Over the past few years, the retail brokerage and wealth management industries have taken it on the chin from the Securities and Exchange Commission in fines and penalties related to personnel misusing private texting applications, and that problem for firms is not going away.

In 2024 industry-leading firms like LPL Financial and Ameriprise Financial Services each revealed they could face penalties as high as $50 million for unapproved electronic communications and employees.

The use of unmonitored messaging apps by financial advisors and employees at wealth management firms has been on the rise in the wake of the COVID-19 pandemic, which reshaped how advisors interact with colleagues and clients.

Messaging apps like WhatsApp and email platforms like Gmail are beginning to play an outsized role in advisor communications, a trend that could increase as more clients choose to communicate via their smartphones.

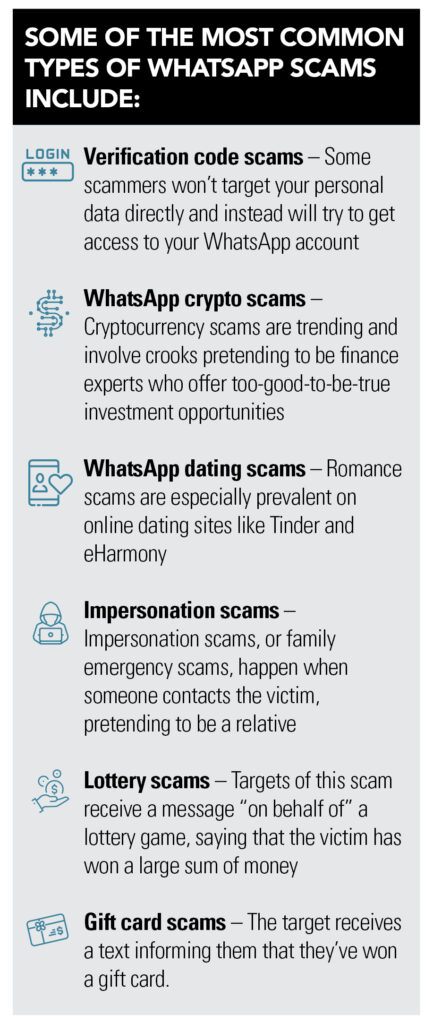

But wealth management firms are facing more pitfalls than fines when it comes to WhatsApp. Now, the phenomenon of fake wealth management executives and advisors popping up on WhatsApp can be added to the long list of potential scams and frauds that financial advisors, their firms, and their clients must watch out for in the age of digital communications.

In March, a WhatsApp chat group, titled "Morgan Stanley Mike Sharing Group," launched, with “Mike” claiming to be Mike Wilson, the wirehouse's chief investment officer and chief US equity strategist. With dozens of people joining the chat, the phony Wilson wrote, "I will leverage best-in-class research to provide institutional and wealth management clients with a unique market perspective."

The chat eventually turned to the topic of digital currencies, and the pretend Wilson sounded enthusiastic. "From now on, I will share the latest cryptocurrency information every day and predict market trends," he wrote. "I will give you precise trading strategies for your reference."

A spokesperson for Morgan Stanley declined to comment, but well-placed sources said that the firm doesn't offer investment advice via WhatsApp chat rooms.

Those same sources called the Wilson chat rooms a scam, and said that the wirehouse has had inquiries about the same or similar chat rooms. The company tells these people not to engage. "It's hard to get these false chat rooms removed," said one industry source. "Morgan Stanley has a fraud team looking into it as well. It’s an issue across Wall Street, these impersonations of high-ranking officials."

Meanwhile, it’s not just Wall Street heavyweights like Morgan Stanley that are targets of WhatsApp impersonations, which could be AI-generated or created by real live scam artists.

Last month, InvestmentNews reported that a Florida -registered investment advisor had been caught up in a similar scam, with unknown bad actors impersonating the firm on WhatsApp to offer false opportunities to make money.

The firm, Capital Wealth Planning, issued a public statement warning the public of “unknown rogue elements” that were masquerading as the firm and its founder and CEO, Kevin Simpson, on WhatsApp. The firm highlighted on its website several points to distance itself from the WhatsApp solicitations, starting with the fact that it does not use WhatsApp as a platform to market or promote its services.

"Use your common sense: if someone reaches out to you on WhatsApp to give investment advice, just say no," said Andrew Stoltmann, a plaintiff’s attorney. "There is a myriad of scams on WhatsApp, including people posing as high-profile bankers or investment gurus. It’s hard to believe people fall for this, but the pitch can be convincing.

"And much of this activity is generated by overseas actors and groups, and those are entities you can't collect from if you try to bring a lawsuit," he added.

"First, remember that financial advisors are not allowed to use WhatsApp, and, on a basic level, these types of solicitations violate all suitability rules," said Fran Congemi, a veteran financial advisor with 37 years of experience. "There are a lot of problems with these unsanctioned, off-channel communications. It doesn't matter what the platform is."

"While WhatsApp’s encryption is what makes it attractive to people looking for a secure messaging app, it’s also a feature that draws scammers," according to Money.com. "If you’re carrying out illicit activities through texts, you wouldn’t want anyone other than the victim to have access to them. Moreover, scammers have developed methods to avoid having to provide their actual phone numbers when registering to WhatsApp, giving them complete anonymity."

A spokesperson for WhatsApp pointed to its online frequently asked question (FAQ) feature as a source of information about such scams.

"Creating a safe space for our users to communicate with each other is our priority," WhatsApp says on its website. "We work diligently to reduce any spam or unwanted messages that might be sent on WhatsApp.

"However, just like regular SMS or phone calls, it's possible for other WhatsApp users who have your phone number to contact you," according to the company. "They may or may not be saved in your contacts. These people might send you messages because they want to trick you into giving them personal or financial information, or they want to spread misinformation."

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning