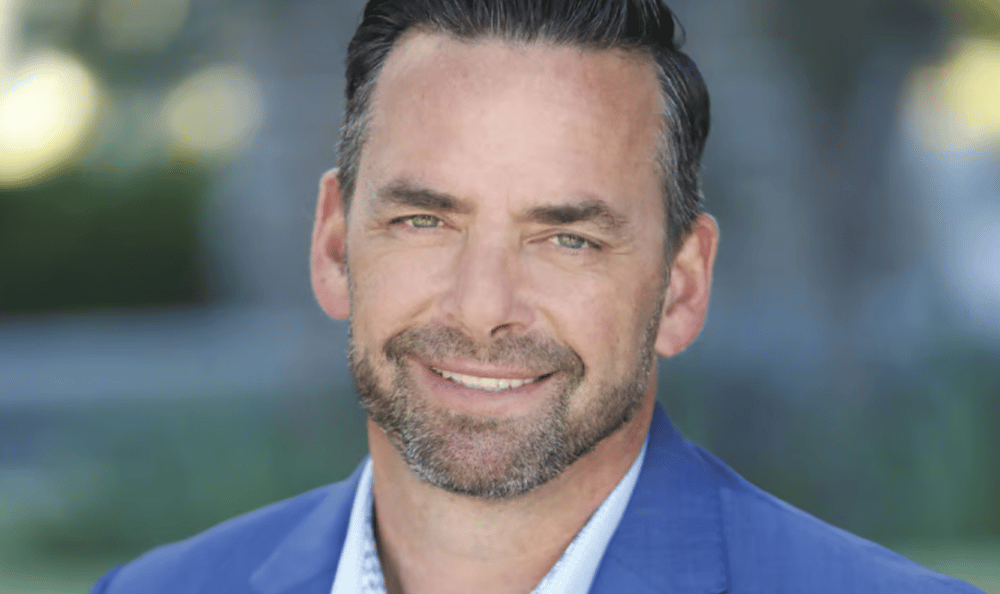

Cetera Holdings said on Thursday afternoon that Adam Antoniades, an independent broker-dealer industry veteran, will retire from his position as CEO at Cetera Financial Group, the broker-dealer network with more than 12,000 financial advisors, at the end of the year.

Antoniades’ position as CEO of Cetera Financial Group has been in question since spring of 2023 when Cetera Holdings hired Fidelity veteran Mike Durbin to be CEO of the holding company, Cetera Holdings. In June 2023, WealthManagement.com reported that Antoniades would be replaced by Durbin as CEO of the broker-dealer network in six to nine months.

In the end, the move to replace Antoniades took longer than that. Two CEOs was too much for Cetera.

In the face of any potential power struggle at the top of Cetera, Antoniades will remain on the company’s board and Durbin will be the CEO of both the broker-dealer network and the holding company.

“Under Antoniades' leadership as CEO, Cetera has grown significantly,” Cetera said in a statement. “From 2019 to 2024, Cetera will have acquired nine companies, boosted AUM by 200%( and increased total revenue by almost $2.8 billion, representing just under 20%” compound annual growth.

Cetera, owned by private equity manager Genstar, now has $521 billion in client assets.

“I am proud to have served as both a turnaround and expansion CEO, guiding the company through crucial phases of growth and transformation,” Antoniades said in a statement. “Mike is a proven leader who will guide the next chapter, driving the company forward into even greater opportunities for accelerated growth and success.”

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.