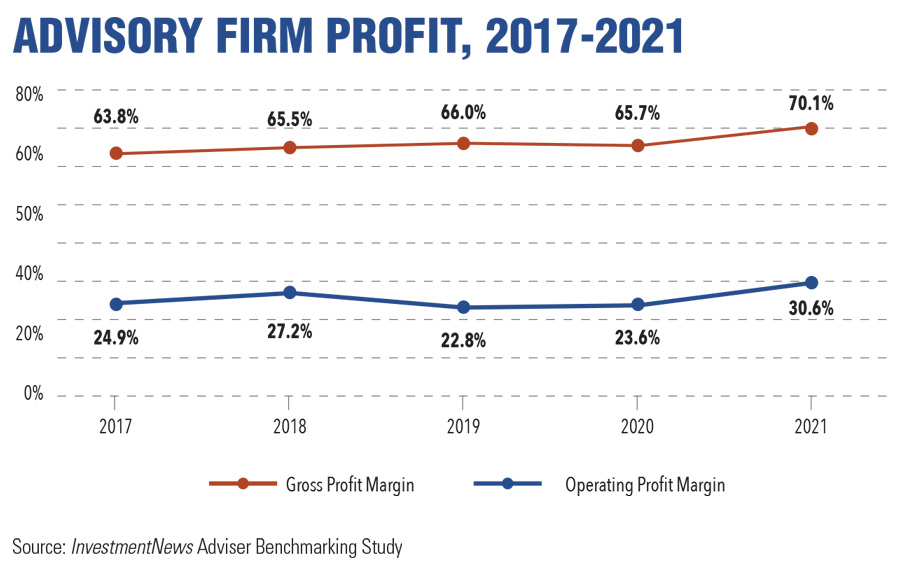

Riding the wave of a record-breaking stock market, profits at registered investment adviser firms shot up to record levels in 2021, with the typical advisory firm producing an average operating profit margin of 30.6% — much higher than in any of the past five years, according to data from InvestmentNews Research.

This represents almost a 30% jump in profitability, according to the InvestmentNews Adviser Benchmarking Study. Historically, advisory firms have considered 25% the standard for profitability and actual results have always been close to this number.

Even amid this period of growth and prosperity, 2021 was a year of records and perhaps a year that will never be repeated, the report concludes. The high returns of the investment market created substantial growth in firms’ assets under management, which is directly linked to the revenue of advisory firms.

And despite reports of a tight labor market for financial services professionals and back-office workers, rising labor costs did not eat into profits at RIAs. Quite the opposite: Static labor costs helped firms see their eye-popping profits.

“At the same time, the continued C-19 restrictions and technology-heavy environment kept expenses lower and productivity high,” according to the report. “Despite growing inflation, labor costs did not change significantly. The result was a record-high average profit margin.”

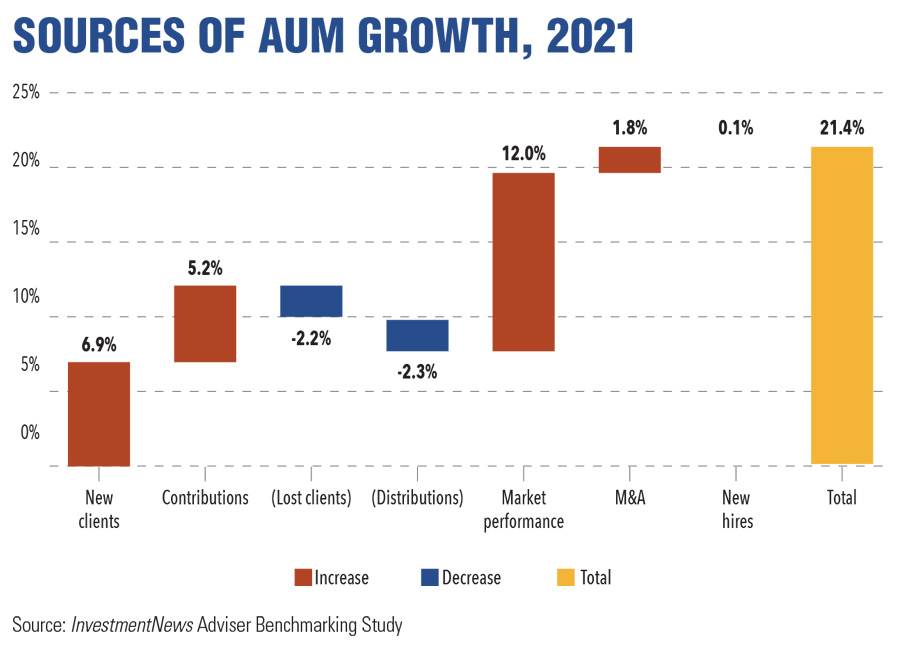

A firm’s existing clients matter the most, the report concludes.

