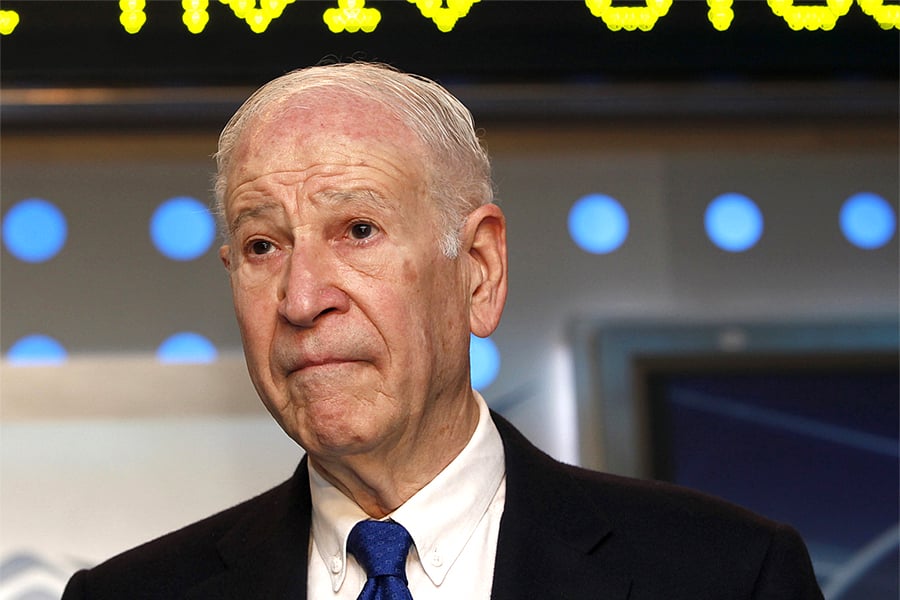

Dr. Phillip Frost, who was charged this month with fraud, said Thursday evening that he was retiring as non-executive chairman of Ladenburg Thalmann Financial Services Inc.

Dr. Frost and nine other individuals

were charged Sept. 7 in a Securities and Exchange Commission lawsuit with participating in "long running schemes that generated over $27 million from unlawful stock sales and caused significant harm to retail investors who were left holding virtually worthless stock," according to the SEC's complaint.

Dr. Frost is the largest shareholder in Ladenburg Thalman, controlling about 36% of the broker-dealer's shares

Along with his role at Ladenburg Thalmann, Dr. Frost is a well-known biotech investor in South Florida. Since March 2007, he has served as chairman of the board and CEO of OPKO Health Inc., a multinational biopharmaceutical and diagnostics company, according to Ladenburg Thalmann's annual proxy statement.

Ladenburg Thalmann is one of the leading networks of independent broker-dealers. Its B-Ds include Securities America Inc., Triad Advisors, Investacorp Inc. and Securities Service Network, which are home to 4,300 independent contractor brokers and financial advisers.

Richard Lampen, Ladenburg Thalmann's CEO and president, will replace Dr. Frost as chairman. Adam Malamed, the firm's executive vice president and chief operating officer, will join the firm's board of directors.

"I have decided to retire from the Ladenburg board and will concentrate my efforts on OPKO Health and my philanthropic interests," Dr. Frost said

in a statement, making no mention of the SEC's fraud charges. "As a long-term shareholder, I am confident in Ladenburg's outlook and look forward to its continued growth and success."

"Ladenburg would not be where it is today without [Dr. Frost's] many contributions, and his presence in the boardroom will be sorely missed," Mr. Lampen said.

Some

had been calling for Dr. Frost to resign, saying that the reputational risk he created for Ladenburg would only increase the longer he stayed with the firm.

The SEC's complaint describes

in elaborate detail the efforts that Dr. Frost and his associates allegedly made to pull off what the SEC called "classic pump-and-dump schemes."

"From 2013 to 2018, a group of prolific South Florida-based microcap fraudsters led by Barry Honig manipulated the share price of the stock of three companies in classic pump-and-dump schemes," the SEC alleges. "Miami biotech billionaire Phillip Frost allegedly participated in two of these three schemes." The companies were not identified by the SEC.

Mr. Honig "allegedly orchestrated the acquisition of large quantities of the issuer's stock at steep discounts, and after securing a substantial ownership interest in the companies, Honig and his associates engaged in illegal promotional activity and manipulative trading to artificially boost each issuer's stock price and to give the stock the appearance of active trading volume," according to the SEC.

Mr. Honig and his associates then dumped their shares into the inflated market, reaping millions of dollars at the expense of unsuspecting investors, the SEC alleges.