After a year of ups and downs, most advisers are anticipating more of the same in 2021.

Overall, a majority of financial advisers look forward to improvements in the economy and equity markets over the next 12 months, according to an InvestmentNews Research survey of more than 300 advisers fielded in the final weeks of 2020.

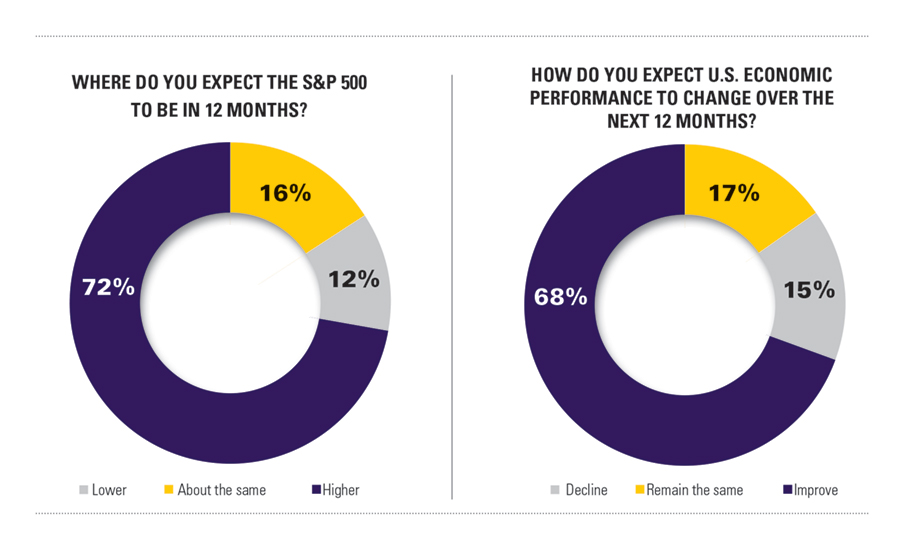

Advisers have been largely optimistic about stock indexes since markets began their initial rebound from the COVID-19 shock, but the gap between their expectations for equities and the overall economy has narrowed. Seventy-two percent expected growth in the S&P 500 and 68% anticipated overall economic improvement, compared with 60% and 44%, respectively, in a July survey.

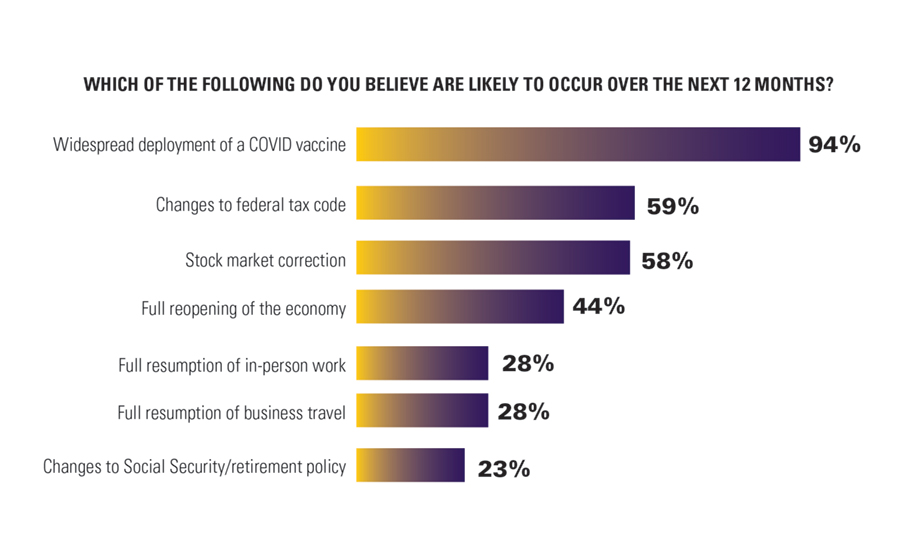

Yet adviser optimism, which was underpinned by the nearly universal expectation of a successful vaccine rollout by year-end, had its limits. Most anticipated that restrictions on business activity would last through the entirety of the next year.

Only 44% of advisers thought the economy would be fully reopened in the next 12 months, and only 28% expected a full resumption of in-person work or business travel.

And although the market outlook for a year from now was overwhelmingly positive, even that came with a caveat. Most advisers expected some choppiness along the way, with 58% saying a market correction was likely to occur.

With volatility expected to persist, survey respondents continued to be on the lookout for alpha, with 25% expecting to increase their use of individual stock picks and 24% saying they would increase usage of actively managed ETFs. International equity was the asset class poised to gain the most over the next year, with 42% of advisers planning to increase their exposure, according to the survey.

Still, the overall buoyancy of the industry stands out against the expectation that many of the headwinds from 2020 will persist through 2021.

But advisers have one more reason to be optimistic about the next year: At least they’ve faced those headwinds before.

For more information on IN’s research offerings, contact [email protected].

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.