Those pining for a physically backed U.S. bitcoin exchange-traded fund are embracing an under-the-radar ruling from the Securities and Exchange Commission.

The SEC gave its blessing to the Teucrium Bitcoin Futures Fund application in a late Wednesday filing. Unlike existing bitcoin futures ETFs, the Teucrium fund was filed under the Securities Act of 1933, rather than the Investment Company Act of 1940 — SEC Chair Gary Gensler’s preferred format up to this point.

In the eyes of Bloomberg Intelligence’s James Seyffart, that nuance matters. Gensler signaled last August that the 1940 law offers greater investor protection than the 1930s law, with the agency allowing the first bitcoin futures ETF to begin trading in October. However, given that a physically backed bitcoin ETF — a structure the SEC has repeatedly denied — would fall under the 1933 act, approving the Teucrium fund could be a needed step to a spot ETF, Seyffart said.

“Gensler initially approved bitcoin futures ETFs citing 1940 Act protections stating they’re better than 1933 Act products. But this is a 1933 Act futures ETF,” Seyffart said. “This strengthens the case for a spot bitcoin ETF, which goes through the exact same process.”

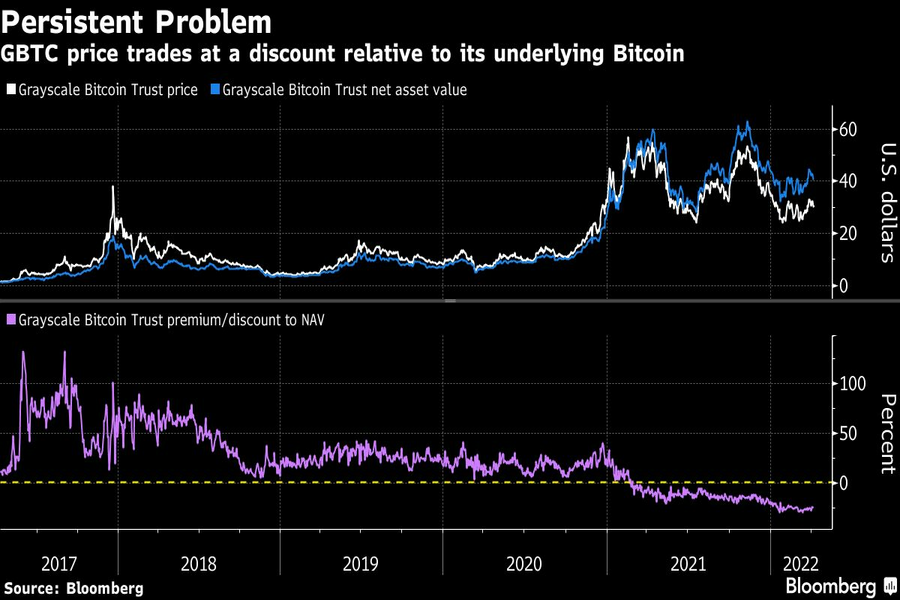

The Teucrium decision also casts a spotlight on Grayscale Investments’ campaign to convert the $28 billion Grayscale Bitcoin Trust (GBTC) into a physically backed ETF. The SEC’s final deadline to make a ruling is July 6, and should the applications be rejected, “all options are on the table” including a potential lawsuit, Grayscale chief executive Michael Sonnenshein told Bloomberg News last month.

While the approval may embolden Grayscale and other potential issuers, issues such as oversight of the cryptocurrency exchanges still remain, according to Morningstar Inc.’s Ben Johnson.

“I don’t think it does anything to address the SEC’s concerns regarding spot Bitcoin ETFs,” said Johnson, director of global ETF research. “That said, it could be the event that compels one or more spot bitcoin ETF filers to sue the SEC in hopes of forcing the issue.”

Nate Geraci of the ETF Store agrees. While the SEC has weakened its own argument for not approving a physically backed fund, it’s still unlikely that they’ll allow such a product to launch in the foreseeable future, he said.

“The SEC had previously said that 40 Act funds provide additional investor protections. With the approval of the Teucrium ETF, the SEC just killed their own argument on that front,” Geraci said. “All that said, I still don’t expect the SEC to approve a spot bitcoin ETF until they have oversight of crypto exchanges.”

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.