Todd Combs, Warren Buffett's apprentice stock picker at Berkshire Hathaway Inc. (BRK/A), posted gains on his first equity bets at the company by buying when markets fell and increasing stakes in investments that declined.

Purchases of seven stocks by Combs in the nine months ended Sept. 30 advanced almost 14 percent as of Dec. 31, according to data compiled by Bloomberg. The Standard & Poor's 500 Index was little changed last year. Combs's results were propelled by a 51 percent surge in holdings of MasterCard Inc. (MA), the world's second-biggest payments network, and a 28 percent advance in an investment in retailer Dollar General Corp.

Combs followed the example set by Buffett, who invested in Goldman Sachs Group Inc. at the depths of the 2008 credit crunch and advised shareholders in 1998 to “rejoice when markets decline.” The portfolio manager hired by Buffett in 2010 added shares of Intel Corp., CVS Caremark Corp. (CVS) and Dollar General on Aug. 8 last year as the S&P 500 had its biggest decline of 2011.

“Those are very Buffett-like tenets of value investing: Buy when the markets are fearful,” said Tom Lewandowski, an analyst with Edward Jones & Co. who has a “buy” rating on Berkshire. “So I'm not surprised to see that Todd was buying.” Aug. 8 was the first trading day after S&P downgraded the U.S.

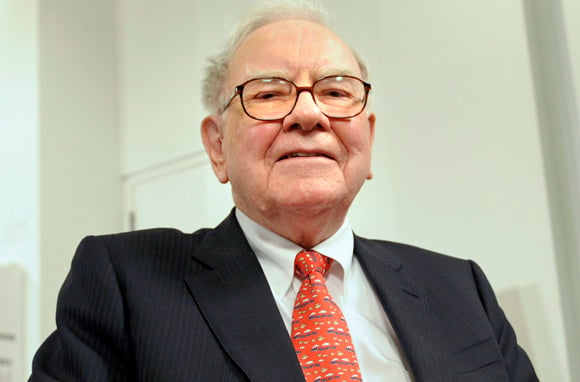

Buffett, 81, has said he'll focus on managing Berkshire's largest stockholdings and count on Combs and Ted Weschler, who was hired to join the Omaha, Nebraska-based firm this year, to take stakes of about $200 million.

The Oracle didn't have nearly as good a year as Combs. Shares of his Berkshire Hathaway Inc. slipped 4.7% last year. It was the second time since 1990 that the company's stock underperformed an S&P 500 that had either declined for the year or rose less than 5%

Buffett himself points to book value as a measure of performance rather than stock gains. By that measure, the Oracle still trailed his younger protege. Berkshire Hathaway's book value, a measure of assets minus liabilities, rose 1.7% to $160 billion in the nine-month period ended Sept. 30, helped by the Burlington Northern Santa Fe railroad and units such as toolmaker Iscar Metalworking Cos..

Buying Stocks

Combs spent about $1.24 billion accumulating positions in seven companies in first three quarters of 2011, according to the data from filings distributed by the National Association of Insurance Commissioners. The holdings of CVS, Intel, Dollar General (DG), MasterCard, Visa Inc. (V), General Dynamics Corp. (GD) and DirecTV were valued at about $1.41 billion at year-end.

“I'd give him an excellent grade,” said David Kass, a professor at the University of Maryland's Robert H. Smith School of Business. “He is very much demonstrating what you might expect a value investor like Warren Buffett to do.”

MasterCard was acquired by Combs at an average cost of about $246.74 in January and April, according to data compiled by Bloomberg. MasterCard, based in Purchase, New York, surged to $372.82 by year-end.

An initial stake in Dollar General was acquired through June 27 at an average price of $33.39. Combs bought a second batch of shares through Aug. 8 at $31.29, and a third through Aug. 29 at $31.69. He paid an average of $32.07 for about 4.5 million shares. Dollar General ended the year at $41.14.

Next Generation

Combs bought about 3.5 million shares of CVS, the largest U.S. provider of prescription drugs, through Aug. 8 at a cost of about $36.15 a share, the data show. He added 2.2 million shares less than a month later at an average of $34.05. The stock ended the year at $40.78 in New York trading.

Combs is part of a second generation of Berkshire leaders who will collectively assume the responsibilities that Buffett has held through his four decades as chairman, chief executive officer and head of investments. He joined Berkshire as Buffett's longtime backup stock picker, Lou Simpson, retired. Combs made the equity investments through Berkshire's Geico Corp., the car-insurance subsidiary whose portfolio previously was overseen by Simpson.

Berkshire's biggest stock bet of 2011 was made by Buffett, who wagered more than $10 billion on International Business Machines Corp. (IBM) Berkshire's top stake is a holding of Coca-Cola Co. valued at more than $13 billion. Combs was assigned to oversee as much as $3 billion and can make trades without consulting Buffett.

‘Bigger Things'

“Any time there's a $200 million purchase or something like that, that's very likely to be Todd or Ted,” Buffett said Nov. 14 in a televised CNBC interview. “That's not me because I look at bigger things.”

Buffett didn't respond to an interview request e-mailed to his assistant, Carrie Kizer. Combs declined to comment.

Combs came to Berkshire from Castle Point Capital Management LLC, where he oversaw shares of financial-services companies including MasterCard. The former hedge fund manager, who was 39 when Buffett announced the hiring in October 2010, has a bachelor's degree from Florida State University. Combs also has a master's in business administration from Columbia University, where Buffett studied.

Berkshire added four companies to the portfolio in the days through Aug. 8, spending about $125 million each on CVS, Intel (INTC), General Dynamics and DirecTV. Berkshire added about $75 million of shares in each company in purchases through late August or early September.

RELATED ITEM Ted Weschler's nine stock holdings before joing Berkshire »

“It was a great time for him to step in, in retrospect,” said Patrick Wang, an analyst at Evercore Partners Inc. who has an “equalweight” rating on Intel shares. “There were a lot of questions about whether stocks would work” in early August.

DirecTV, the largest U.S. satellite-TV provider, was one of Weschler's stock picks at his Charlottesville, Virginia-based, Peninsula Capital Advisors LLC. Berkshire said in September it was hiring Weschler, a marathoner who also invested in W.R. Grace & Co. and made a gain trading Bank of America Corp. shares.

“I found it fascinating that Todd Combs purchased DirecTV (DTV),” said Kass. “It sort of implies that Todd Combs is in agreement with Ted Weschler” on the stock, he said.

The purchase dates and prices, detailed in NAIC statements, aren't included in quarterly filings to the Securities and Exchange Commission. When stakes are built across multiple days, the NAIC allows companies to consolidate acquisitions under the date of the last purchase. The NAIC tracks securities held by regulated insurance companies.

--Bloomberg News--