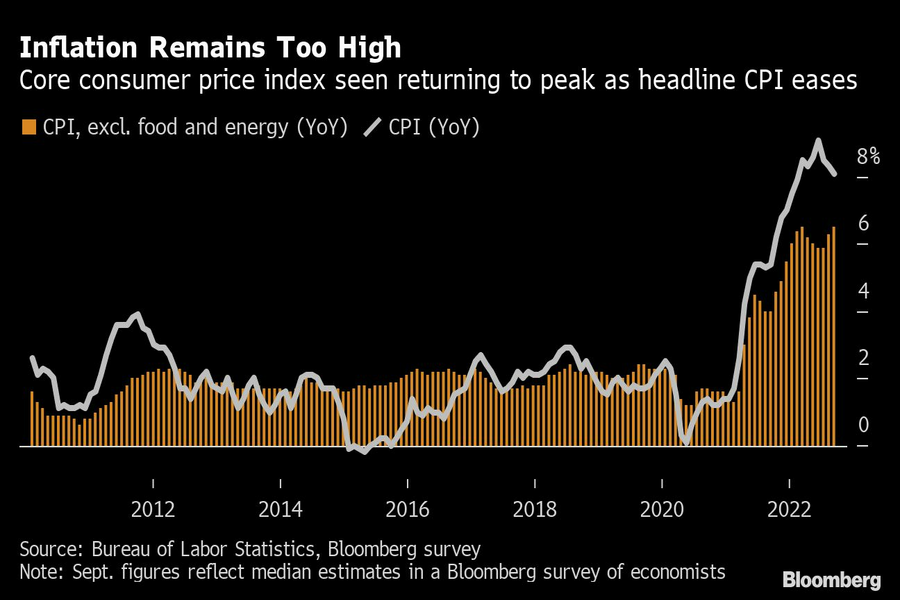

A key U.S. inflation measure due Thursday is set to return to a four-decade high, underscoring broad and elevated price pressures that are pushing the Federal Reserve toward yet another large interest-rate hike next month.

The so-called core consumer price index that excludes food and energy is projected to rise 0.4% in September from the prior month and 6.5% from a year earlier, matching the rate seen in March that was the highest since 1982. But about a third of economists in a Bloomberg survey expect a print of 6.6% or more.

The overall CPI, however, is expected to decelerate to a still-rapid 8.1% annual pace, restrained by a decline in gasoline prices, based on the median estimate.

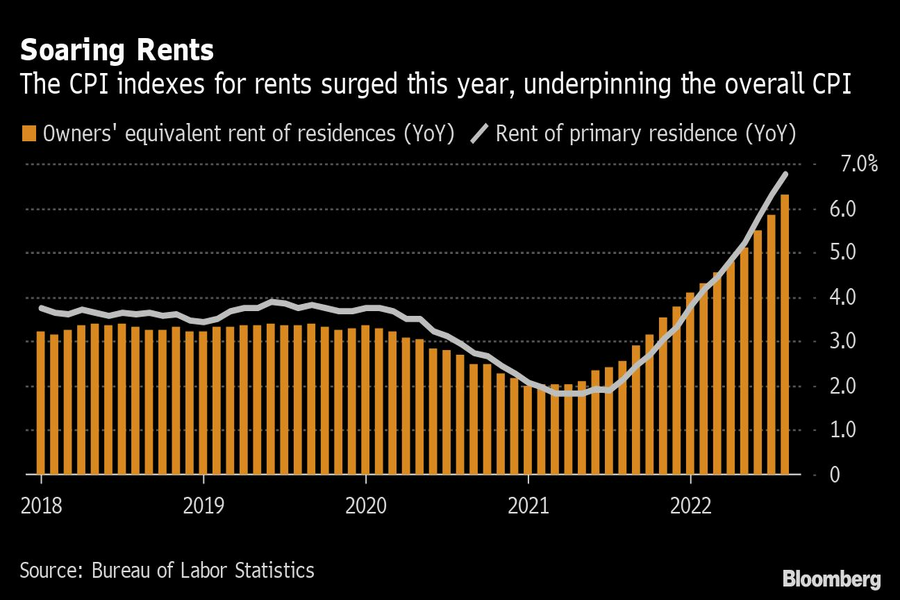

The report is also set to underscore the enormous role played by one component in particular — housing. Even so, analysts are seeing signs that core inflation has peaked and is finally on a downward slope, though the decline may take time.

“We’re probably near a peak, but that being said, I don’t think we’re going have a speedy return to lower numbers in part because” of the persistence of rental inflation, said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co.

