With the COVID-19 pandemic raging across the U.S. in 2020, large registered investment adviser firms in the Northeast struggled to keep up with their competitors in other parts of the country. An InvestmentNews analysis of data from RIAs shows that business at large firms based in and around the major metropolitan areas of New York, Boston and Philadelphia on average shrunk at an annual rate of 0.6%.

That assets at large RIAs actually declined year over year is almost unthinkable in an industry that over the past decade has seen nothing but growth as the broader stock market continued to hit fresh highs and thousands of advisers left Wall Street banks and other less high-profile broker-dealers to open RIAs that they own, control and handsomely profit from. But this year the progress of RIAs in the Northeast ran into the buzzsaw of the pandemic, which slowed business opportunities in the region and ultimately stunted growth.

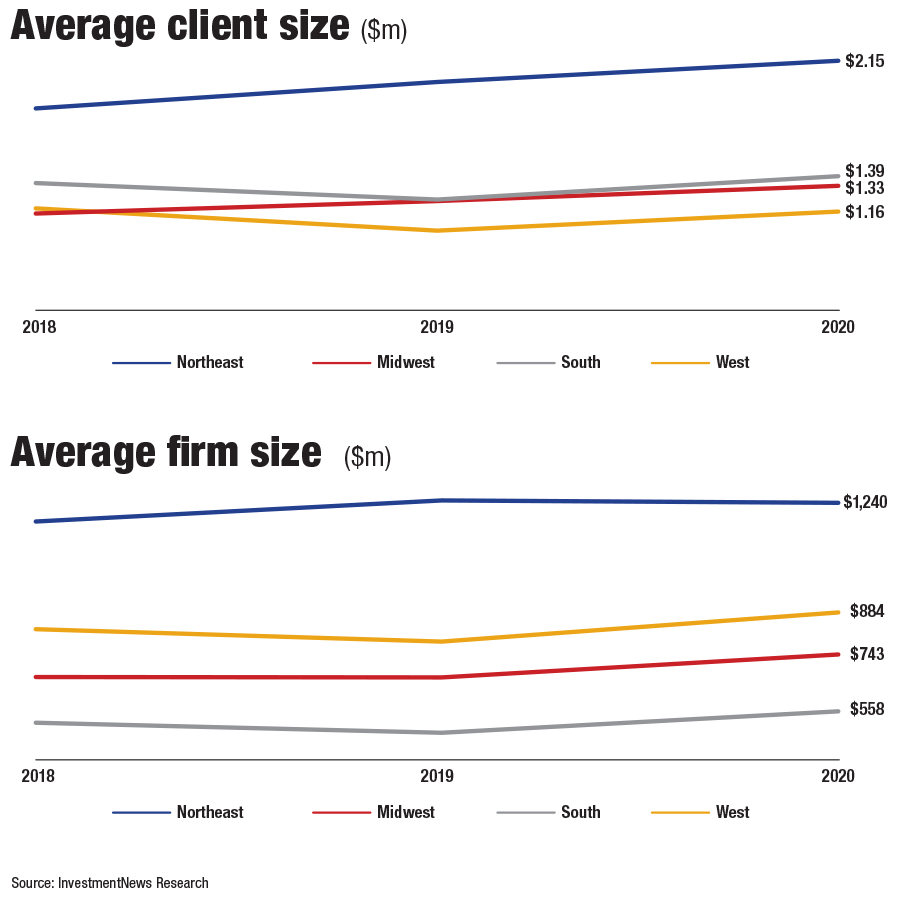

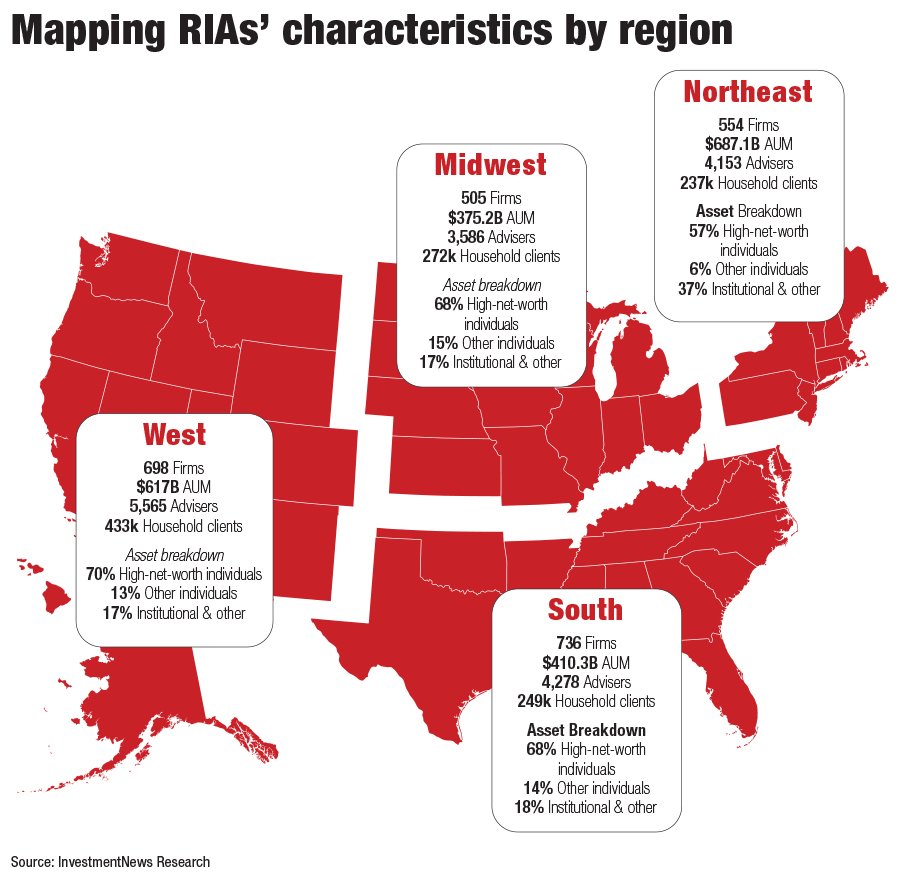

The InvestmentNews annual review of RIAs by region includes firms with $100 million or more in assets, according to their most recent Form ADV on file with the Securities and Exchange Commission, and splits them into four regions: the aforementioned Northeast along with the West, Midwest and South. While firms in the Northeast on average failed to grow assets, they remain by far the largest, with 554 firms on average each managing $1.24 billion in client assets. No other region dominates when it comes to RIA heft and girth.

