Janney Montgomery Scott's has quietly continued its growth efforts over the past few weeks.

The most recent small steps in November have definitely added up, including the addition of several advisors managing over $710 million in combined client assets, as well as the opening of a new branch office in Chicago.

In recent weeks, Janney has welcomed multiple experienced advisor teams across the country, reflecting its ongoing commitment to attracting top talent.

Among the most notable additions, Paul Butler and Elizabeth Ferraro, operating as Butler Private Wealth Group in Bedminster, New Jersey, joined from UBS. The team manages over $180 million in client assets. Butler, who has over four decades of industry experience, specializes in working with high-net-worth individuals, pension funds, and 401(k) plans, while Ferraro brings expertise in financial planning across estate, insurance, investment, retirement, and tax strategies.

Elsewhere, Bob Stiles, previously with Baird, joined Janney in Charlotte, North Carolina, with $300 million in assets under management. Stiles, a senior wealth management professional with nearly 45 years in the industry, is accompanied by Deidre Caldwell, a senior registered private client associate.

“Our advisor-centric culture provides the autonomy and resources he needs to grow his practice while delivering exceptional service,” said Tim Jones, Charlotte complex director, said in a November 19 announcement.

Other advisor hires include:

Prior to those moves, Janney added $1.1 billion in assets as it welcomed advisor teams from Kestra, LPL, and Raymond James from across the Eastern US.

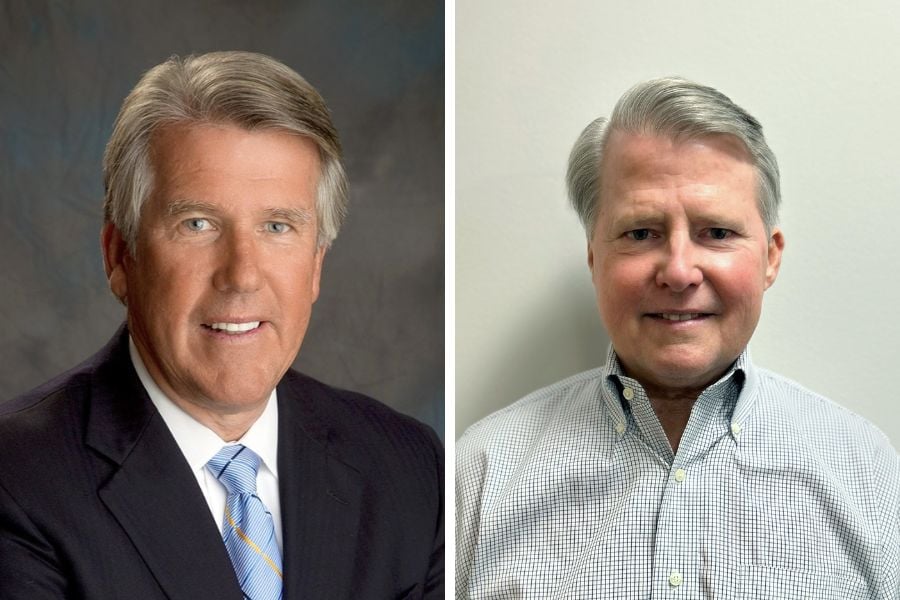

Janney has also opened a new branch office in Chicago, marking its continued push into the Midwest market. Ned Kennedy, an industry veteran with over 30 years of experience, will lead the new office as senior vice president and complex director. Kennedy previously held leadership roles at Wells Fargo Advisors, JPMorgan Private Bank, and Salomon Brothers.

“We’re excited to welcome Ned to Janney as we expand our Private Client Group in the Midwest,” Tom Galvin, Midwest regional director said in an announcement Wednesday. “Ned brings extensive experience in recruiting top talent and a strong network in the Chicago area, making him well-positioned to lead our growth efforts in this region.”

Kennedy expressed enthusiasm about the move, stating, “Janney’s boutique culture and client-centric approach create an ideal environment for advisors to best meet client needs. I’m looking forward to recruiting experienced advisors to the office and supporting the growth and success of our team in this dynamic market.”

Janney’s recent growth in Chicago builds on the success of its Capital Markets Group, which has added several public finance professionals over the past year.

Earlier in July, it was revealed that private fund giant KKR will be acquiring Janney under a definitive agreement with the Penn Mutual Life Insurance Company. That deal, which would include KKR establishing a broad-based equity ownership program for Janney’s 2,300 employees, is set to be completed in the fourth quarter this year.

After a two-year period of inversion, the muni yield curve is back in a more natural position – and poised to create opportunities for long-term investors.

Meanwhile, an experienced Connecticut advisor has cut ties with Edelman Financial Engines, and Raymond James' independent division welcomes a Washington-based duo.

Osaic has now paid $17.2 million to settle claims involving former clients of Jim Walesa.

Oregon-based Eagle Wealth Management and Idaho-based West Oak Capital give Mercer 11 acquisitions in 2025, matching last year's total. “We think there's a great opportunity in the Pacific Northwest,” Mercer's Martine Lellis told InvestmentNews.

Osaic-owned CW Advisors has added more than $500 million to reach $14.5 billion in AUM, while Apella's latest deal brings more than $1 billion in new client assets.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.