After watching thousands of financial advisors jump to competitors or retire after a fake credit card debacle in 2016, Wells Fargo Advisors appears to have reached a point of stasis, with senior company officials making pronouncements about the stability of the 12,000-strong financial advisor wirehouse.

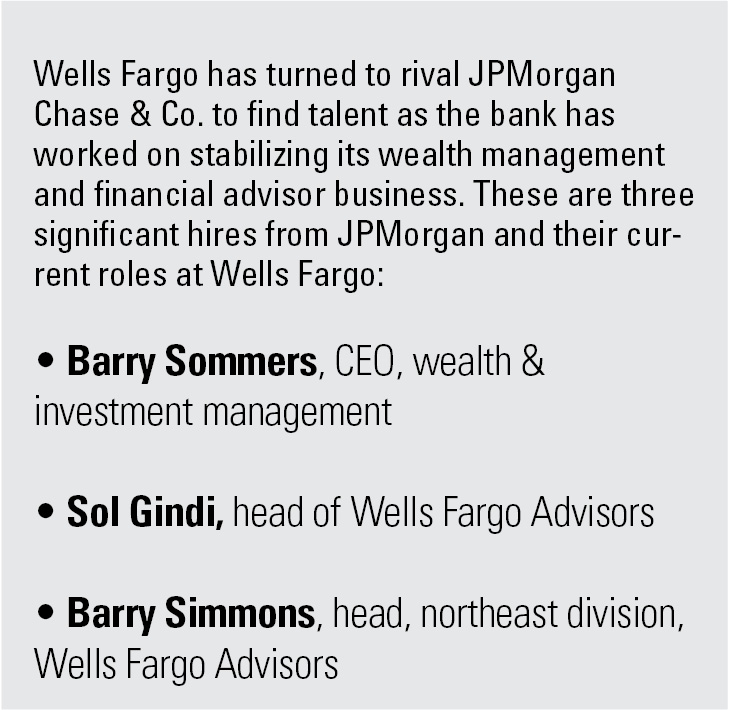

As part of its push to stabilize Wells Fargo Advisors, its parent bank, Wells Fargo & Co., has hired senior managers over the past several years from competitor J.P. Morgan Chase & Co. to lead its wealth and investment management group, which internally is called WIM.

In turn, that team of executives has focused on a strategy of rebooting its recruiting and, perhaps most importantly, hanging onto its advisors by making it easier for them to move internally from the employee work channel to the independent channel, where financial advisors must pay their own expenses but can earn more income.

“Management seems and sounds pretty positive,” said one well-placed industry source. “If there’s pain right now, they’re hiding it well.”

Wells Fargo Advisors has stayed away from acquisitions of competing broker-dealers or registered investment advisors, and its parent bank is operating under Federal Reserve restrictions on mergers.

Despite its hard-won stability, Wells Fargo Advisors faces stiff competition for advisors from aggressive and nimble competitors like LPL Financial Holdings Inc. and Raymond James Financial Inc., as well as recently opened financial advisor aggregators, including the newly launched &Partners, which is stocked with former Wells Fargo Advisors executives.

“I haven’t seen the statistics for 2024, but a bunch of Wells Fargo financial advisors have moved to &Partners and other firms,” said Danny Sarch, an industry recruiter.

“However, financial advisor and broker movement is down this year overall, so Wells Fargo may be a beneficiary of what’s happening more broadly in the advisor market,” Sarch said. “That also may have allowed for more Wells Fargo advisors to switch internally to FiNet,” Sarch said, referring to Wells Fargo Advisors Financial Network, the independent broker channel at the firm.

“It sounds like maybe the faucet of advisors leaving has turned into a drip,” he added.

The message from Wells Fargo management is clear. The bleeding of financial advisors has stopped.

“One of the most important things that the team has focused on over the last four or five years now is to stem that attrition, and we’ve done that,” said Mike Santomassimo, the bank’s chief financial officer, at an industry conference in September. “We feel really good. The tide has turned.”

“We’re seeing good recruiting,” he said. “We went from industry-leading attrition to what we think is sort of industry-leading retention in terms of the overall platform.”

“We’ve got to look at all the big advisor teams that move across the industry at this point,” Santomassimo said. “We’ve got a great investment platform. We’ve got the banking and lending capabilities that continue to get better. And so I think we feel good about sort of the momentum that has sort of shifted in that business.”

The bank’s CEO, Charlier Scharf, in April made similar comments. “We’re back to more normal, or maybe slightly below normal, attrition levels across the [financial advisor] business, which is good,” Scharf said during a conference with analysts. “And we’re feeling very good about our ability to recruit high-quality advisors.”

2016 was the annus horribilis for the bank, Wells Fargo & Co. Inc., which was rocked by revelations that bank employees had secretly created millions of unauthorized accounts in the names of customers without their consent. The bank was fined $185 million, and then-CEO John Stumpf resigned abruptly.

That damage to the bank’s reputation spilled over into the financial advisor group, which is part of the bank’s wealth-management, or WIM, division. At the time of the bank scandals, Wells Fargo Advisors reported more than 15,000 financial advisors across its multiple business lines.

Like its Wall Street wirehouse competitors, Wells Fargo Advisors no longer reports a count of its financial advisors. In January 2023, the last time the bank reported an advisor head count, the tally was close to 12,000. That means roughly 20 percent of Wells Fargo’s financial advisors had either left or retired over a seven-year span.

InvestmentNews data for last year show net losses of 153 financial advisors at Wells Fargo Clearing Services, the broker-dealer for the employee, private client group, and just eight at its independent group, Wells Fargo Advisors Financial Network.

The net losses of financial advisors at Wells Fargo have decreased substantially over the past couple of years. In 2021, the private client group saw a net loss of 1,012 financial advisors, and Financial Network, or FiNet, saw a net loss of 69, according to InvestmentNews.

But the firm is still facing questions from advisors due to its recent history, one executive noted.

“One thing advisors are looking at is whether Wells Fargo still has that cultural problem, like what happened with the credit cards,” said one senior industry executive, who spoke confidentially to InvestmentNews. “That’s an example of a firm putting profits over its clients. It takes a long time to change the culture of a firm.”

Most firms place a limit on advisors’ sales of alternative investments to clients in the neighborhood of 10% a customer’s net worth.

Those jumping ship include women advisors and breakaways.

Firms in New York and Arizona are the latest additions to the mega-RIA.

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.