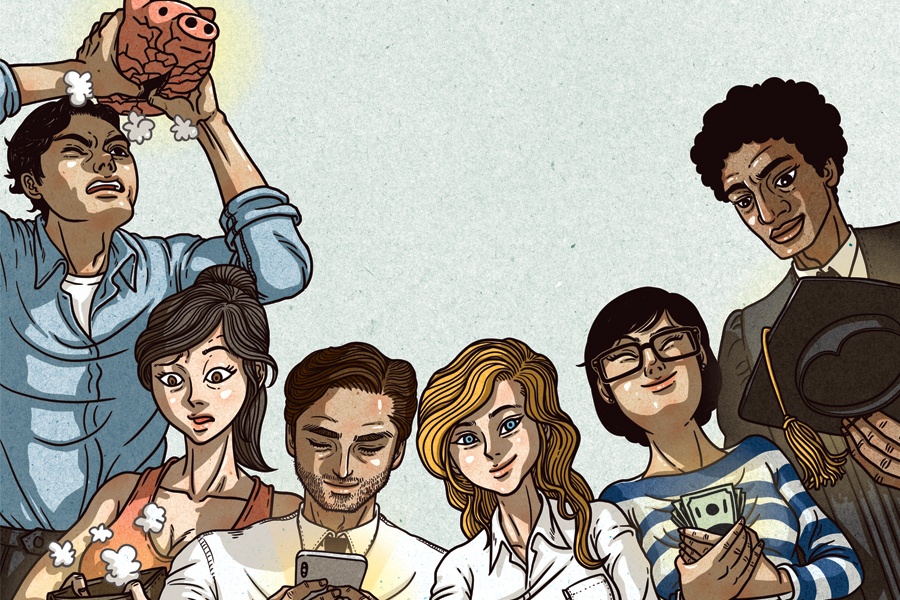

The market volatility during the first quarter of the year, which included the messy banking crisis, exposed some investor patterns that break down generationally.

According to the Apex Next Investor Outlook report, the least experienced investors made moves that were counter to those of older investors who have lived through a few financial calamities.

“Gen Z investors were in elementary school when Lehman Brothers crashed in 2008, so in many respects, the first-quarter bank crisis was really that generation’s first true financial crisis,” Connor Coughlin, chief commercial officer at Apex Fintech Solutions, said in a statement.

The quarterly report, which analyzes the investing patterns of platform participants, not only showed more activity among younger investors, but also a penchant for different types of investments and financial information, Coughlin explained.

“This is a generation that invests in disruptors and against expected trends, and over $70 trillion in assets will be passed down to this generation in the coming decades,” he said. “Fintechs and advisors need to understand the attitudes, interests and values of this digital and disruptive generation.”

Key findings from the analysis of activity in 5.6 million accounts during the first three months of the year showed that Gen Z investors were less fazed by bank uncertainty than other generations that had experienced similar financial crises previously.

On March 29, when bank stocks were selling off, Gen Z investors traded at a lower rate than any other age group.

While older generations were selling bank stocks, there was increased buying by millennials, who moved aggressively into names such as Charles Schwab (SCHW) and First Republic Bank (FCRB) while values were plummeting.

The various generations were in general agreement about their favorite stocks. The seven largest holdings in retail accounts on the Apex platform during the first quarter were Tesla (TSLA), Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Nvidia (NVDA), Google (GOOG) and Meta Platforms (META).

The quarter also saw a brief increase in the appetite for gold. While global retail demand for gold dropped by 13% compared to the same quarter a year ago, investors on the Apex platform moved heavily into the precious metal. From March 6 through March 13, the notional value of gold investments on the platform increased by 560%.

Another data point that stood out was the interest among the youngest investors in cryptocurrency exposure through companies like Coinbase Global (COIN), Marathon Digital Holdings (MARA) and CrowdStrike Holdings (CRWD).

“We’re seeing that older generations are less reactionary to big headlines, while younger investors want to react quickly to what’s going on,” Coughlin said. “Also, younger generations are more willing to take financial advice from alternative sources, including social media, which is why financial advisors need to create that digital experience.”

Plus, a $400 million Commonwealth team departs to launch an independent family-run RIA in the East Bay area.

The collaboration will focus initially on strategies within collective investment trusts in DC plans, with plans to expand to other retirement-focused private investment solutions.

“I respectfully request that all recruiters for other BDs discontinue their efforts to contact me," writes Thomas Bartholomew.

Wealth tech veteran Aaron Klein speaks out against the "misery" of client meetings, why advisors' communication skills don't always help, and AI's potential to make bad meetings "100 times better."

The proposed $120 million settlement would close the book on a legal challenge alleging the Wall Street banks failed to disclose crucial conflicts of interest to investors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.