“Existing client referrals proved crucial for business development, but they have to be cultivated carefully as part of the client relationship,” according to the report. “The most effective strategies for growth depend on the firm and its target clients, and there is no silver bullet.”

With the winds of record-breaking profits at their backs, financial advisers must continue to invest in their firms and build their brands to attract new clients, according to the report.

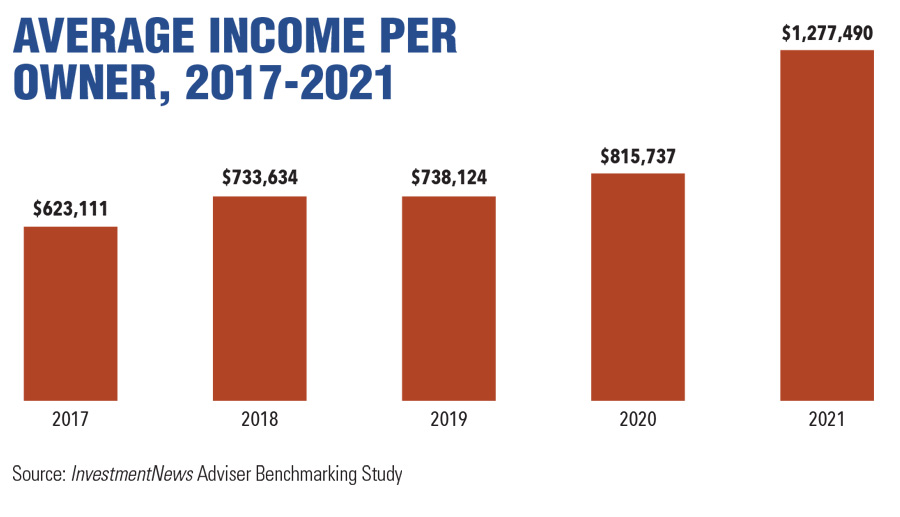

And the most well-to-do firms look as if they reaped the greatest rewards last year. “In 2021, the top performers reached higher levels of profitability than their peers by utilizing their advantage of size and having dramatically better productivity despite working with slightly smaller clients,” according to the report. “Top performers also grew faster than their peers.”

Indeed, the leading firms reported whopping levels of profits, the degrees of which have undoubtedly been attracting private equity investors to the RIA industry for the past five years.

“The top-performing firms achieved an operating profit margin of 47.3% compared to 29.7% for all other firms,” according to the report. “The high profitability rewarded the owners/partners of top firms with pretax income per owner of almost $3.1 million, or almost five times higher than the $640,000 income per partner for all other firms.”

The 2021 leap in profits at RIAs should hardly be a surprise. The stock market roared, which is always good news for financial advisers and their firms, which charge an annual fee on client assets in the neighborhood of 1%.

The S&P 500 repeatedly hit record highs throughout the year and posted a total annual return, including dividends, of 28.7% — almost twice its annual median return of 15.4%.

The RIA industry benefitted tremendously from high market returns, the report noted, with firms gaining an average 12% in AUM from appreciation in client portfolios. RIA firms, of course, use a wide variety of portfolios to mitigate risk for their clients.

“Note that advisory firms typically have diversified portfolios consisting of stocks, bonds and other asset classes,” the report states. “They also hold securities from international markets. Therefore, annual appreciation in client portfolios tends to be quite different than market measures such as the S&P 500.”

But the record profitability of 2021 is already a story that won't be repeated in 2022, according to the report. “The markets are down significantly, and while the industry has not yet seen labor costs increase, many fully expect them to in the near future.”

