Investors fled most major asset classes in the past week, with U.S. equities and Treasuries a rare exception to the massive exodus, amid concerns that tightening monetary policy will push leading economies into a recession.

Global equity funds had $5.2 billion of outflows in the week to May 18, led by redemptions from mutual funds, although U.S. stock funds managed to attract a small $300 million inflow, according to Bank of America Corp.’s note citing EPFR Global data. Bond fund outflows reached $12.3 billion, with only Treasuries and government debt seeing additions. Investors also exited cash and gold.

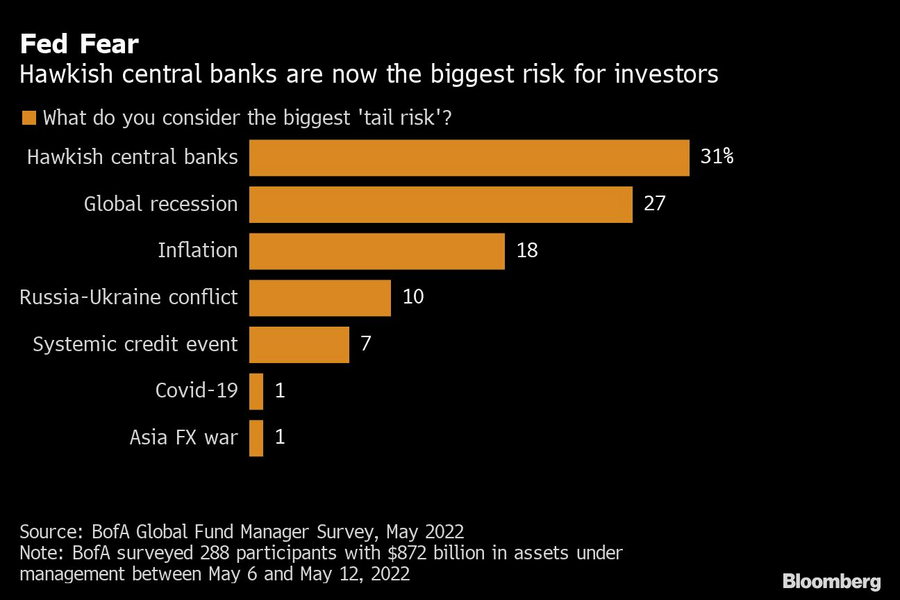

Stocks have lost nearly $12 trillion in market value since a peak in March as investors dumped risk assets amid a flurry of concerns spanning hawkish central banks and surging inflation. In BofA’s monthly fund manager survey released earlier this week, fears of a recession trumped the tail risks from inflation and the war in Ukraine, with investors turning the most underweight equities in two years.

Although strategists ranging from David J. Kostin at Goldman Sachs Group Inc. to Marko Kolanovic at JPMorgan Chase & Co. have said fears of an imminent recession are overblown, the likes of Morgan Stanley and BofA say that the equity market rout has further to go.

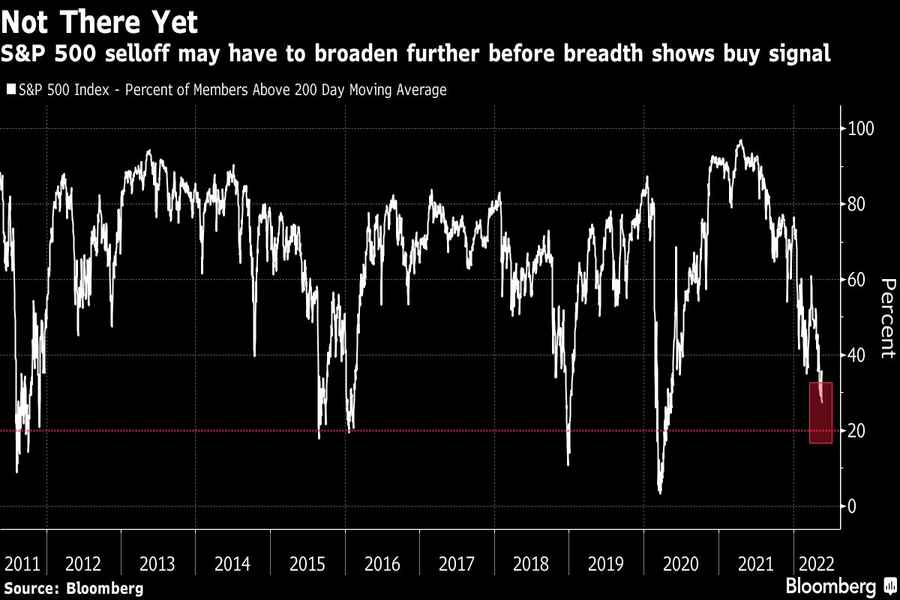

While BofA’s custom Bull & Bear indicator tumbled to an “unambiguous” contrarian buy signal for stocks, strategists led by Michael Hartnett reiterated their recommendation to sell any bear rallies. The S&P 500 has attempted to recover this week after flirting with bear market territory, but the bounce has proved short-lived, and the benchmark is set for its longest weekly losing streak since 2001.

Hartnett said that in 19 U.S. equity bear markets over the past 140 years, the S&P 500 saw an average decline of 37.3% with an average duration of 289 days. If repeated, BofA said the latest bear market would end in October, with the S&P 500 at 3,000 points — about 23% below current levels, and the Nasdaq at 10,000 points — 16% lower from here.

“3,600 is the new bull case,” Hartnett wrote in the note, referring to the S&P 500 level, which would mean 7.7% downside from here.

Among equity funds in the past week, U.S. stocks saw $300 million inflows, followed by $200 million of additions to Japanese shares, while European stocks extended their outflows to a 14th week. Investors piled into U.S. large-caps and growth stocks, while exiting value and small-caps. Among sectors, utilities and real estate led the inflows, while financials, materials and energy saw outflows.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Following a similar move by Robinhood, the online investing platform said it will also offer 24/5 trading initially with a menu of 100 US-listed stocks and ETFs.

The private equity giant will support the advisor tech marketing firm in boosting its AI capabilities and scaling its enterprise relationships.

The privately backed RIA's newest partner firm brings $850 million in assets while giving it a new foothold in the Salt Lake City region.

The latest preliminary data show $117 billion in second-quarter sales, but hints of a slowdown are emerging.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.