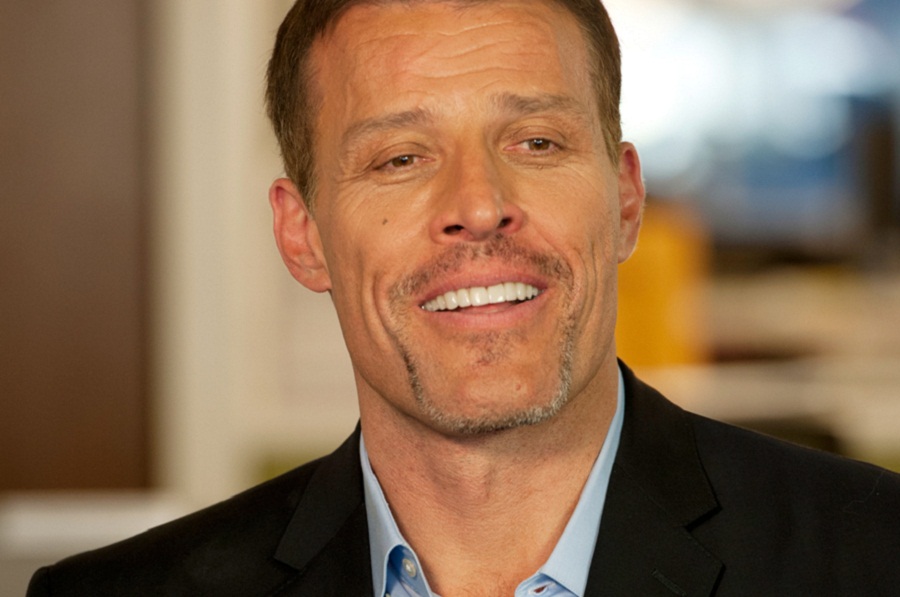

Self-help guru Tony Robbins is quickly becoming persona non grata across the financial planning industry following recently reported accusations by nine women of sexual misconduct over several decades.

Overland Park, Kans.- based

Creative Planning, which hired Mr. Robbins three years ago as a chief of investor psychology, has severed ties with the 59-year-old author and life coach.

The

$38 billion advisory firm, which did not respond to a request for comment, filed an

updated form ADV earlier this week stating that it has "eliminated the position of chief of investor psychology, and consequently Anthony Robbins is no longer associated with Creative Planning nor serves on the firm's advisory board."

"Hats off to Creative Planning for taking definitive action and separating from Tony Robbins," said April Rudin, president of financial services marketing firm The Rudin Group.

The accusations against Mr. Robbins, which were first reported by the website BuzzFeed last week and include allegations of sexual misconduct over the past three decades, are examples of the risks of associating with celebrities.

"There are takeaways and lessons that other RIAs can learn about how to take action when something like this happens to their brand," Ms. Rudin said. "There's a woman issue here and there's a brand issue here, and when these things come up it's important to take swift action."

Like the #MeToo movement that emerged in 2017 after a string of powerful men were accused of long histories of sexual misconduct, the attention on Mr. Robbins has been gaining momentum, including a new video from the 1980s showing the speaker using

racial slurs and vulgarity.

"Once there is material evidence and videos, these are no longer just accusations, and Creative Planning did what was absolutely necessary," said Tina Powell, chief executive of C-Suite Social Media.

"My feeling is that any personality that represents a financial planning firm should uphold the same values and principles of the advisers and the support people who live and breathe it every day," she added.

A spokeswoman for Mr. Robbins declined comment for this story, but in

video statement posted on YouTube, Mr. Robbins challenged the BuzzFeed reports, saying they were "salacious" and said the "facts don't support what they're talking about." He added that the stories include "flat out lies."

In a

letter to BuzzFeed, Mr. Robbins includes a link to a

video from a woman explaining how much she has benefitted from the self-help programs.

Regardless, the financial planning industry has been virtually in lockstep in condemning the latest example of high-profile sexual misconduct allegations.

"Everyone has their dark side and the drive that makes people successful is often a double-edged sword," said Carolyn McClanahan, founder and director of financial planning at Life Planning Partners.

"People in positions of power must be held accountable just like everyone else," she added. "It is good that he was fired, as this sends a message that his behavior is not acceptable."

In March 2016, when Mr. Robbins officially joined Creative Planning, the plan was for him to help train advisers to better manage clients' emotional needs and to help draw attention to broader financial literacy efforts.

"I want to be a voice for the individual," Mr. Robbins said of his new role in 2016.

While the allegations against Mr. Robbins are still just that, the reaction from the financial planning industry is generally supportive of creating distance between the now tainted image of the self-help guru.

"I've always been skeptical of prophets like him," said Kashif Ahmed, president of American Private Wealth.

"As for these allegations, I'm not entirely surprised," he added. "Men throughout history have done foolish things, and the larger they become the more chances are they will do something stupid."

Vance Barse, wealth strategist at Manning Wealth Management, echoed similar sentiment.

"Hiring Tony Robbins was a brilliant move on the part of Creative Planning, and so was ending the business relationship," he said. "There's too much political risk in being associated with such a high-profile person undergoing allegations like these."