of all, I confirmed that the Secret Society of Real Financial Advisers exists. I'm excited to continue sharing what I've learned from them to help other advisers.

From Michael Evans at The Cogent Advisor to Alex Madlener at Open Circle Wealth and Matt Hall at Hill Investment, I've seen firsthand just how many honest, capable and technically proficient advisers exist. And this is just a small sample.

Australia. South Africa. Europe. U.K. Ireland.

Everywhere I've gone, I continue to meet more members of this secret society. I'd send my mom to these professionals. I also wouldn't hesitate to send someone who needed help with a complex estate issue. They're that good and that dedicated to doing the hard work of real financial advisers.

I share all this because I know there are more of you out there doing amazing work. And over the next five years, as I move on from BAM, I plan to do everything I can to help advisers like you and shine a spotlight on your work.

It starts with the simple things, but not easy things, I've been sharing as part of the Master Communicator. Asking questions. Listening more than we talk. Acting as a news filter to separate the valuable from the useless. In the coming weeks and months, I'll continue to share more ways we can do a better job as real financial advisers.

But for today, I didn't want to miss the opportunity to tell you that I see the good work you're doing. I know you're making a real difference in people's lives, and I plan to continue helping you do the work of a real financial adviser.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He's also the author of the weekly "Sketch Guy" column at the New York Times. He published his second book, "The One-Page Financial Plan: A Simple Way to Be Smart About Your Money" (Portfolio), last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.