The past few months have seen the announcement of two huge deals that directly affect thousands of registered reps and financial advisers. First, in November, The Charles Schwab Corp. said it was acquiring TD Ameritrade Holding Corp. for $26 billion in stock. Then, last month, Morgan Stanley said it had agreed to buy ETrade Financial Corp. for $13 billion.

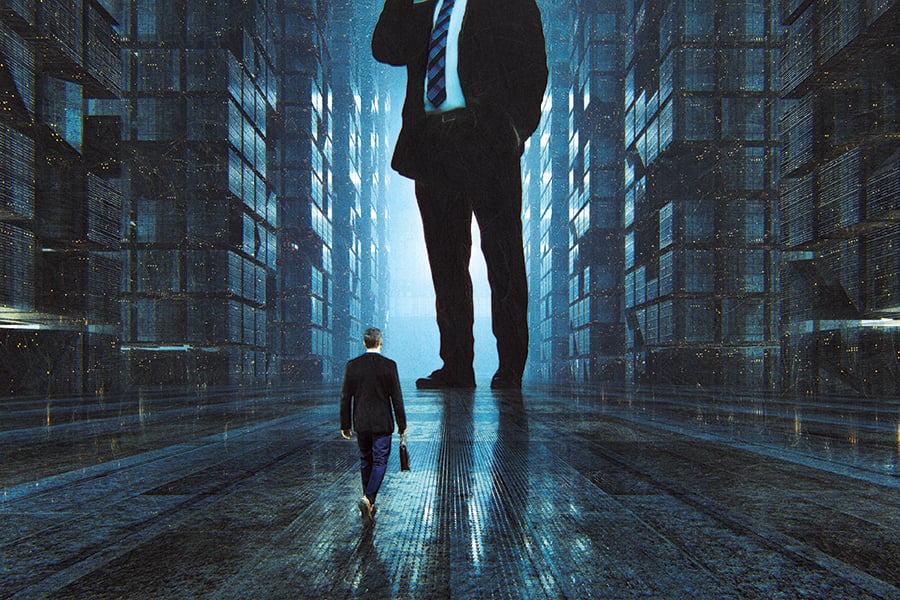

With giant mergers and acquisitions of financial institutions back in vogue, the Department of Justice’s antitrust division is taking a particularly hard look at Schwab’s acquisition of TD Ameritrade. The proposed combination would create a financial services powerhouse with $5 trillion under management. The deal raises immediate concerns around the combined custody business. Plus, there’s a technology issue that can’t be ignored: With two huge custody platforms coming together, and with TD wearing the mantle of an industry innovator, will the deal inhibit the development of new technology for advisers?

The combined Schwab-TD Ameritrade would control 11% of overall investible assets of the $25 trillion to $26 trillion wealth management market, according to Schwab.

Meanwhile, Morgan Stanley’s purchase of ETrade would merge what some in the industry estimate to be half what the Schwab-TD combination would control of the wealth management market, which includes wirehouses, independent broker-dealers and banks. Schwab and TD’s custody units appear to have a unique overlap of businesses, specifically the RIA custody market. The proposed merger would bring together 50% of the financial advice industry’s custody business, and some say that’s a low estimate. That raises a series of questions for the Department of Justice that Morgan Stanley’s impending purchase of ETrade does not, according to attorneys, industry executives and consultants.

“The deal between Schwab and TD Ameritrade, two of the largest low-cost brokerage companies, should concern the DOJ’s antitrust division,” said David S. Stone, senior managing partner at Stone & Magnanini. “While ostensibly it can potentially benefit consumers through efficiencies of scale and new product offerings, it poses many of the concerns that regulators focus on in such mergers.”

There are roughly 20,000 RIAs in the wealth management space who manage about $4 trillion in client assets, according to industry consultants. Schwab Advisor Services, TD Ameritrade Institutional, Fidelity and Pershing already control 80% of the market. In a presentation to investors from 2019, Schwab reported a 30% custody market share. Combined with TD, that would create a service platform for more than 14,000 RIAs, some of whom already use both to split up client assets.

“Between them they appear to control over 70% of the custodial market for RIAs,” Mr. Stone said. “RIAs use custodians to store and protect their securities and clear trades. This increased market power will give Schwab the ability to raise prices for these services and will discourage innovation.”

According to industry attorneys, executives and consultants, the key questions that raise antitrust concerns around any deal focus on multiple theories of harm, including:

“What the adviser needs to look out for is a consolidation of their specific niche,” said Timothy Z. LaComb, an associate at MoginRubin. “The retail investment side of the TD-Schwab deal doesn’t raise a lot of red flags because neither is the major or dominant player in retail wealth management. But on the RIA side of the combination, that’s where you see some issues that could raise antitrust flags.”