“The most pressing question of the industry’s new economic reality post-Covid has remained: Will it be able to sustain these very high margins using remote work and technology, or will rising labor costs return profitability to the previous level and perhaps even lower?”

The survey included close to 200 firms and was fielded from May to August.

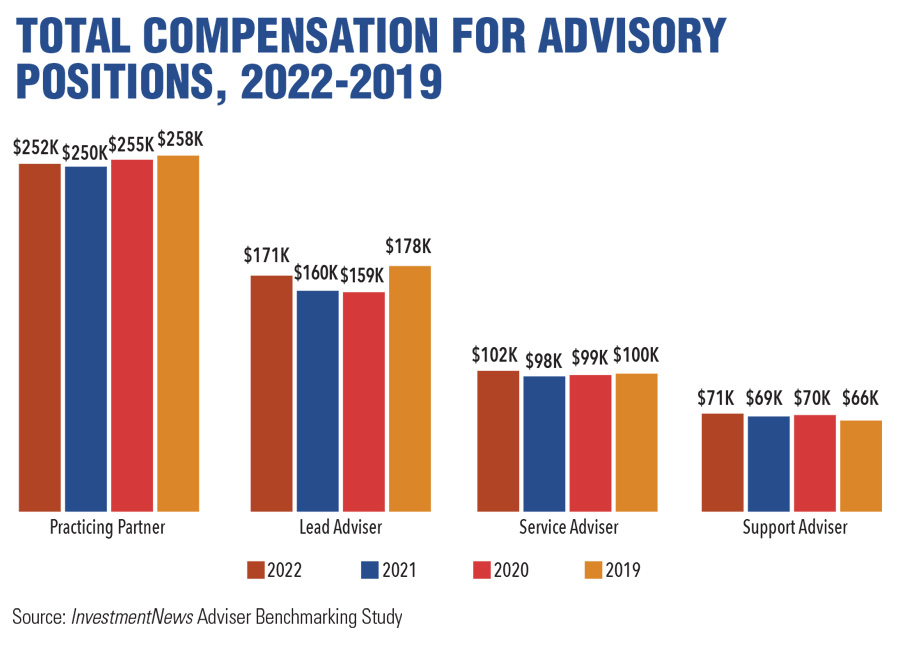

As revenues climbed at RIAs in 2021, the overall percentage of expense for compensation actually decreased to varying degrees based on the job, a boon to RIA firm owners and partners. For example, “management compensation as a percent of revenue also declined from 3.9% in 2020 to 3.7% in 2021,” according to the study.

Compensation dipped across various jobs, on average, according to the report. “Administrative and operations compensation went from 9.4% of revenue in 2020 to 8.5% in 2021. The combined compensation of all staff went from 47.0% in 2020 to 41.8% in 2021, with all the difference going to the bottom line of the typical firm.”

RIAs for years have desired to work with more elite, wealthy clients, or those with $5 million to $10 million or more in assets. Many of those clients remain at brokerage wirehouses like Merrill Lynch and Morgan Stanley, with RIAs still focused on the less-than-super-rich.

Overall, despite the appeal of highly wealthy clients, those with around $1 million in assets are the bread and butter of the advisory industry, according to the report. That group represents 23% of firms’ clients, followed by clients with $2 million, at 19%, and clients with around $500,000, at 18%.

The base compensation for advisers changed little in 2022, in line with pay at other RIA jobs.

“Lead advisers earned a median salary of $135,000 in the study year 2022 compared to $132,000 in 2021 and $135,000 in 2019,” according to the report. That means there was essentially no change in median salaries as the 2% increase is not statistically significant.

But practicing partners (lead advisers with ownership in the firm) have been subject to perplexing and consistent salary declines, according to the report. “In 2019 practicing partners had a median salary of $237,000. That salary declined to $219,000 in 2020, dropping further to $200,000 in 2021 and now $194,000 in 2022.”

This decline affects only 1% of firms engaged in recruiting practicing partners, the report said.

“This is not due to changes in the labor market but rather reflects internal dynamics,” according to the report. “Most likely firms are promoting partners internally — 6% of firms did — and the new partners are coming in at much lower levels of compensation.”

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

Rising costs, low wages are making it hard for young Americans to move ahead

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.