InvestmentNews readers yawned in reaction to Warren Buffett's latest jabs at Wall Street, bankers and financial professionals, with a clear majority responding in a poll this week that the Oracle from Omaha's disparaging comments about the broad finance industry were either "not relevant to me" or "entirely irrelevant."

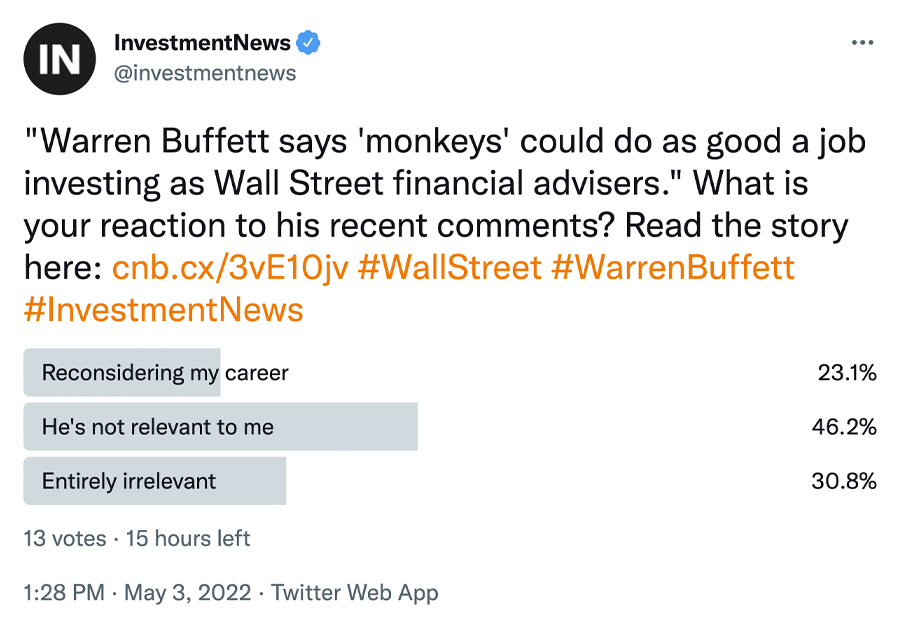

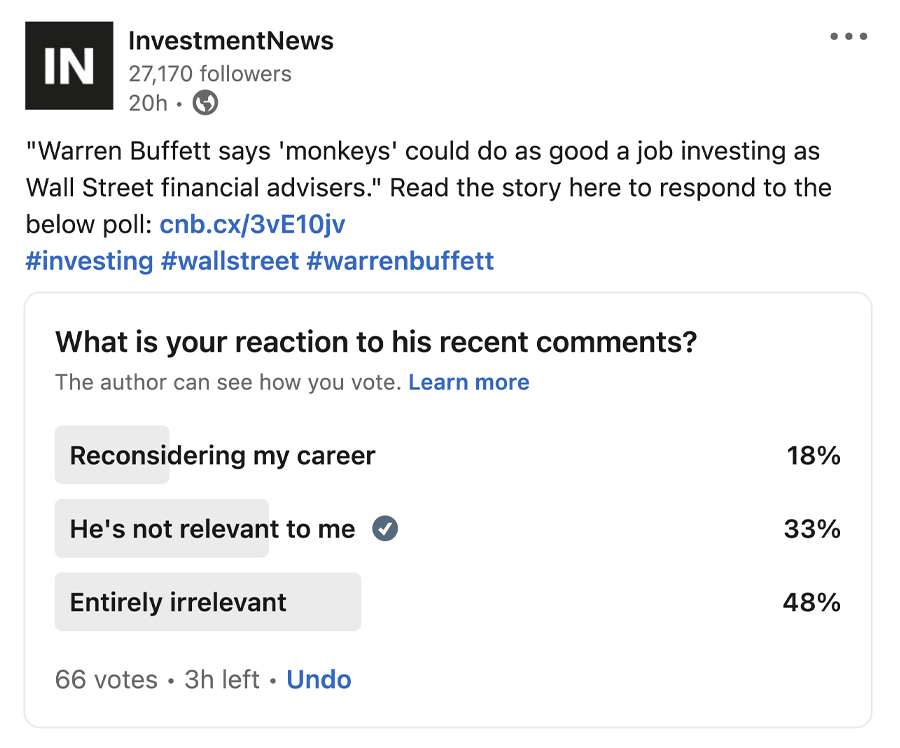

In an informal, nonscientific poll taken Tuesday and Wednesday on Twitter and LinkedIn, the 77 respondents indicated that Buffett, the chairman and CEO of Berkshire Hathaway Inc. and a legendary value investor, may no longer hold the dominant position of thought leadership in the financial services industry that he did a decade or two ago.

Buffett made the comments Saturday at the annual shareholder meeting for Berkshire Hathaway in Omaha, Nebraska, the first in three years due to the COVID-19 pandemic. In one bromide, Buffett said, "The money is in churning stocks. Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism."

In another, he criticized money managers and financial professionals, saying "monkeys" could do as good a job running money. "You can have monkeys throwing darts at the page, and, you know, take away the management fees and everything, I’ll bet on the monkeys," he said, according to a report from CNBC.com.

InvestmentNews readers felt little sting from Buffett's comments. Sixty-two of the 77 — or 81% — said the comments were “not relevant to me” or “entirely irrelevant.” And just 19%, or 15 readers, in both polls said Buffett's comments were sparking them to “reconsidering my career.”

A spokesperson for Berkshire Hathaway did not return a call Wednesday morning to comment.

Meanwhile, a father-son pair of advisors and ex-marines from ex-Edward Jones gives Kingsview its newest location in Arkansas.

New Vanguard and FINRA data show Americans increasingly vulnerable to financial shocks, with hardship withdrawals and cash-outs reaching a new high.

Many people have already continued working past their planned retirement date

A new analysis finds long-running fiscal woes coupled with impacts from the One Big Beautiful Bill Act stand to erode the major pillar for retirement income planning.

Caz Craffy, whom the Department of Justice hit with a 12-year prison term last year for defrauding grieving military families, has been officially exiled from the securities agency.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.