States will likely try to keep up with the SEC when it comes to reforming the way that investment advisers can promote their businesses.

The landmark Securities and Exchange Commission marketing rule will allow advisers registered with the agency to use testimonials for the first time. Whether advisers who are registered at the state level can take advantage of the same opportunity depends on whether their state adopts the SEC rule or something similar.

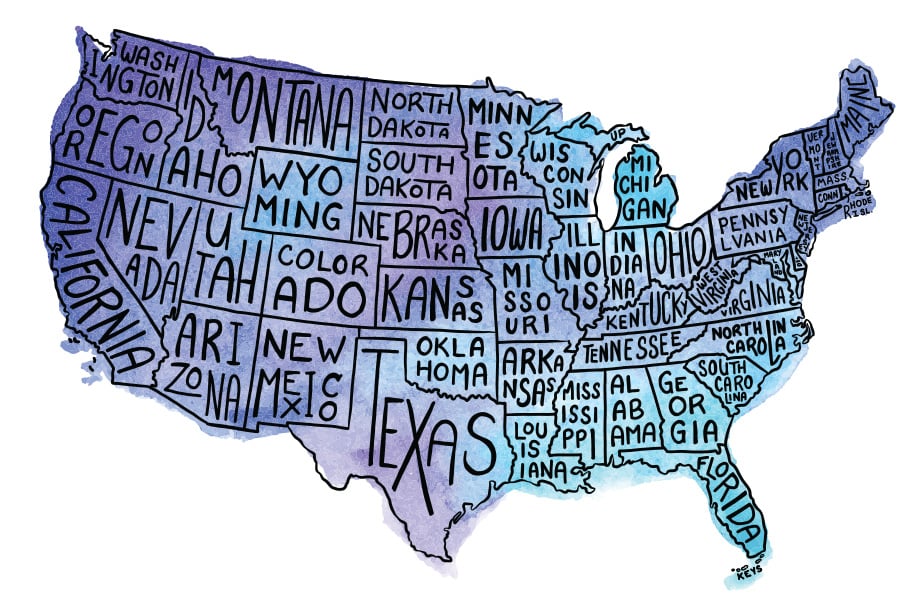

So far, 23 states have said they will not follow the rule when it goes into force on Nov. 4, another 12 said they will follow it, one state said it will do so next year and 11 states haven’t mentioned their plans, said Ann Keitner, senior principal consultant at ACA Group, a compliance consulting firm.

The state statistics were compiled by ACA Group based on its own monitoring.

Keitner anticipates that more states will adopt the SEC rule, but that they’ll be in a wait-and-see mode for a while.

“I don’t think everyone will sign on at once,” she said. “They want to see how the SEC enforces it and what it will look like in practice.”

The North American Securities Administrators Association will try to provide states with a road map on how they can update their advertising regulations.

“We’re working on a model rule that will largely mirror the SEC rule,” Stephen Brey, a Michigan securities regulator, said in September at NASAA’s annual conference in Nashville, Tennessee.

That could be welcome news for state-level advisers who don’t want to be left behind when their SEC-registered counterparts start airing testimonials.

“It’s interesting that NASAA is taking a proactive view,” Keitner said.

It could be a while before a final NASAA model emerges. Once the committee that Brey heads drafts a measure, it will be reviewed by NASAA membership, could be released for comment and then potentially revised. Once NASAA approves the model rule, it must then be adopted state by state through a regulatory or legislative process.

[More: A marketing conundrum]

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.