LPL Financial Holdings Inc. appears to be on the hook for a $50 million settlement and penalty from the Securities and Exchange Commission over compliance failures in keeping records of financial advisors' and employees' electronic communications, such as text messages and apps.

One year ago, LPL reported that the SEC had made inquiries into whether the broker-dealer was meeting industry standards related to retaining with electronic communications on personal devices unapproved by the giant brokerage, but it did not detail the amount of a potential penalty.

In LPL Financial Holdings' annual report, issued Wednesday, the firm disclosed the details of the penalty.

"In October 2022, the company received a request for information from the SEC in connection with an investigation of the company’s compliance with records preservation requirements for business-related electronic communications stored on personal devices or messaging platforms that have not been approved by the company," according to the annual report.

SEC staff proposed a potential settlement to resolve the matter, including a $50 million civil monetary penalty, according to the annual report. LPL recorded a $40 million expense in 2023 as a result, which is the amount that is not covered by its captive insurance subsidiary.

With 21,000 financial advisors across various business channels, LPL reported the $40 million charge in October in its third-quarter earnings.

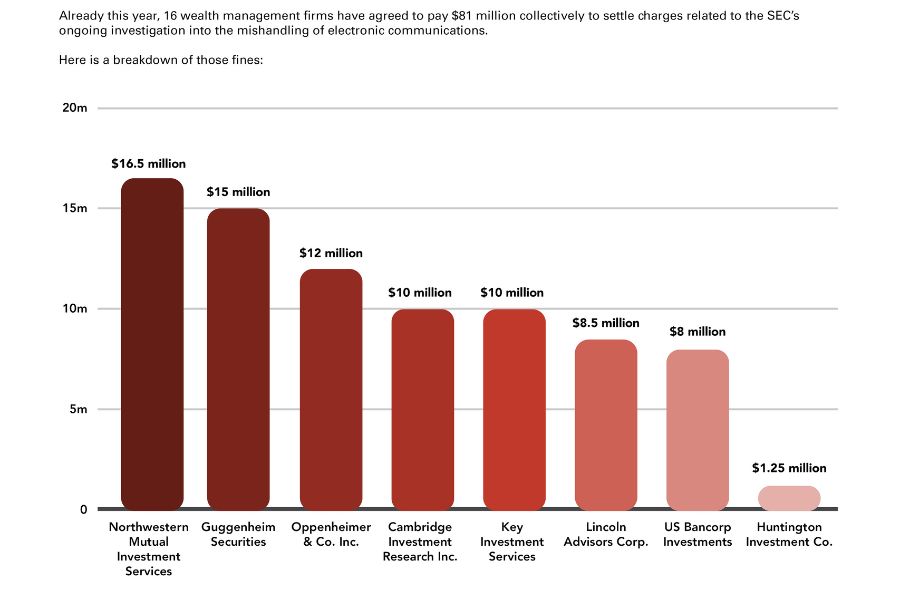

The size of the penalty against LPL stands out, particularly as the SEC penalized 16 wealth management firms a total of $81 million earlier this month over mishandled electronic communications, one compliance executive noted.

"The SEC is indicating very strongly that there needs to be a sea change in this area of communications at firms," said Sander Ressler, managing director of Essential Edge Compliance Outsourcing Services. "It's using fines against firms to change behavior, and the large size of such fines underscores the point that regulators want this behavior to change quickly."

The use of unmonitored messaging apps by financial advisors and employees at wealth management firms has been on the rise in the wake of the Covid-19 pandemic, which reshaped how advisors interacted with colleagues and clients.

Messaging apps like WhatsApp and email platforms like Gmail are beginning to play an oversized role in advisor communications, a trend that could increase as more clients choose to communicate via their smartphones.

In the past, LPL has paid large fines to settle compliance issues with the Financial Industry Regulatory Authority Inc. and state regulators. In 2014 and 2015 alone, the firm paid $70 million in fines and restitution to customers, a staggering sum for a retail-focused broker-dealer.

At the end of last year, LPL and Finra reached a $6.15 million settlement over the firm's falling short on its supervision of thousands of transactions that its financial advisors and brokers completed from 2012 to 2019 with product sponsors such as a mutual fund company. In industry parlance, these transactions are known as "direct" business.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.