In comparison, large firms in other regions appeared to thrive in a remarkable year that saw the broader stock market drop by 37% over a few weeks in February and March only to rebound to record heights; a presidential election that took weeks to settle; and an unprecedented modern pandemic that had resulted in 270,000 deaths at the time this article was written.

RIAs typically file Form ADVs after the close of their fiscal year, mostly in March with a smattering in the summer. This year the March deadlines were extended, so assets were reported when the broader market had recovered some of its winter losses.

Aided by lower state taxes and warm weather, which made common practices like meeting clients outdoors for lunch easier, RIAs in the South posted the strongest annual increase in assets, with 736 firms posting average assets of $558 million, for a growth rate of 14.1%.

Meanwhile, firms in the West and Midwest, respectively, compiled year-over-year growth rates of 12.9% and 11%. The 698 firms in the West on average have assets of $884 million, while the 505 RIAs in the Midwest have $743 million.

One caveat: Firms in the South, on average, are smaller than those in other regions when tallying size by assets. That means it takes a smaller increase in assets to raise the overall percentage of growth.

There is no doubt the pandemic severely challenged the ability of large RIAs in the Northeast to woo wealthy clients over dinner and drinks, compete fully in the current Rock ’Em Sock ’Em mergers and acquisitions market, and execute plans to increase staff. Clients were also withdrawing money from their RIA accounts to pay for children who lost jobs and apartments during the pandemic and moved home with mom and dad. That undoubtedly hurt asset levels at firms as well.

“We have seen some faster growth over this year with firms in the Southeast and the South,” said Shirl Penney, CEO of Dynasty Financial Partners, a technology and wealth management services firm that works with advisers leaving wirehouses and starting their own RIAs. “And I do think there is a correlation between some of the locations,” he said, with advisers in warmer climes in 2020 benefiting from simple practices like avoiding New York City subways and meeting new prospects in outdoor restaurants.

It’s easier to talk M&A in such an environment, Penney added.

“Money is such a personal thing for people,” he said. “And trusting someone is not going to happen unless you have a relationship. It would be difficult for high-net-worth individuals to get comfortable with a new adviser if they’re only talking on Zoom.”

Dynasty, which recently moved its corporate headquarters from Manhattan to St. Petersburg, Florida, works with 46 RIA firms that control more than $40 billion in client assets.

“I personally know boomers in retirement who literally moved out of New York City,” said Dennis Gallant, senior analyst at Aite Group, who is located outside Boston. “In the Northeast, we were caught flat-footed by the pandemic. And by the time we realized how bad it was, it had already spread.”

“I think it’s tougher to win new business in the wealth management channel during the pandemic,” said Danny Sarch, an industry recruiter. “Would you give your money to an adviser you never met?”

Others offer a much more sanguine outlook on RIA geography. During a conference call last month with analysts, Rudy Adolf, CEO of Focus Financial Partners Inc., was asked whether Focus was targeting certain areas or regions for RIA purchases. A leading RIA aggregator, Focus Financial reported $1.2 billion in revenue in its 2019 fiscal year.

“We have been really geographically agnostic in many ways,” Adolf said. “In this industry, there are excellent firms just about everywhere. We have eight firms in California, Massachusetts, New York, six firms in Georgia, five firms in Illinois and of course, in many, many other geographies. You can find fantastic firms in many locations. They almost always operate in multiple states and, quite frankly, many of them are, of course, operating on a national level.”

The pandemic hit the Northeast like a storm in March and April, and New York City basically closed its doors, with offices shut and advisers working from home the norm. That made adding new business extremely difficult for RIA firms, which traditionally have faced obstacles in the region, one executive noted.

“It’s not just one issue,” said Brian Hamburger, president and CEO of MarketCounsel, which advises breakaway brokers. “That said, the old sectors of financial services, the wirehouses, banks and trust companies, continue to have a relative stronghold in that region that they are losing more quickly in the rest of the country. The traditional money centers, New York, Boston and others, have lagged in the transition to the RIA wealth management model.

“The hotbeds for RIAs are in places that Wall Street has ignored,” Hamburger said. “Look at Omaha, Nebraska, or Overland Park, Kansas, right outside Kansas City. There’s a slew of firms located in that corridor.”

Eliseo Prisno, a former Merrill advisor, allegedly collected unapproved fees from Filipino clients by secretly accessing their accounts at two separate brokerages.

The Harford, Connecticut-based RIA is expanding into a new market in the mid-Atlantic region while crossing another billion-dollar milestone.

The Wall Street giant's global wealth head says affluent clients are shifting away from America amid growing fallout from President Donald Trump's hardline politics.

Chief economists, advisors, and chief investment officers share their reactions to the June US employment report.

"This shouldn’t be hard to ban, but neither party will do it. So offensive to the people they serve," RIA titan Peter Mallouk said in a post that referenced Nancy Pelosi's reported stock gains.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.