Shelter makes up about a third of the overall basket of consumer prices, and an even larger share of the so-called core CPI. The run-up in rents and housing prices over the past two years has slowly fed into the Bureau of Labor Statistics’ CPI figures, fueling massive jumps in the indexes for rent of primary residence and owners’ equivalent rent.

Both increased 0.7% in August and were up the most since 1986 on an annual basis. Deutsche Bank AG economists expect both metrics to rise by yet another 0.7% in Thursday’s report.

These measures are a key factor for the ultimate path of U.S. inflation and are poised to keep a floor under inflation prints well into next year before recent signs of a cooling in asking rents begin filtering into the government’s measure.

Fed Governor Christopher Waller reinforced this thought when he said last week that he’s closely watching shelter inflation “in determining” his outlook for U.S. inflation. He went on to say that “unfortunately, the message is that shelter inflation will likely remain high for several months.”

Bloomberg Economics doesn’t expect year-over-year rates for the major shelter components to peak until well into the second half of next year.

Societe Generale SA Chief U.S. Economist Stephen Gallagher sees a relatively rapid deceleration in core CPI toward 4% over the coming year, but said it gets “incredibly challenging” to continue to see inflation drop when rents are still growing at a rapid pace. He noted that a softer labor market is needed to slow rent inflation to a degree that is consistent with the Fed reaching its ultimate inflation goals.

But even excluding food, energy and shelter, inflation is still extremely high — up 6.4% in August from a year earlier.

The Fed is “not raising rates just because shelter is high, they’re raising rates because so much of the basket is growing much faster than they want to see it growing,” said Omair Sharif, founder and president of Inflation Insights. That said, “my feeling is this is the start of a much more sustained period of softer core CPI prints.”

A separate report on Wednesday showed that prices paid to U.S. producers rose in September by more than expected, suggesting inflationary pressures will take time to moderate.

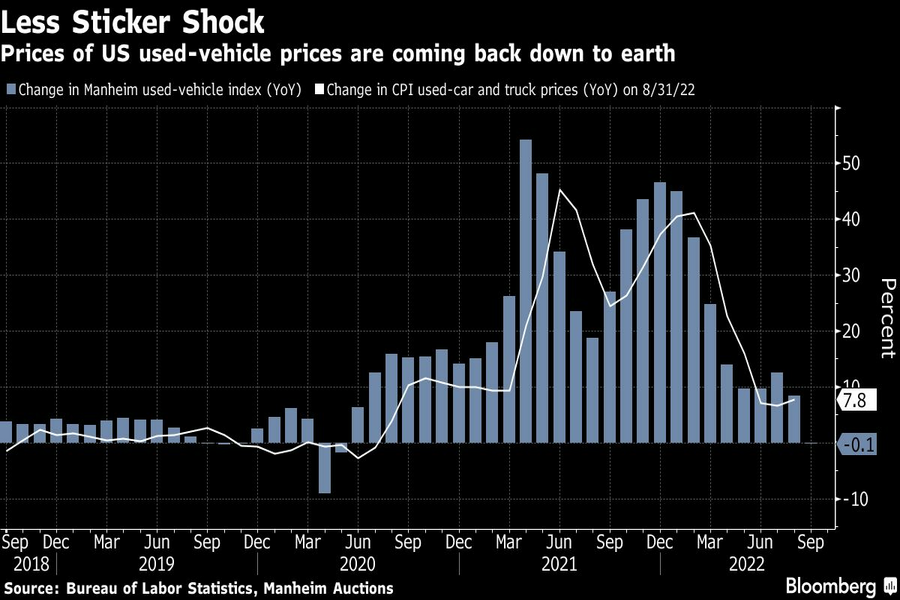

Used car and truck prices, a key driver of inflation last year, are set to drop for a third straight month, but by a much greater extent. Sharif expects used car prices to fall 2% in September, a reflection of both a decline in wholesale used-car prices and the way the government adjusts the price data each September for differences in the quality of newer cars in the sample.

Similarly, other categories are set to soften this month or in the near future. Retailers are announcing widespread price cuts and sales to clear inventory, and the strength of the U.S. dollar compared to other currencies is likely to weigh on foreign demand for American goods.

Similarly, medical care is set to turn negative starting with the October report after solidly advancing for much of the last year, Sharif said.

Geopolitical developments threaten to complicate matters in the coming months. Russia’s war with Ukraine continues to disrupt various commodity supplies, and oil prices climbed higher after the OPEC+ alliance agreed to cut output last week.

While this may be “the last stand” for high core inflation prints, central bankers likely won’t be happy with a deceleration driven by just a handful of categories, said Sharif. “My own feeling is they’re going to want to see more breadth of disinflation.”

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.