“If you are an RIA, especially one that has a lower assets under management than the average Schwab RIA, you need to look at what or how you are going to be treated after the merger,” Mr. LaComb said. “Schwab has indicated that it will transition away from TD’s platform. Firms with lower assets under management could potentially see a decrease in service and no longer have an individual client [service] rep but will be diverted to call centers when trying to access your custodian.”

The two sides are working to close the acquisition by the end of the year, but it could take two to three years to integrate the companies.

From all accounts, the Department of Justice is making a vigorous inquiry. It is reaching out to consultants, smaller custodians, technology vendors and others, asking for background about the RIA custody business.

At the end of January, the Department of Justice requested additional information from both Schwab and TD as part of its research into the deal’s antitrust implications.

“I spoke to the DOJ in the middle of February and the conversation lasted more than two hours,” said Tim Welsh, an industry consultant who worked for Charles Schwab more than a decade ago. “The DOJ is taking this very seriously, and the conversation was before the announcement of the Morgan Stanley acquisition of ETrade.”

ETrade has a small custody business, with 225 advisers and $19 billion in assets. Morgan Stanley, which employs more than 15,000 registered reps and financial advisers, is widely considered to not want to hang onto that business as it would create a direct competitor for its wealth management business under its own roof.

“That means ETrade is likely gone and takes one more alternative [custodian] off the table,” Mr. Welsh noted. “That’s another potential theory of harm for the antitrust attorneys at DOJ — fewer and fewer places for small advisers to go for custody.”

In December, the owner of BlackCrown Inc., Franklin Tsung, filed a lawsuit in federal court in Manhattan, that alleged the Schwab and TD combination would “harm competition and disenfranchise a great majority and minority of RIAs and [investment adviser reps] most of whom are legally referenced as small to medium-sized businesses.”

“Most prominently, the acquisition would eliminate competition to deliver and administer custodial services for the entire independent wealth management industry, disenfranchise a great segment of the industry by effectively establishing a caste system for independent business owners within the entire wealth management industry,” according to the complaint, which was dismissed days later, but not for its allegation.

BlackCrown is a buyout firm that is also a registered investment adviser but has no client assets, according to its Form ADV, filed with the Securities and Exchange Commission. The judge in the matter, Gregory H. Woods, ruled that since BlackCrown’s owner, Mr. Tsung, was not an attorney, the complaint could not go forward because corporations must be represented by attorneys.

Schwab is not sweating questions about anti-competitive implications over its deal for TD, at least not in public. “We feel very confident that the transaction as announced is in the best interests of all consumers, both end investors as well as RIAs,” Schwab’s CEO, Walt Bettinger, said when the TD acquisition was announced. “And we feel, continuing to demonstrate through facts, that that’s the case.”

Technology is one more big antitrust hurdle, according to industry attorneys, executives and consultants. TD’s current open platform — dubbed VEO Open Access and which supports 175 third-party vendor applications — is extremely popular, particularly with advisers who want to customize their technology to their practice, much like gamers want their computers customized to their exact specifications. By comparison, Schwab’s technology platform has about half as many vendors, higher barriers of entry and limited integration abilities.

“There are so many tech vendors that will feel an impact because of the Schwab and TD deal, especially the small ones,” said Robb Baldwin, CEO of TradePMR, a small RIA custodian. “It will be a major pain point for advisers.”

Schwab is clearly aware of the antitrust hurdles and is sending a message to the RIA custody market that it embraces small advisers, or those with $100 million or less in assets. Schwab does custody business with 3,500 advisers that are registered with the states and not with the SEC, meaning they have less than $100 million in client assets.

In a move that was highly regarded across the industry, Schwab in December plucked the retired Tom Bradley, former head of TD’s RIA group, from the sidelines to lead its small adviser group and initiative. In February, the firm embarked on a goodwill public relations program about how it has always had the best interests of small advisers at heart.

To many financial advisers in the industry, Schwab is fighting the common perception among veteran advisers and the RIA industry that the biggest custodian had no interest in working with them when they were small.

“The DOJ is trying to get their hands around what that looks like,” Bernard “Bernie” Clark, head of Schwab Advisor Services, said in an interview last month. “It’s hard to believe that people could worry about increased pricing when you’re talking about is a company that has gotten rid of transaction-fee pricing. We are about every size adviser and always have been.”

“We’re are serving that [small adviser] community and serving it well,” Mr. Clark said. Regarding the common perception in the industry, that Schwab in the past has overlooked smaller advisers, he added: “That’s why we have Tom’s group.”

Each side faces a potential $950 million termination fee if the deal collapses. But the antitrust burden that could trigger the hefty fee appears to weigh more heavily on Schwab than TD, attorneys said.

“Schwab at this point is going to say all the right things,” said Mr. LaComb. “The company is on the hook for a $1 billion termination fee to TD. That’s a significant financial incentive for Schwab to convince the DOJ the deal should go through.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.