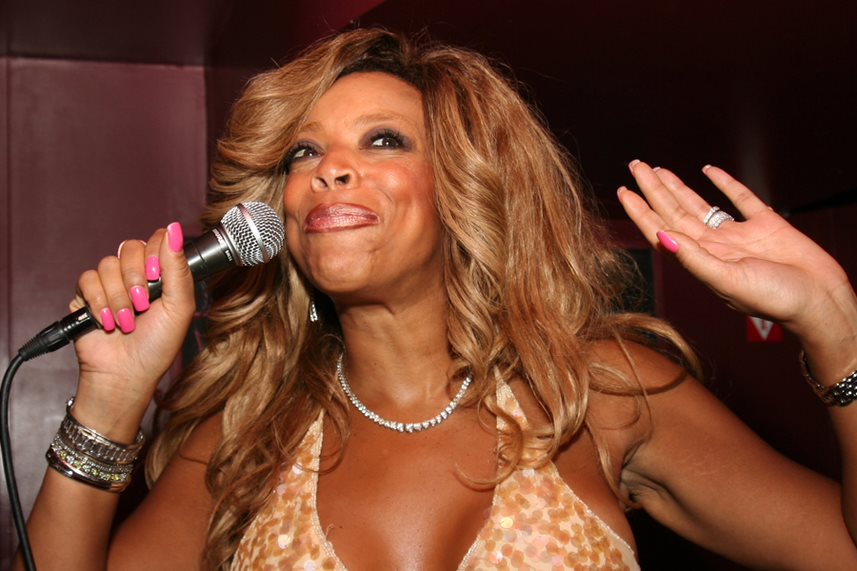

TV talk show host Wendy Williams went on Instagram Wednesday and claimed Wells Fargo & Co. and one of its financial advisers, 23-year veteran Lori Schiller, were blocking her access to her cash as part of a bitter guardianship battle that has been going on for weeks.

"My thing is that I’ve been asking questions about my money, and when I began asking questions about my money, suddenly, Lori Schiller has got no response regarding my money," Williams said in the video. "I want my money. This is not fair."

Schiller has been registered with Wells Fargo Advisors since 2017 and is based in its midtown Manhattan branch, according to her BrokerCheck profile. She has previously worked at UBS, Morgan Stanley and Merrill Lynch. A Wells Fargo staff person hung up on an InvestmentNews reporter who called Friday morning and asked to speak with Schiller.

According to the New York Post, in February Wells Fargo claimed in a filing with New York Supreme Court that Williams was incapacitated and needed a guardianship. The letter to Judge Arlene Bluth requested a hearing to determine whether Williams needed a professional to intervene in her affairs. The case of whether Williams is an incapacitated person who needs a guardianship was then sealed, meaning documents are not available to the public.

“And Wells Fargo has no questions and answers with regarding my money," Williams said in the Instagram post. "This is not fair. And Lori Schiller and Wells Fargo have this guardianship petition about keeping me away from my money. This is not right.”

In the video, Williams also claimed that a former doctor of hers — and one she fired — gave medical information to Schiller.

Bitter public disputes involving celebrities and the control of their finances have made headlines of late; Britney Spears' fight to control her finances led to the #FreeBritney movement.

On Friday, a spokesperson for Wells Fargo Advisors declined to comment.

Earlier, before the case was sealed, the spokesperson in February told Variety that the firm's "priority is the financial well-being of Ms. Williams and the preservation of her privacy."

"As we have expressed to the court, Wells Fargo is open to working with Ms. Williams’ counsel to release funds directly to her creditors for bills historically and regularly paid from her accounts," the spokesperson said at the time.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.