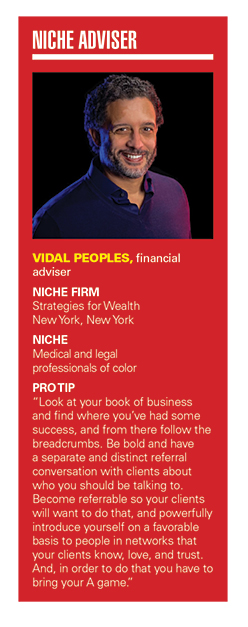

In 2010, Vidal Peoples wasn’t so much looking for a niche to help launch his financial advisory career as much as he was looking for a leg up through some communications training.

While Peoples, an adviser with Strategies for Wealth in New York City, candidly recalls the training sessions as “three days I’ll never get back,” he is grateful for befriending the medical doctor sitting next to him, who became the launching pad for an advisory practice focused on “medical and legal professionals of color who have had to take on significant debt.”

Fast forward to 2021 and Peoples, 49, still sounds like an adviser scrambling for his first client.

“My success is about turning my clients into raving fans,” he said, underscoring the rock-solid advantage of loyal clients willing to refer new clients to his doorstep.

Peoples, who worked as a fashion model and hotel concierge, among other things, before the events of September 11, 2001, inspired him to go back to college, said about 60% of his clients fit into his niche, and he brings on a handful of new doctors each year.

Peoples admits that his first doctor client, who was already working with another financial adviser, was a bit beyond his depth as someone in the business for just seven months at that time.

“We developed a friendship, and he gave me an opportunity even though he already had an adviser,” Peoples said. “I really didn’t know my way around the conversation as I do now and brought in a partner to help me out.”

Turned out, even though the doctor was working with an adviser, it was just an investment portfolio and didn’t include any comprehensive financial planning, including risk management.

“We did proper planning and at the base was a disability contract, because he didn’t have any risk protection,” Peoples said. “The only thing he was doing was putting money into investment products.”

That early successful connection inspired Peoples to tap into the vein of the kind of professionals that can see their incomes skyrocket in a relatively short period of time but are also often saddled with mountains of student loan debt.

“I’ll comb through my clients’ LinkedIn contacts, filter the contacts, and create lists of people I should be talking to,” he said.

The prospecting also includes asking existing clients “who on the list contacts will take a meeting with me, and can I use your name?” Peoples explains.

“If I send 10 invites, I might get two hits and of two hits, I might get one client,” he added.

While most of Peoples’ clients currently come via referral from existing clients, he is also expanding his presence in the medical and other professional communities.

In addition to applying to medical associations as an associate member, he does educational seminars to students at the State University of New York, and the City University of New York.

“I speak to graduating medical students and residents,” said. “It’s a long game and the idea is to meet them where they are. I give them some financial education whether they’re third-year or second-year medical students. And those that get placed, I talk about risk management, income protection, and disability insurance because if you get hurt and can’t work, those student loans will still be there.”

In terms of his niche, Peoples believes he has demographic trends on his side.

“The landscape of hospitals is changing, and there are more black and brown people working as doctors now,” he said. “Doctors are great clients because they are smart with medicine, but they are often clueless when it comes to finances.”

While he refers to his niche generally as doctors and lawyers of color, Peoples said the opportunity he sees is “mass affluent people of color, who are highly educated, have great education pedigree, great currency, but don’t have the time to do what I do.”

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Following a similar move by Robinhood, the online investing platform said it will also offer 24/5 trading initially with a menu of 100 US-listed stocks and ETFs.

The private equity giant will support the advisor tech marketing firm in boosting its AI capabilities and scaling its enterprise relationships.

The privately backed RIA's newest partner firm brings $850 million in assets while giving it a new foothold in the Salt Lake City region.

The latest preliminary data show $117 billion in second-quarter sales, but hints of a slowdown are emerging.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.